Asia-Pacific taxation (GSTINC)

In iMIS systems that use GSTINC as the taxation method for the default organization, you can include the GSTINC (Good and Services Tax, Inclusive) tax amount in the price of online membership joins and cash renewals.

The GSTINC tax code is a special tax authority for clients in countries other than Canada (notably countries located in the Asia-Pacific region) that use the Canadian taxation method for calculating taxes and also include the GST tax in the advertised unit price of products and events.

The GSTINC tax authority assumes a product’s advertised price already includes applicable taxes. When the GSTINC tax authority is applied, taxes are extracted from a product’s advertised price when an order is entered. For example, a product with an advertised purchase price of 150.00 that includes a 12.5% GST tax will have a unit price of 133.33 with a sales tax of 16.67.

Both the GSTINC and Primary GST tax codes have similar functionality, and both tax codes are set up exactly the same way. The difference between the two is that GSTINC extracts calculated taxes from advertised product prices rather than calculating and adding taxes to product prices.

The GSTIN Org Code must be enabled for the Default Organization on the Organization Names window before establishing the specific tax codes used by the different modules of iMIS. After enabling the taxation method, exit and restart iMIS to implement GSTINC calculations for the Default Organization.

Do the following to enable GSTINC for the Default Organization:

- In Advanced Accounting Console, go to File > System Setup to open the System Setup window.

- Click Organization Names to open the Organization Names window.

- Add or update an organization:

- If adding a new organization, click New and enter a code for the organization in the Org field.

- If updating an organization, select an organization from the Org Codes list and click Edit.

- Enable the Default Organization option.

- Enable the GSTIN taxation method option.

- Enter the GST/HST Remittance number in the GST/HST Remittance # field.

- If licensed for Fundraising, enter the registration number in the Registration Number field.

- Click Save, close all windows, and restart iMIS for changes to take effect.

Do the following to define the GSTINC tax code:

- In Advanced Accounting Console, go to Settings > Commerce > Set up tables > Tax codes to open the Tax codes window.

- Click New.

- Enter GSTINC for the tax Code.

- Enter a Title for the GSTINC tax code.

- Enter the BASE_GST in the first Related Tax field.

- Click Save.

Note: Leave the Rate and GL Account fields blank.

How you define the prices and taxes for your individual products determines which tax code you define as the default tax authority. Organizations within some countries calculate taxes for product prices and then add the taxes into the advertised price of the products; advertised product prices include any applicable taxes.

- If your organization's policy is to include GST tax in the advertised product price (inclusive), then set GSTINC as the Tax Authority for the Default Organization on the Organization Names window (select File > System Setup, and click Organization Names).

- If your organization's policy is to not include GST tax in the advertised product price (exclusive), then set GST as the Tax Authority defined for the Default Organization on the Organization Names window.

Note: An organization should be defined as using either GST or GSTINC. It is recommended that all Asia-Pacific pricing use the GSTINC model exclusively.

In the Staff site, go to Settings > Contacts > General and set the default country (SystemDefaultCountry) to an Asia-Pacific country, for example, Australia.

Asia-Pacific taxation for Events involves applying appropriate taxes to individual events and event functions. After defining GSTINC tax codes using the GSTINC taxation selection in the Organization Names window, you can enter the tax codes for your individual events and event functions.

Because services are consumed in the country in which they are delivered, all customers are considered taxable. Only customers with a nontaxable status are exempt.

Note: Once you register a customer for event functions designated as GSTINC, you cannot change that registrant's Tax Authority on the Events > Register for an event > Attendee tab until you un-register the customer from the GSTINC functions.

Do the following to assign taxation to an event:

- Ensure that the following setup tasks are complete:

- Enable the Canadian taxation method for the default organization.

- Define the tax codes as needed.

- Define the default tax authority.

- In Advanced Accounting Console, go to Events > Define an event to open the Define an event window.

- Double-click the event to open it in the Define an event window.

- Click Edit.

- Enter the default tax authority code in the Tax Authority field, or select the field’s lookup icon to search for a tax code.

- Click Save.

Do the following to assign taxation to an event function:

- In Advanced Accounting Console, go to Events > Define an event to open the Define an event window.

- Double-click the event that uses GSTINC taxation to open the event in the Define an event window.

- Double-click the function to open the Event Function Detail window.

- Click Edit.

- Enable the GST/HST taxable option.

- Click Save.

When a customer registers for an event function, the system will automatically calculate the tax based upon the tax options you have defined for the specific function.

GSTINC calculation for Orders involves enabling the Canadian taxation method option for countries and applying GSTINC taxes to product categories, individual products, and freight and handling charges.

Freight and handling taxes are charged in addition to any other taxes that are applied to products sold in the country using GSTINC calculation, and freight and handling taxes are calculated on both taxable and nontaxable product purchases.

When processing orders using Asia-Pacific taxation, the Ship to Address’s country and state/province determine which tax authority is used for calculating taxes:

- If the Use Taxation option is enabled for the Ship to Address’s country on the Country names window, verify whether the Ship to Address’s state/province code matches a tax code defined on the Tax codes window:

- If a match exists, select the Ship to Address’s state/province code for the order’s Tax Authority on the Orders window (go to Customer Service > Orders).

- If a match does not exist, set the order’s Tax Authority on the Enter and edit orders window to equal the Tax Authority defined for the Default Organization on the Organization Names window (normally, this is the tax code GSTIN).

- If the Use Taxation option is not enabled for the Ship to Address’s country on the Country names window, leave the order’s Tax Authority field blank on theOrders window (go to Customer Service > Orders). No taxes will be charged.

- For orders for which no country is defined for the Ship to Address, the assumption is that the Ship to customer shares the same home country as the organization and therefore is taxable. For a Ship to Address for which no country is defined, verify whether the Ship to Address’s state/province code matches a tax code defined on the Tax codes window:

- If a match exists, select the Ship to Address’s state/province code for the order’s Tax Authority on the Orders window (go to Customer Service > Orders).

- If a match does not exist, set the order’s Tax Authority on the Enter and edit orders window to equal the Tax Authority defined for the Default Organization on the Organization Names window (normally, this is the tax code GSTIN).

Ensure that the following setup tasks are complete:

- Enable the Canadian taxation method for the default organization.

- Define the GSTIN tax code.

- Define the default tax authority.

Do the following to apply taxation to a product:

- In Advanced Accounting Console, go to Commerce > Inventory > Products to open the Products window.

- Select a product code from the list of Current Products.

- Click Edit.

- Enable the Taxable (GST/HST) options.

- Click Save.

Warning!

Tax settings at the product level override those at the category level. If you enable taxes for a category but not for a product in that category, no taxes are calculated. If you disable taxes for a category but enable taxes for a product in that category, taxes are calculated.

Do the following to apply taxation to a product category:

- In Advanced Accounting Console, go to Settings > Commerce > Set up tables > Product categories to open the Product categories window.

- Select a product category from the list of Current Categories.

- Click Edit.

- Enable the Taxable (GST) options.

- Click Save.

Do the following to apply taxation to freight and handling charges:

- In Advanced Accounting Console, go to Settings > Commerce > Configure commerce options to open the Configure commerce options window.

- Click Add-on Charges to open the Add-on Charges window.

- Click Edit.

- Enable the Apply Sales Tax to Freight Charges and Apply Sales Tax to Handling Charges options.

- Click Save.

To include GSTINC in the price of these membership billing products, create a GSTINC tax product to pair with the membership billing product. These products should use identical product codes and types, except you must append the suffix “_GST” to the product code for the GSTINC tax product. For example, you could use MEM as the product code for the membership billing product and MEM_GST as the product code for the tax product.

When the product codes conform to this format and the membership billing product is included in the online billing cycle, the products create a kit, meaning that when a user selects the membership billing product, the GSTINC tax product is automatically included in its price in the membership details page, the cart, and the online order confirmation page.

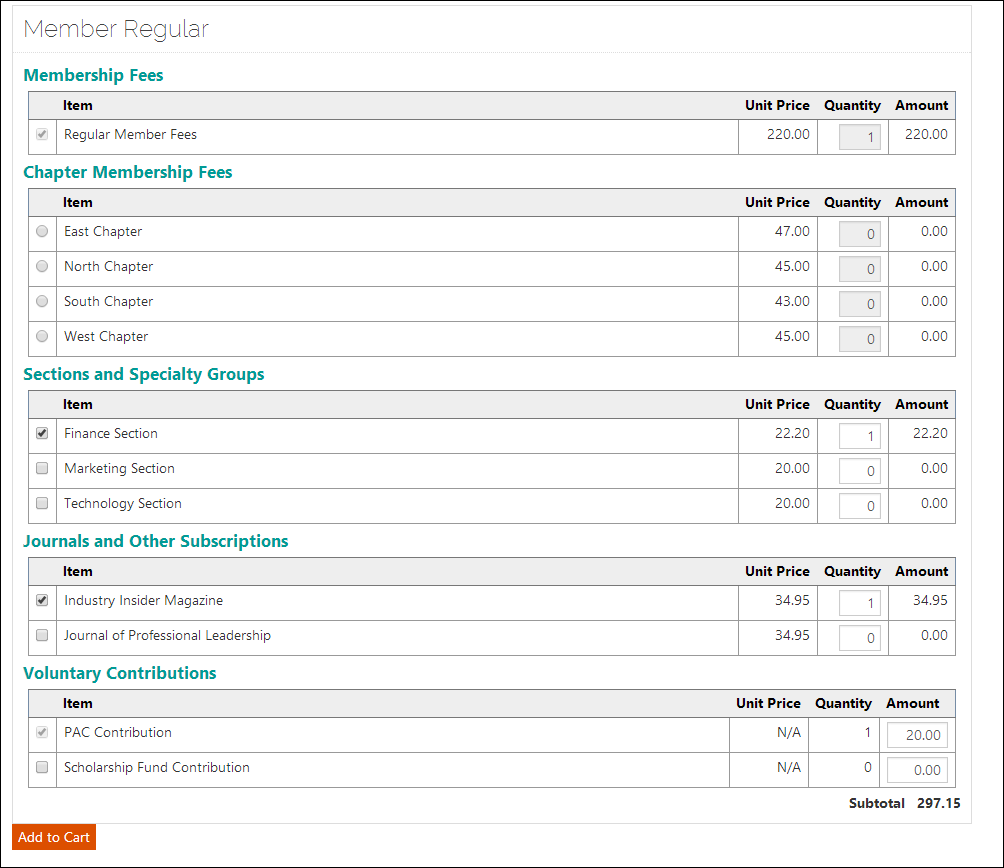

In the example below, the Regular Member Fees product (Product Code = REG), which is priced at 200.00, has a paired GSTINC tax product (Product Code = REG_GST) with a price of 20.00. The Finance Section product (Product Code = FIN) , which is priced at 20.00, has a paired GSTINC tax product (Product Code = FIN_GST) with a price of 2.20. Although the paired GSTINC tax products do not display separately in the membership details page, the cart, and the online confirmation page, they are automatically bundled with their paired membership billing products, which list the combined prices for both products. Thus, the Regular Membership Fees product is listed with a price of 220.00, and the Finance Section product is listed with a price of 22.20.

Membership details page for an online join that includes GSTINC in the Regular Member Fees and Finance Section Fees

Note: On the membership details page, a consolidated price displays for the membership billing product and the GSTINC tax product. The GSTINC tax product is not listed separately.

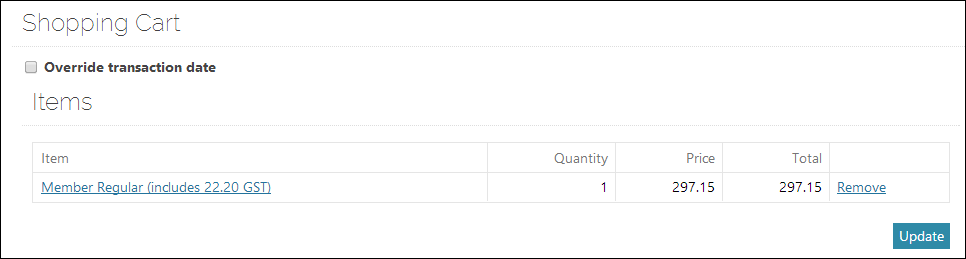

Cart page for an online join that includes 22.20 of GSTINC for the Regular Member Fees and Finance Section Fees

When the member renews online, the invoice line in the cart includes the GSTINC in the price, but does not display the (includes XX.XX GST) message for the membership billing product.

- In the Advanced Accounting Console, go to File tab > System Setup > Organization Names to confirm that GSTINC taxation is enabled.

- Confirm that Canadian is the Taxation Method.

- Confirm that GSTINC is the Tax Authority.

- Go to Settings > Billing > Billing products to create the GSTINC tax product.

- Click New.

- Enter the Product Type, which must be the same product type as its paired membership billing product.

- Enter the same Code as the membership billing product with _GST appended. For example, if the membership billing product Code is MEM, the GSTINC tax product Code should be MEM_GST.

Enter the Standard Price. To obtain this amount, calculate the GSTINC tax amount owed on the primary billing product.

- Select Accept Payments on the Web to use the GSTINC tax product with online joins and renewals.

Enter additional information as needed.

- Save the new tax product.

(Optional) If your organization has members who reside in countries that do not use GSTINC, click Special Prices to define a pricing rule that limits the application of the tax product to contacts residing in countries in the AP region. In these cases, you may want to set the Standard Price of the GSTINC tax product to 0 and create a pricing rule that matches the contact’s country of residence to the appropriate GSTINC tax amount.

Note: In situations where different member types receive different member rates, you can create special pricing rules that set the price of the GSTINC tax product as the correct amount for each member type.

Save the changes to the tax product.

- Go to Settings > Billings > Billing cycles to confirm that the membership billing product is included in your online billing cycle. If the membership billing product is selected for the billing cycle, the paired tax product is automatically included and added to the membership billing product’s price when purchased online. To learn more about setting up an online billing cycle, read Setting up Join Now.