Enabling VAT for the default organization

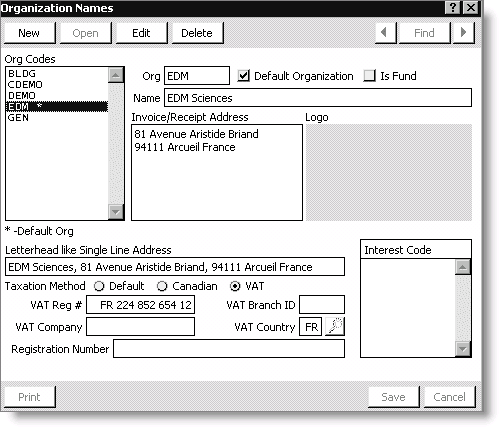

Before you can configure iMIS to handle VAT for your organization, you must select VAT as a Taxation Method for your Default Organization on the Organization Names window. After that, you can create the specific VAT tax codes used by the different areas of iMIS. After enabling the VAT taxation method, be sure to restart iMIS for the change to take effect.

Note: VAT has a separate license key. You must be licensed for VAT to enable it as a taxation method.

- Default Organization - (required) Enable to identify the organization using VAT as the default organization. If the organization using VAT is not designated as the Default Organization, the VAT taxation method will not be implemented. An asterisk displays to the right of the default organization in the Org Codes list.

- Taxation Method: VAT – (Displays only if you are licensed for VAT) Enable to use the VAT taxation method. The following fields display when the VAT taxation method is enabled:

- VAT Reg # – Enter the numeric part of an alphanumeric VAT number. Length and structure will vary depending on country. For example, FR 224 852 654 12 is used in France and BE 422 544 865 is used in Belgium.

- VAT Branch ID – (optional) Enter the VAT branch ID for an organization.

- VAT Company – (optional) Enter the VAT company for an organization.

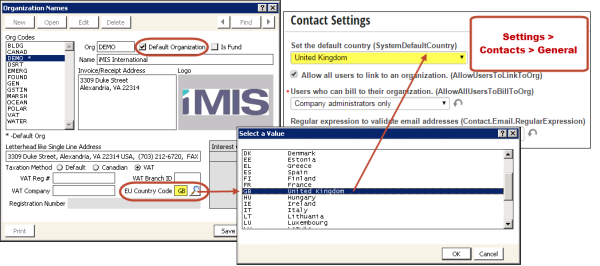

- VAT Country – Enter the alphabetic part of an alphanumeric VAT number that corresponds to the EU member country of the organization. Select the lookup icon to look up a country from those defined in the Country Names table.

- Registration Number - (optional, Fundraising) Enter the registration number associated with an organization or fund. Fundraising organizations must have a registration number (Canada) or tax identification number (United States) to claim and verify tax-exempt status.

Warning!

If the lookup populates the wrong VAT Country code, you first need to fix the entries in your Country Names table and then update the entry here.

Troubleshooting tip: The country that you set for your Default Org must match the System Default Country that you specify for your website.

To enable VAT for the Default Organization

- In Desktop, select File > System Setup, Organization Names to open the Organization Names window.

- If adding a new organization:

- Click New, and enter a code for the organization in the Org field.

- Select an organization from the Org Codes drop-down list and click Edit.

- Enable the Default Organization option.

- Enable the VAT taxation method option.

- Click Save, close all windows, and restart iMIS for the changes to take effect.

If updating an existing organization: