Working with deferred income

Deferred income provides delayed recognition of income to coincide with when the income is earned, to match when the related expenses are incurred, rather than when the invoice is generated or the funds are received. Deferred income credits a user-specified deferred income liability account rather than the regular income account when the transaction is initially entered. iMIS manages the recognition of the appropriate income amounts as the income is earned, and generates the corresponding entries to transfer those amounts from the deferred income account to the regular income account in the General Ledger.

iMIS processes deferred income arising from dues and subscription products differently than event registrations and exhibition/exposition orders. iMIS uses the following deferral methods to handle these transactions:

- Incremental - Deferred income for dues and subscription products is recognized in equal monthly increments over the number of months in the dues or subscription term, starting with the begin date. (iMIS calculates the term from the beginning and ending dates of the dues or subscription term.)

- Lump Sum - Deferred income for event registrations and exhibition/exposition orders is recognized in the month that the event occurs.

For example, for a normal 12-month subscription, iMIS recognizes one-twelfth of the income during each month of the subscription term.

For example, if the Begin Date of an event/exhibition/exposition is 12/10/2002, iMIS recognizes the entire amount of income on the first day of the month of the Begin Date, 12/01/2002.

When the deferred income account is referenced for a dues/subscription product or an event/exhibition/exposition product, the full amount charged or received will be booked as deferred income. Each time the GL interface procedure runs; iMIS analyzes which deferred balances can be completely or partially identified as earned income. When iMIS finds deferred income amounts, it automatically generates journal entries to transfer earned income amounts out of deferred income.

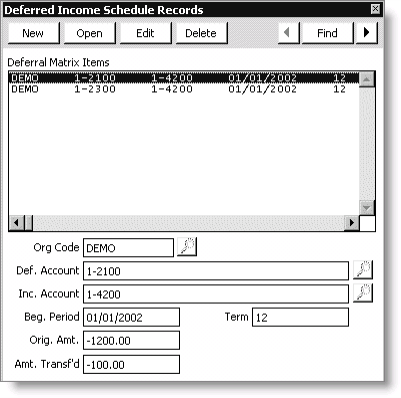

As iMIS processes individual deferred income transactions through the GL interface, the deferred income amounts are posted to a summarized Deferred Income Matrix (AR/Cash > Process month-end procedures > Deferred Income Schedule Records). This table (Deferral_Matrix) keeps track of the total balance in the deferred income account(s), which are divided into the following summary components:

- Deferred Account - Deferred income account number (Trans.DEFERRED_GL_ACCOUNT)

- Income Account - Income Account number (Trans.GL_ACCOUNT)

- Beginning Period - (for example, month-year) Date to begin income recognition (Trans.EFFECTIVE_DATE)

- Term - (for example, number of months) Time frame over which to spread income (Trans.MONTHS_PAID)

An entry is made into this table for each Deferred Account-Income Account-Beginning Period-Term combination. From this structure, iMIS determines and generates the necessary entries to transfer amounts from deferred income to regular income.

The iMIS GL interface procedure performs the work related to deferred income processing as follows:

- Creates a deferred income entry to credit the deferred income account instead of the regular income account for the full amount for all deferred income transactions

- Updates the deferred income matrix table for the combined dollar amount of the transactions involved

- Analyzes the deferred income matrix and creates the appropriate transfer entries to recognize income

Note: In some cases, transfer entries work in a catch-up mode. For example, if late cash-basis subscription payments are received and processed after the subscription term has begun, iMIS immediately recognizes the full amount due to be recognized as the accounting period being processed (that is, if a payment entry is recorded six months after a subscription started, iMIS generates an entry to recognize or transfer one-half (6 ¸ 12) of the subscription income amount).

The following is an example of a GL interface file. Lines 3 and 4 create a deferred income entry to credit the deferred income accounts, and lines 5 and 6 analyze the deferred income matrix and create the transfer entries to recognize income.

01/01/2002 1-1100 PAY,DEMO-DUES-PAY 1200.00 01/01/2002 1-1200 AR,DEMO-MEETING-AR 500.00 01/01/2002 1-2100 DIST,DEMO-DUES-BASIC -1200.00 01/01/2002 1-2200 DIST,DEMO-MEETING-TECX/MAIN -500.00 01/01/2002 1-4200 Deferred Income Transfer -100.00 01/01/2002 1-2100 Deferred Income Transfer 100.00