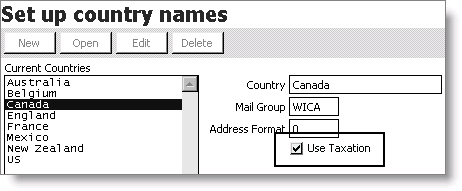

Enabling Canadian taxation for countries

When setting up GST and PST calculations for Orders, you must enable Use Taxation for each country for which taxes are collected. To enable GST taxation for individual countries, enable the Use Taxation option on the Country names window.

When the Use Taxation option is enabled for a country, GST and PST taxes (Canadian) are calculated for orders that ship to customers within that country. If you ship orders to customers in multiple countries that use the Canadian taxation method, enable the Use Taxation option for each of those countries.

To enable taxation for a country

- From Customers, select Set up tables > Country names to open the Country names window.

- If adding a new country:

- Click New.

- Enter the name of the Country.

- Enter the country’s Mail Group.

- Accept the default Address Format.

- Click Edit.

- Enable the Use Taxation option.

- Click Save.

- Exit and restart iMIS.

If updating an existing country:

Note: If you want to use or set up a different address format, click Address Layouts after completing this procedure to open the Country Address Layouts window and set up the format.