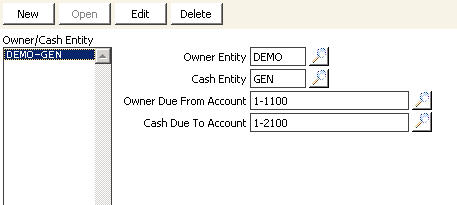

Set up due to/due from window

The Set up due to/due from window enables you to define the DueTo/DueFrom relationships between your general ledger accounts.

In this window, you can set up entries for each multiple-entity combination in which cash is received by one entity for transactions that belong to another entity.

Owner/Cash Entity

Lists Due To/Due From accounts specifying the source entity and the destination entity.

Owner Entity

Specifies the entity that owns the income.

Cash Entity

Specifies the entity that owns the cash account for the cash received.

Owner Due From Account

Specifies the receivables account number for the entity that owns the income (debit).

Cash Due To Account

Specifies the liability account number for the entity that received the cash (credit).

To set up Due To/Due From accounts

- From Set up due to/due from window, click New.

- Enter the Org Code for the entity that owns the income or accounts receivable in the Owner Entity field, or use the lookup icon to select a value.

- Enter the Org Code for the entity that received the cash in the Cash Entity field, or use the lookup icon to select a value.

- In the Owner Due From Account field, enter the GL account in which to record the intercompany receivable (debit) transaction for the entity that owns the income, or use the lookup icon to select a value.

- In the Cash Due To Account field, enter the GL account in which to record the intercompany payable (credit) transaction for the entity in which the cash account resides (cash entity), or use the lookup icon to select a value.

- Click Save.