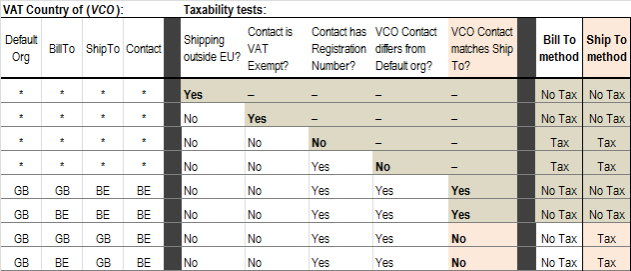

Taxation based on Bill To versus Ship To

The Tax based on: options determine when iMIS does not charge VAT:

|

Bill to data |

Ship to / Recipient data |

|---|---|

|

|

Definitions:

- All orders have an associated financial entity, defined through System Setup > Organization Names. Each financial entity specifies a VAT Country.

- VAT Exempt means having the VAT Exempt option enabled on the contact's VAT tab (Customers > Manage customers).

- VAT registered requires having a VAT Registration Number specified on the contact's VAT tab. If so, whether a contact is VAT registered then depends on the tax method and the value in VAT Country:

- Bill to Data: if VAT Country is blank, the contact is VAT registered in the VAT Country of the order’s financial entity. (Exception: Web orders honor the original iMIS VAT implementation by first trying to establish the order’s financial entity from product lines.)

- Ship to / Recipient data: if VAT Country is blank, the contact is not VAT registered.

Here is a table that shows how VAT taxes apply to orders according to each Tax based on setting. You can substitute your EU countries for the ones used here (GB - Great Britain, BE - Belgium).