Enabling Canadian taxation for the Default Organization

The Canadian taxation method must be enabled for the Default Organization on the Organization Names window before establishing the specific tax codes used by the different modules of iMIS. After enabling the Canadian taxation method, exit and restart iMIS to implement GST or HST calculations for the Default Organization.

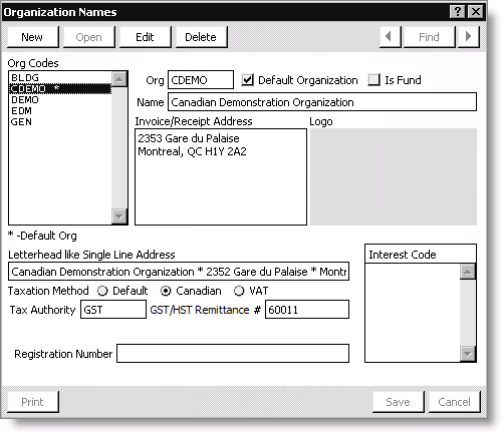

Organization Names window

- Org Codes - Lists the codes for the available organizations.

- Org - (required) Enter an abbreviated, descriptive code for an organization.

- Default Organization - (required) Enable to identify the organization using Canadian taxation as the default organization. If the organization using Canadian taxation is not designated as the Default Organization, the Canadian taxation method will not be implemented. An asterisk displays to the right of the default organization in the Org Codes drop-down list.

- Is Fund - (optional) Enable to indicate that an organization is also a fund.

- Name - (optional) Enter the full name of an organization. A maximum of 60 alphanumeric characters can be entered.

- Invoice/Receipt Address - (optional) Enter an organization’s complete address. This address is the receipt address for invoices and other correspondences. It is also used on reports where the name and address display as a block.

- Logo - (optional) Paste an organization’s logo into this area of the window.

- Letterhead like Single Line Address - (optional) If an organization’s letterhead is a single line address, enter it in this field. The letterhead is used on reports where the address appears in a single line, such as event confirmations.

- Taxation Method: Canadian – Enable to use the Canadian taxation method. The following fields display when the Canadian taxation method is enabled:

- Tax Authority – Enter an organization’s default tax authority. When defining a default tax authority for a Canadian organization, enter the Primary GST for the default tax authority.

- For non-Canadian organizations that use Canadian taxation and include the GST tax in the advertised price of all products (some organizations in Australia and New Zealand), enter GSTINC for the default tax authority.

- Press Ctrl+L to look up the tax authority codes defined on the Set up tax codes window (from AR/Cash, select Set up tables > Tax codes).

- GST/HST Remittance # – (optional) Enter the Canadian GST (Goods and Services Tax) number. The Canadian GST can be printed on invoices.

- Interest Code - (optional, Fundraising) Enter the interest code associated with each fund. Press Ctrl+L to find the interest codes defined on the Set up interest codes window (from Customers, select Set up Fundraising > Interest codes). This field appears only if you are licensed for Fundraising.

- Registration Number - (optional) Enter the registration number associated with an organization or fund. Fundraising organizations must have a registration number (Canada) or tax identification number (United States) to claim and verify tax-exempt status. This field is applicable for the Fundraising module.

To enable GST for the Default Organization

- In iMIS, select File > System Setup to open the System Setup window.

- Click Organization Names to open the Organization Names window.

- Add or update an organization.

- Enable the Default Organization option.

- Enable the Canadian taxation method option.

- Enter the GST/HST Remittance number in the GST/HST Remittance # field.

- If licensed for Fundraising, enter the registration number in the Registration Number field.

- Click Save, close all windows, and restart iMIS for changes to take effect.

If adding a new organization, click New and enter a code for the organization in the Org field.

If updating an organization, select one from the Org Codes list and click Edit.