Implementing mass write-off of debit/credit balances

The AR/Cash module allows you to perform a mass write-off of debit/credit balances based on a user-defined cutoff date and a maximum dollar amount.

The system setup options for this feature include an AR/Cash Set up module option that allows you to define the maximum default dollar amount to write off. During the write-off process, all debit or credit balances less than or equal to this amount are written off. You can overwrite this default during the actual write-off process. See Set up module window for AR/Cash for details.

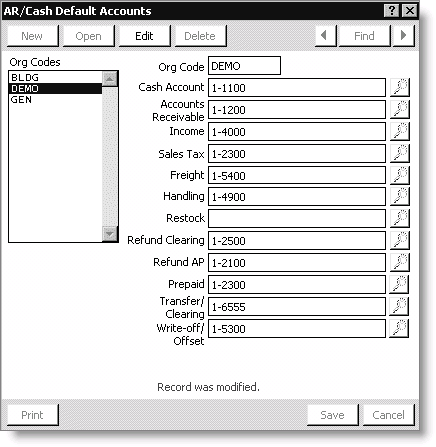

A default GL account number, entered on the AR/Cash Default Accounts window, that offsets the credit or debit created by the write-off process will be written. For example, if you write off credit balances, iMIS creates a debit to the default AR account and a credit to the write-off offset account specified on the AR/Cash Default Accounts window.

To set the default write-off amount

- From AR/Cash, select Set up module to open the Set up module window.

- Click Edit.

- Enter a default dollar amount in the Default Cut Off Amount for Write-offs field.

- Click Save.

To enter the default write-off offset account

- From AR/Cash, select Set up module to open the Set up module window.

- Click Default Accounts to open the AR/Cash Default Accounts window.

- Click Edit.

- Enter the GL account number to which you will be recording the write-offs in the Write-off/Offset field.

- Click Save.

To process mass write-offs

- From AR/Cash, select Process month-end procedures, and click Credit/Debit Write-Offs to open the Credit/Debit Invoices Write-Off window.

- Enable Debit or Credit and click Load List. A list of all records that meet the Cutoff Date and Amount criteria are displayed. Select these records for write-off by:

- Selecting an individual record by selecting the item and clicking Mark/Unmark.

- Selecting all records by clicking Mark All.

- If you need to view the detail for an item, select the item and click Ledger Card. The Transaction Ledger window displays the balance details.

- Print a list of all displayed items by clicking Print Invoice List for an audit report before processing the actual write-offs.

- After you verify that the records selected for write-off are correct, click Write Off on the window to process the actual write-offs.

- You can view the results of the write-off on the customer's Transaction Ledger window. From Customers, select Manage Customers to open the Manage customers window.

- Click Find.

- Enter the ID for the customer who had the write-off applied to their account.

- Select the AR/Cash tab to view the accounts receivable information.

- Double-click the line item that was written off to open the Transaction Ledger window.

- Verify that the write-off has been recorded, and click OK.

Note: The Cutoff Date field defaults to the system date and the Amount field defaults to the amount specified on the AR/Cash Set up module window. You can overwrite either or both of these fields as needed. iMIS writes off all debit or credit balances where the INVOICE_DATE is equal to or older than the date specified in the Cutoff Date field and the balance is equal to or less than the amount specified in the Amount field.