Ensuring an accurate deferral term

The accuracy of the deferral term depends primarily on the accuracy of the dates established in the Last Billed area, in Period (Subscriptions.BILL_BEGIN) and Thru (Subscriptions.BILL_THRU).

To ensure accuracy, you should understand how iMIS dues/subscription product billing and related processing automatically determines these dates.

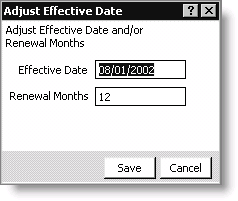

If your dues or subscription billing is done on a cash basis, term overrides can occur at payment time. If you override the system-calculated Paid Thru date on a deferred income line item, a window is displayed which allows verification and adjustment of the Effective Date or term (Renewal Months).

For example, if the projected Paid Thru date of the BASIC line item was changed from 06/30/2003 to 07/31/2003 during the payment data entry, the Adjust Effective Date window is displayed, allowing you to modify the Effective Date (begin date) or Renewal Months (term). If no changes are made, the Effective Date is set to 08/01/2002 and a 12-month term (08/01/2002 - 07/31/2003) is used. If you specify a different Effective Date and press Tab, the resulting term is automatically calculated and displayed in the Renewal Months field. If you specify a new term in the Renewal Months field and press Tab, the resulting begin date is automatically displayed in the Effective Date field.

If you process dues on an accrual basis, no subsequent overrides of the system-calculated term are possible. Verify the term dates on your Billing Batch Detail Report or Individual Accrual Dues Posting window before finalizing the billing details.