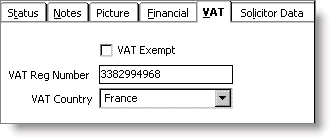

Setting VAT tab data for a contact

Before entering an order for a customer, you need to enter the VAT details for the customer on the Manage customers window’s VAT tab. This ensures that these details print on invoices.

- VAT Exempt - Enable if this customer is exempt from VAT in all cases, regardless of VAT Rules.

- VAT Reg Number - Enter the VAT Registration Number for the customer. The VAT Registration Number on the VAT tab corresponds with a customer’s VAT exempt status. If a value is entered in the VAT Reg Number field, a customer will be considered exempt and will not be charged VAT.

- VAT Country - Select the VAT country from the drop-down list. This information displays on the AR/Cash Enter and edit orders window.

The information entered in the VAT Reg Number field displays on the Enter and edit orders window (from AR/Cash, select Process orders > Enter and edit orders).

Note: iMIS only processes VAT Registration Numbers issued by countries within the EU. If you enter a VAT Registration Number for a country outside the EU, VAT processing will be incorrect.

To enter VAT information for an individual

If User Defined Company Flow Down has been set up for VAT, you only need to enter the following information for [1] company records or [2] those with no company affiliation.

- From Customers, select Manage customers to open the Manage customers window.

- Click Find to locate the customer’s record.

- Select the VAT tab.

- (optional) If a customer is exempt from all VAT taxes, enable the VAT Exempt option.

- (optional) Enter a customer’s VAT Registration Number in the VAT Reg Number field. If a value is entered here, a customer is considered exempt.

- Enter a customer’s country code in the VAT Country field.

- Click Save.