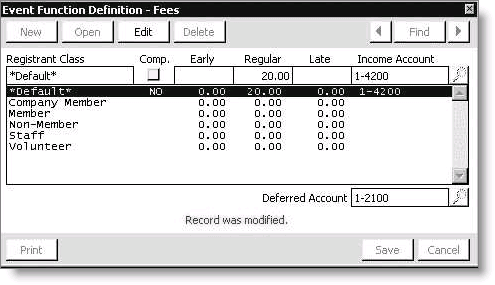

Event Function Definition - Fees window

Registrant Class

Displays the registrant class selected from the list below the field. You have the option of charging different registration fees for different registration classes. If the Default registrant class is selected, all registrant classes will be charged the same registration fees.

Comp

Designates functions which are complimentary (free of charge) for one or more registrant class.

Early

Specifies the fee charged when a registrant places an order on or before the established Early Cutoff date as defined on the Define an event window.

Regular

Specifies the fee charged when a registrant places an order after the Early Cutoff date but on or before the Reg Cutoff date.

Late

Specifies the fee charged when a registrant places an order after the established Reg Cutoff date as defined on the Define an event window.

Income Account

Specifies the general ledger account number assigned to the function for this specific registrant class.

Deferred Account

Specifies the general ledger number that records the fee until it is transferred to earned income. (This field is visible only if you are licensed for Deferred Income)

To define event function fees and GL information

Note: Although this procedure describes assigning a flat fee for all registrant classes and all registration dates, you can assign different fees for different registrant classes and registration dates.

- Define an event.

- Define an event function.

- On the Event Function Detail window, click More and select Fees from the drop-down list.

- Click Edit.

- Choose a registrant class or the *Default* class.

- Enter the amount for the Early, Regular, and Late fees or check the Comp box if you will not charge members of this registrant class a fee for this function.

- (optional) Enter the general ledger account number where the income should be credited in the Income Account field, or click the lookup icon to select an account.

- (optional) Enter the deferred income account in the Deferred Account field, or click the lookup icon to select an account.

- Click Save.

The Event Function Definition - Fees window opens.

Note: If you are using a General Ledger interface, you must assign a GL account number to all fees other than complimentary.