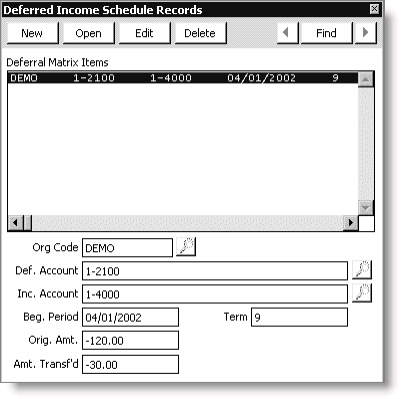

Deferred Income Schedule Records window

To build the deferred income matrix initially, use the Deferred Income Schedules Records window. This window contains the following fields:

Find button

Select to find a deferred income entry. You can specify the Org Code, Def Account, Inc Account, Beg Period, Term, Orig Amt, or Amt Transf'd of the deferral income entry for the search. The first deferral income entry that matches the search criteria will be selected.

Deferral Matrix Items

The list of existing deferred income entries is displayed in this scrolling list.

Org Code

Enter the organization or entity code as established on the Organization Names window (select File > System Setup), or use the lookup icon to select a value.

Def Account

Enter the GL deferred income (liability) account number to which the original amount was initially posted (to await subsequent recognition and transfer to regular income), or use the lookup icon to select a value.

Inc Account

Enter the GL income account to which the amounts will be transferred as the income is earned and recognized, or use the lookup icon to select a value.

Beg Period

Enter the accounting date (typically month, first day of the month, year) either for which the income was initially recognized or will be recognized (Conversion method 1), or for which you want iMIS to begin generating the necessary transfer entries to recognize income and reduce deferred income (Conversion method 2).

Term

Enter the number of months over which the original amount is to be recognized as income. This may be the original term (Conversion method 1), the net number of months remaining within the original term for which income is yet to be transferred, or 1 (Conversion method 2).

Orig Amt

Enter the total dollar amount that will be recognized in prorated monthly amounts over the term of the deferred income item. Because deferred income accounts carry a credit balance, enter only negative amounts (enter a minus sign followed by the digits that represent the amount).

This field should contain one of the following:

- Original amount posted in the starting month to this deferred income/regular income/term combination (Conversion method 1)

- Net amount remaining to be recognized over the remainder of the term (Conversion method 2)

- Total amount of the existing deferred income balance to be transferred from the deferred income account identified to the regular income account identified for the single-month term (Conversion method 2)

Amt. Transf'd

Enter the dollar amount portion of the original amount already recognized in previous periods. As with the original amount, the amount transferred must be represented by a negative amount. (This field should only be used when using conversion method 1. See Conversion Methods for Building the Initial Matrix.)

To build the initial matrix

- From AR/Cash, select Process month-end procedures.

- Click Deferred Income Records to open the Deferred Income Schedule Records window.

- To build the table, you must create one entry for each Deferred Account - Income Account - Beginning Period - Term (or number of months) -combination.

- Click New.

- Enter data into the Org Code, Def. Account, Inc. Account, Beg. Period, Orig. Amt., Amt. Transf'd, and Term fields, or click the Find icon to select a value.

- Click Save.