Defining VAT tax codes

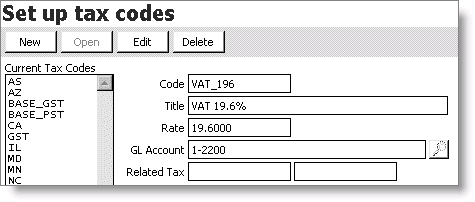

If you are using different VAT tax rates, you must define the different rates in iMIS before you can apply them to any type of event, product, or order. You do so in the Set up tax codes window. The following sections include examples of various VAT tax codes.

- Current Tax Codes - Lists the current tax codes.

- Code - Enter the abbreviation you want to assign to the tax code.

- Title - Enter the title of the current tax code.

- Rate - Enter the tax rate of the current tax code.

- GL Account - Enter the General Ledger account number assigned to the tax code. Select the lookup icon to search for an account number from the GL Account general lookup/validation table.

- Related Tax - Use these two fields to enter multiple tax codes. Enter the codes for any other taxes you want to relate to the tax defined in the Code field.

To define VAT-exempt tax codes

Different events and products may require defining different VAT rates.

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Enter VAT_EXEMPT in the Code field.

- Enter a Title for the VAT_EXEMPT tax code.

- Enter the GL Account number (select the lookup icon to look up the account).

- Click Save.

To define VAT zero-percent tax codes

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Enter a Code for VAT zero-percent.

- Enter a Title for the VAT zero-percent tax code.

- Enter the GL Account number (select the find icon to look up the account).

- Click Save.

To define VAT percentage tax codes

- From AR/Cash, select Set up tables > Tax codes to open the Set up tax codes window.

- Click New.

- Enter a Code for the VAT tax code.

- Enter a Title for the VAT tax code.

- Enter a tax Rate for the VAT tax code.

- Enter the GL Account number (select the find icon to look up the account).

- Click Save.