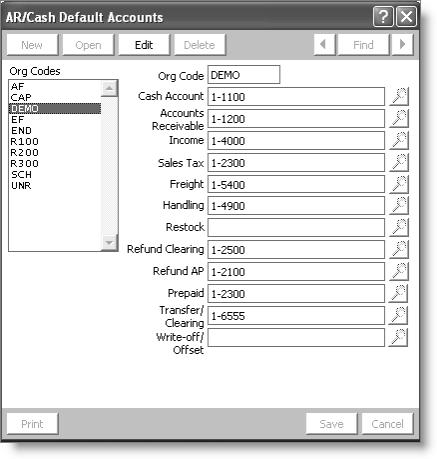

Default Accounts window

Org Codes

The Org Codes listed are set up in the Organization Names window using the iMIS system setup menu. The selected organization is displayed in the Org Code field.

Cash Account

(Required unless you are using batch control) If you are using batch control, all cash account codes are set by the Cash Account table entry for that batch.

This account is used for all iMIS cash-related transactions unless batch control is enabled or a credit card override account is specified. Multiple cash accounts can be defined and used at the batch control level.

Accounts Receivable

(required) This is the only place you can enter the main AR account code.

This is the main account that iMIS uses whenever full payment is not received for any order (for example, sales item or event registration). You can only have one Accounts Receivable account per organization.

Income

(required if a specific income account is not supplied at the product level) iMIS uses this default income account only for those transactions where an income account is not specified at the product level.

Sales Tax

(required if any account codes are not supplied at the tax authority level) iMIS uses this default sales tax account only for those transactions where a sales tax account is not specified at the product level.

Freight

(required) Enter an account code for the freight charges associated with orders.

Handling

(required) Enter an account code for the handling charges associated with orders.

Restock

Enter an account code for the charges associated with restocking returned orders.

Refund Clearing

This default account is the offsetting account that iMIS uses when it clears credit balances marked for refunds. Refund processing is performed on the Credit Invoices window (from AR/Cash, select Process month-end procedures, and click Credit Invoices). For more information, see Creating credit invoices.

This account also serves as a suspense (or bridge) account between AR and AP.

Each time iMIS generates a refund, accounts receivable is debited (to clear the credit balance) and the refund clearing account is credited. This credit balance is debited and cleared only when you enter the parallel account payable (AP) entry.

Refund AP

(Required only if you are licensed for the iMIS AP interface and you are importing into your third-party accounts payable software) This account is the accounts payable control account for the AP interface.

Prepaid

iMIS uses this account when a prepaid order is initially entered. The Cash account is debited and the Prepaid account is credited. When the order is invoiced, iMIS clears the prepaid amount and credits (transfers to) the appropriate income account.

This is a required account that is used in conjunction with prepaid order processing (simple or full order entry). The prepaid account is typically a deferred income balance sheet account.

Note: Non-credit card cash order prepayments will involve the prepaid account, because check and currency receipts are immediately recognized upon order entry. Credit card payments will also use the Prepaid account if the Recognize Credit Card Order Payments as Prepaid Cash option is enabled (from AR/Cash, select Set up module). Otherwise, credit card payments are recognized when the order is invoiced.

Transfer/Clearing

This account is reserved for transaction generation where forced balancing is required.

iMIS uses the Transfer/Clearing account for two different system processes:

- Used in conjunction with prepaid order processing (simple and full order entry). It is used as a clearing account in the process to transfer the prepayment offset from prepaid (deferred income) to income.

- Used in the GL interface procedure for certain GL package choices. It is used when GL journal entries are generated and a restricted number of transaction lines are mandated.

Note: When the Transfer/Clearing account is used in a line item within a transaction, there will always be an offsetting line item(s) in an associated transaction to ensure that entries to the transfer account will always balance to zero.

Write-off/Offset

This is the GL account to which the offset credit or debit created by the credit/debit write-off process (from AR/Cash, select Process month-end procedures, and click Credit/Debit Write-Offs) will be written.

To assign AR/Cash default accounts codes

- From AR/Cash, select Set up module to open the Set up module window.

- Click Default Accounts to open the AR/Cash Default Accounts window.

- From Org Codes, choose an organizational code.

- Click Edit.

- Enter the account number (or click the lookup icon to select a value) in each field.

- Click Save.