Recording credit memos

Credit memos make adjustments that reduce or reverse normal open AR items. Use credit memos to perform the following operations:

- Write off an uncollectible open item.

- Reduce or reverse a line item charge.

- Reverse a previously entered sales (or simple order) transaction.

Note: Although credit memo transactions create accounting entries that are used to reduce or reverse an open debit item, these transactions do not produce any documents other than normal transaction entries on batch and other transaction-related audit trail reports.

To write off bad debt

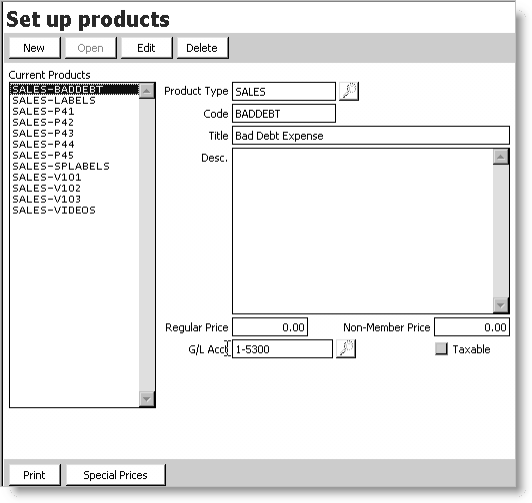

iMIS allows you to write off a bad debt, an uncollectible item you do not expect to see fulfilled. In order to write off a bad debt, you must first set up a product that corresponds to the bad debt expense on the Set up products window.

- From AR/Cash, select Set up tables > Products to open the Set up products window.

- Click New.

- Enter SALES in the Product Type field.

- Enter a code for the bad debt item. BADDEBT is used in this example.

- Enter a title in the Title field. Bad Debt Expense is used in this example.

- If desired, enter a short description in the Des. field.

- Leave the Regular Price and Non-Member Price at zero so that you can enter variable balances.

- (optional) Place the cursor in the GL Account field and enter or change the GL account number for the bad debt write-off. If the Allow GL Account Edit for Sales Transactions option is not enabled (from AR/Cash, select Set up module), the GL Account field is display-only and the GL account number cannot be added or changed.

- Click Save. You can now reference the item (in this example, BADDEBT) on the Enter and edit credit memos window and properly track this expense account.

To adjust an open item

To adjust an existing open item, first enter the item's invoice number or reference in the Invoice # field on the Enter and edit credit memos or Enter and edit debit memos window. If you do not know the invoice number or reference:

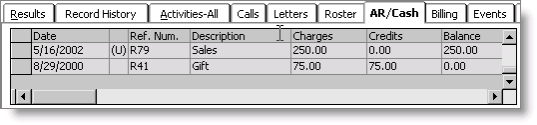

- From Customers, select Manage customers to open the Manage customers window.

- Click Find and enter the customer ID in the Search window, then press Enter.

- Select the AR/Cash tab to view the AR/Cash information.

If you double-click a record, the Transaction Ledger window displays, showing detailed information.

- Locate the invoice number or reference you need in the Ref. Num. column.

- From AR/Cash, select Enter and edit transactions > Credit memos to open the Enter and edit credit memos window (or select Enter and edit transactions > Debit memos to open the Enter and edit debit memos window).

- Click New.

- Enter the customer Id, or click the lookup icon to select a value.

- Enter the invoice or reference number in the Invoice # field, or click Find to look up the invoice or reference number. Make sure to capitalize any letters when you enter the code, for example, R12.

- Enter the data according to the following adjustment situations in the Product, Quantity, and Unit Price fields. Repeat these steps for all line items that require an adjustment.

- To apply credit memos to open items, select one of the following options:

- To write off a bad debt, select the product (for example, BADDEBT), enter the quantity as 1, and enter the unit price as the amount of the balance to be written off.

- To correct an overcharge, enter original product and quantity; adjust the unit price.

- To reverse an entire sales transaction, enter the original product, quantity, and price for all line items.

- To credit a returned product, enter original product, quantity returned, and original price.

- To make debit adjustments to correct an undercharge, enter the original product and quantity, and adjust the unit price as needed.

- (optional) Place the cursor in the GL Account field and enter or change the GL account number. If the Allow GL Account Edit for Sales Transactions option is not enabled, the GL Account field is display-only and the GL account number cannot be added or changed.

- Click Save.

To record debit adjustments

Debit adjustments make adjustments that increase the debit balance of open AR items. Debit adjustment transactions have the opposite effect of credit memos.

Debit adjustments are used to increase or add a line item charge; bring a credit balance to zero due to an overpayment or credit memo; or cancel a transaction.

Note: iMIS AR/Cash has more automated facilities for processing refunds or application/transfers of credit balances to other sales transactions. See Creating credit invoices.