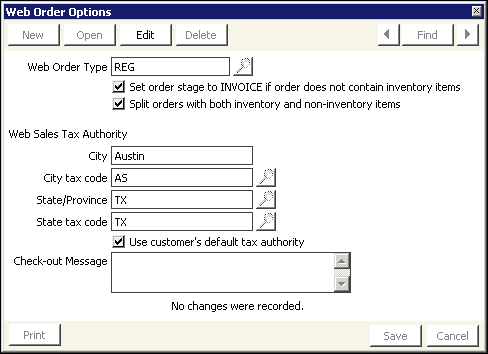

Defining web order options

iMIS allows you to define default order types, tax authority, and tax codes for orders placed over the web.

In the Advanced Accounting Console, go to Settings > Commerce > Configure commerce options, and click Web.

The Web Order Type can now be defined through the Staff site. See General for more information.

The Web Sales Tax Authority options allow you to define the tax codes for orders placed over the web. If the customer's ship-to address (city or state) match the addresses entered in the Web Sales Tax Authority or the state's tax authority in the web setup in iMIS, the web view shows the calculated taxes. If these settings do not match, no taxes are assessed. The logic behind this is that you are assessed taxes if the organization you are ordering from is located in the same city or state.

- City - Enter the city from which you want to generate your web orders.

- City tax code - Enter the tax code for the city or municipality entered in the City field if taxes are applicable. Tax codes are defined on the Set up tax codes window (in the Advanced Accounting Console, go to Settings > Commerce > Set up tables > Tax codes).

- State/Province - Enter the state from which you want to generate your web orders. State/Province codes are defined on the State/province codes window (in the Advanced Accounting Console, go to Settings > Membership > Set up tables > State/province codes).

- State tax code - Enter the tax code for the state or province entered in the State/Province field. Tax codes are defined on the Set up tax codes window (in the Advanced Accounting Console, go to Settings > Commerce > Set up tables > Tax codes).

Note: You must enter a tax authority and a tax code for taxes to be calculated and applied. For example, if you specify a State/Province but no State tax code, no tax is calculated.

The Use customer’s default tax authority option displays on the Web Order Options window only when the selected Taxation Method is set to Default on the Organization Names window.

Note: If the Canadian or VAT taxation method is enabled, the Use customer’s default tax authority option is not displayed.

Note: The Check-out Message is only used for iMIS Public View sites. These sites have been deprecated.

Enter the message you want to display on your order checkout page.

The Use customer's default tax authority option is on the Web Order Options window (in the Advanced Accounting Console, go to Settings > Commerce > Configure commerce options, and click Web). A tax authority and a tax code must be specified in the Web Order Options window for taxes to be calculated and applied.

When Use customer’s default tax authority is enabled, iMIS automatically calculates taxes for product orders placed over the web, based on the customer’s Default Tax code. The Default Tax code is defined on the Financial tab of the Manage customers window (in Desktop, go to Customers > Manage customers > Financial tab). For more information, refer to the iMIS Classic Helpsite.

If a Default Tax code is not defined for the customer, then the city’s tax authority is used when the Ship to city and state match, or the state’s tax authority when only the Ship to state matches.

When Use customer’s default tax authority is disabled, then the city’s tax authority is used when the Ship to city and state match, or the state’s tax authority when only the Ship to state matches.

Note: If there is no match for Ship to city or Ship to state or the tax authority is unassigned, no tax is applied.

The Use customer’s default tax authority option displays on the Web order options window only when the Taxation Method is set to Default on the Organization Names window (in the Advanced Accounting Console, go to File > System Setup > Organization Names).

If the Taxation Method is set to Canadian or VAT, the Use customer’s default tax authority option will not be displayed.