Modifying reports and invoices for VAT

To help with VAT reporting, key reports include details about the VAT being collected for the order:

- The new ORDER-Order Status- Order Detail Report VAT (Crystal) report includes the customer's VAT details, such as VAT Exempt status or a VAT registration number and country. The charges at the bottom include explanation of the VAT portion, if any, including the percentage that applies and the net amount being collected.

- The MEETING-Confirmations- Confirmation Letter (Crystal) report shows the amount of VAT tax included in the registration fee.

iMIS ships with an invoice standard report that includes an analysis of the VAT. In order to use this report, you need to modify the invoices in iMIS.

To modify standard reports for VAT

- Select Utilities > Report Specs to open the Report Specifications window.

- Scroll and select the specific report you wish to modify (Omnis only):

- Select MEETING-Invoices-Print Invoices to modify Event Invoices

- Select ORDER-Invoices-Activity Menu Items to modify Order Invoices

- Select a standard Omnis report

- Click Clone.

- Tab to the Title field, and place a period (.) at the beginning of the title.

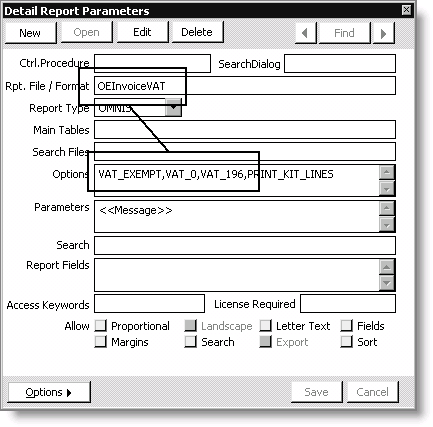

- Click Parameters to open the Detail Report Parameters window.

- Change the Rep File / Format to OEInvoiceVAT.

- For standard reports and Order Invoices:

- Enter the VAT tax codes in the Options field. Precede each tax code by VAT_, such as VAT_EXEMPT, VAT_0, and VAT_196.

- For Event Invoices, do not change the Options.

- Click Save.

Note: Putting a period at the beginning of the title places the report first in the alphabetical report category, making it the default.