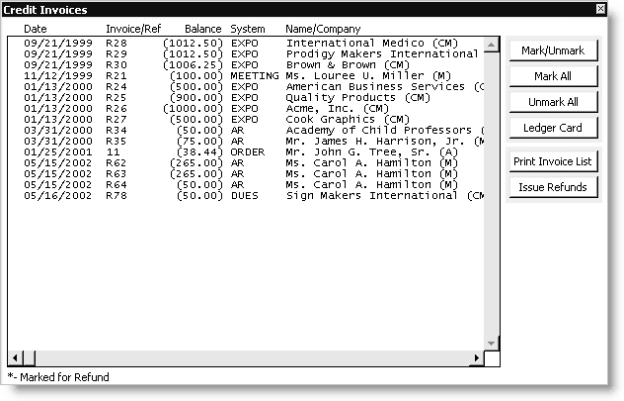

Credit Invoices window

Credit Invoices scrolling list

This area contains a list of all credit invoices, including Date, Invoice/Ref, Balance, System, and Name/Company. Each item is labeled with the initial transaction date, invoice or reference number, credit balance, source system, and customer/customer name.

Mark/Unmark button

Select to mark individual items for refund, which is indicated by an asterisk at the far left. The button toggles (turns off or on) the marking of any selected items.

- * = marked

- (no *) = unmarked

Mark All button

Select to mark all items for refund. Click the Mark/Unmark button to individually unmark each item you do not want refunded.

Unmark All button

Select to unmark from all items.

Ledger Card button

Select to view an item's transaction detail or ledger card history on the Transaction Ledger window. To display this detail, double-click on a line item, or click on a line item and click Ledger Card.

Print Invoice List button

Select to print a report of credit items, including initial transaction date, reference or invoice number, source system, general item description, total charges, total credits and resulting (credit) balance, and the customer ID and name.

Issue Refunds button

Select to reverse the balances (for the marked items only) by generating the necessary debit-adjusting entries and print a report documenting the refunds (reversals).

The entries debit the appropriate AR account for the full balance and credit the default refund clearing account.

In a multiple-entity situation, the owner entity for the generated transaction is assigned according to the owning entity of the initial sales-related transaction. iMIS appropriately uses AR from the initial transaction, and uses the refund clearing account from the default tables for the owning entity.

Note: Use the generated report as the basis for the refund items, which should be processed in AP. The refund clearing account should be entered as the AP offset or distribution account, bringing the net effect on the clearing account to zero.