Enabling deferred income processing

To set up deferred income processing, enter a deferred income account number in addition to the regular income account number for products and functions. You must identify both of these accounts in all relevant modules.

To set up deferred income for a dues or subscription product

- From Billing, select Set up module > Products to open the Set up products window.

- Select a current product from the Current Products list.

- Click Edit.

- Enter the income account number in the G/L Acct field, or press the lookup icon to select a value.

- Enter the deferred income account number in the Deferred field, or click the lookup icon to select a value.

- Click Save.

To enable deferred income for an event function

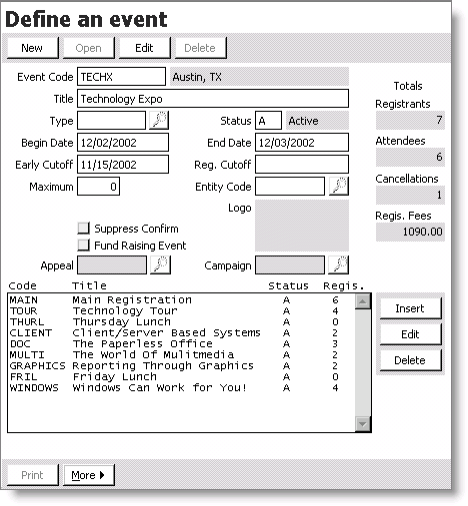

- From Events, select Define an event to open the Define an event window.

- Click on a line item to select an event.

- Click Edit to open the Define an event window for the selected event.

- Select the appropriate event function.

- Click the Edit button displayed to the right of the event functions to open the Event Function Detail window.

- Click More and select Fees from the drop-down list to open the Event Function Definition - Fees window.

- On the Event Function Definition - Fees window, select the Default line item to display the Deferred Account field.

- Enter an account number in the Deferred Account field, or click the Find icon to select a value.

- Enter an account number in the Income Account field, or click the Find icon to select a value.

- Click Save.