Defining Canadian tax codes

Canada has several types of taxes: a Harmonized Sales Tax (HST), a national Goods and Services Tax (GST), and a Provincial Sales Tax (PST). Because provincial taxes sometimes include a tax on the base national tax (a tax on a tax) in addition to taxes calculated for goods and services, set up base and primary tax authorities that allow for this extra calculation.

Note: Verify current tax rates for Canada (http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rts-eng.html) and Quebec (http://www.revenuquebec.ca/en/entreprise/taxes/tvq_tps/) before implementing your codes.

These are the roles of the various tax authorities:

- BASE_GST - Specifies the GL account for national tax and tax rate.

- BASE_HST - Specifies the GL account for harmonized tax and tax rate. For multiple rates, create codes for each, for example, BASE_HST12, BASE_HST13, BASE_HST15 (for 12%, 13%, and 15% respectively).

- Primary GST - (required) Primary GST entry, which relates back to the BASE_GST (no GL account or tax rate should be entered).

- Primary PST - Specifies the GL account. This is related to BASE_GST and may indicate that PST tax is also applied to the GST tax amount. Use the province abbreviation.

Warning!

Never use the BASE_GST as the primary taxation authority; rather, use BASE_GST as the related taxation authority to calculate the primary PST and GST. As the basis for tax calculation and tracking, the BASE_GST must contain the correct rate and GL account.

Here is an example of how you might define tax codes across provinces.

| Code | Title | Notes | Rate | GL Acct | Related tax | Taxable |

|---|---|---|---|---|---|---|

|

BASE_GST |

Base GST |

|

5 |

GST |

|

|

|

GST |

GST |

|

|

|

BASE_GST |

|

|

BASE_HST12 |

HST 12% |

|

12 |

HST |

|

|

|

QC |

Quebec |

GST at 5%, PST at 7.5%, GST taxed |

7.5 |

|

BASE_GST |

Enabled |

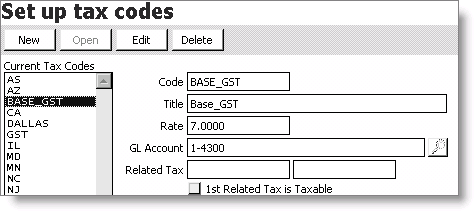

Set up tax codes window

- Current Tax Codes - Lists the current tax codes.

- Code - Enter an abbreviation you want to assign to a tax code.

- Title - Enter the title of the current tax code.

- Rate - Enter the tax rate of the current tax code.

- GL Account - Enter the General Ledger account number assigned to the tax code. Select the lookup icon to search for an account number.

- Related Tax - Use these fields to enter multiple tax codes. Enter the codes for any other taxes you want to relate to the tax defined in the Code field.

- 1st Related Tax is Taxable - Enable to make the first Related Tax field taxable. The option displays only if the Canadian taxation method is enabled for the Default Organization.

- Print button - Lets you print the Tax Table Listing report of the defined tax codes, descriptions, rates, and GL accounts.

To define BASE_GST

You will need to define a code for the base national Goods and Services Tax (GST). The BASE_GST is used as the related taxation authority when calculating the primary GST and PST. Because it is the basis for tax calculation and tracking, the BASE_GST must contain the correct rate and GL account number.

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Define a Code, Title, and tax Rate for the BASE_GST tax code.

- Enter the GL Account number (select the lookup icon to look up the account). Do not enter a Related Tax because this is the base tax.

- Click Save.

To define BASE_HST

You will need to define a code for the base Harmonized Services Tax (HST). The BASE_HST is used as the related taxation authority when calculating tax for provinces using HST. Because it is the basis for tax calculation and tracking, the code must contain the correct rate and GL account number. For multiple rates, create additional codes: BASE_HST12, BASE_HST13, BASE_HST15 (for 12%, 13%, and 15% respectively).

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Define a Code, Title, and tax Rate for the BASE_HST tax code.

- Enter the GL Account number (select the lookup icon to look up the account). Do not enter a Related Tax because this is the base tax.

- Click Save.

To define Primary GST

Enter a code for the Primary GST. Since the Primary GST relates to the BASE_GST, no GL account number or rate should be entered.

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Enter a Code and a Title for the provincial tax code.

- Enter the BASE_GST in the first Related Tax field.

- Click Save.

Note: Leave the Rate and GL Account fields blank.

To define a provincial tax code (PST)

Enter a code for each province for which taxes will be calculated. A provincial tax code is cross-referenced as the primary taxation authority for an organization, so you will need to enter both a rate and a GL account number. In addition, the base national GST will need to be entered as a related tax.

For provinces for which the base national GST is taxable, enable the 1st Related Tax is Taxable option. Provincial Sales Tax (PST) then will apply to the base national GST.

Some organizations may require provincial tax codes for multiple provinces:

- Organizations using Multi-Warehousing (Orders only)

- Organizations with offices in multiple provinces

Note: Organizations that do not charge provincial taxes, such as Australian and New Zealand organizations and PST exempt Canadian organizations, do not need to define provincial tax codes.

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Define a Code, Title, and tax Rate for the provincial tax code.

- Enter a GL Account number (select the lookup icon to look up an account).

- Enter the BASE_GST tax code in the first Related Tax field.

- (optional) For provinces for which the base national GST is taxable, enable the 1st Related Tax is Taxable option.

- Click Save.