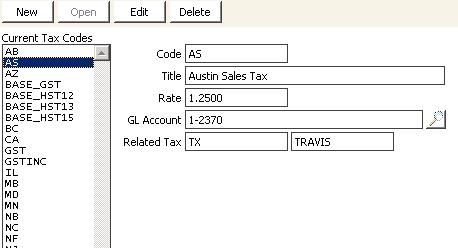

Set up tax codes window

Current Tax Codes

This list displays the currently defined tax codes.

Code

Enter the abbreviation you want to assign to the tax category. For the best results when defining a state tax, use standard state abbreviation so the tax code on the Enter and edit orders window (from AR/Cash, select Process orders > Enter and edit orders) can automatically default to the customer's state abbreviation.

Title

Enter the full name to assign to the tax code. This description helps users select from the available taxes using the look-up function.

Rate

Enter the percentage rate assigned to the tax.

GL Account

Enter the general ledger account number assigned to the tax code, or use the lookup icon to select a value.

If you leave this field blank, iMIS records this entry in the Sales Tax account that you designated on the AR/Cash Default Accounts window (from AR/Cash, select Set up module, and click Default Accounts).

Related Tax

These fields allow you to piggyback (use multiple) one or two additional Tax Authority codes.

Enter the codes for any other taxes you want to relate to the tax code. As shown on the previous Set up tax codes window, a city tax may always be associated with a county and a state tax. These tax codes must always be set up in distinct accounts so that the taxes can be tracked separately but calculated for the customer as a single amount.

To enter a new tax code

- From Set up tax tax codes, click New.

- In the Code field, enter the abbreviation you want to assign to the tax category.

- In the Title field, enter the full name assigned to the tax.

- In the Rate field, enter the percentage rate assigned to the tax.

- In the GL Account field, enter the GL account number assigned to the tax, or click the Find icon to select a value.

- In the Related Tax field, enter the codes for any other taxes you want to relate to the tax, such as a city or county tax code.

- Click Save.