Organization

You can configure organization settings from the Staff site, and in the Advanced Accounting Console.

From the Staff site, go to Settings > Organization:

- The full name of the organization that owns the site

- Enter the name to appear in the title tag of the front page of your sites.

- The abbreviated name of the organization that owns the site

- Enter an abbreviated name if desired. You may leave this field blank.

- The default email address for the site

- Enter the email address to receive all email by default when errors occur in the site. Typically, this email address is for the webmaster and the primary contact for the organization. This email address also receives the order email confirmation when a contact makes a purchase but does not have an email address listed in the Personal Details section of their account page

Note: When you change the default email address for the site, it is a global change that updates many of the settings in iMIS Desktop, including the default address set up at Desktop > System Setup > Module setup > Quick setup.

- The default Customer Type to use when creating new customers online

- (Required) Specifies the Member Type that will be assigned to individual contacts when a new account is created from your iMIS website.

- The default Customer Type to use when creating new organizations online

- Specifies the Member Type that will be assigned to new iMIS contact records created for non-individuals (for example, organizations) from your website.

- The default Customer Type for event guests added by members

- Specifies the Member Type that will be assigned when an individual member of your organization creates a new account for a guest during an event registration. If the type is not defined, the new contact will be assigned the default Customer Type.

Note: The default Customer Type for event guests is based on the member status of the registrant sponsoring the guest. For example, as a Company Administrator, if you create a guest for a coworker who is a member, the guest will have the customer type for event guests added by members, even if you as a Company Administrator are not a member.

- The default Customer Type for event guests added by non-members

- Specifies the Member Type that will be assigned when an individual who is not a member of your organization creates a new account for a guest during an event registration. If the type is not defined, the new contact will be assigned the default Customer Type.

Note: The default Customer Type for event guests is based on the non-member status of the registrant sponsoring the guest. For example, as a Company Administrator, if you create a guest for a coworker who is a non-member, the guest will have the customer type for event guests added by non-members, even if you as a Company Administrator are a member.

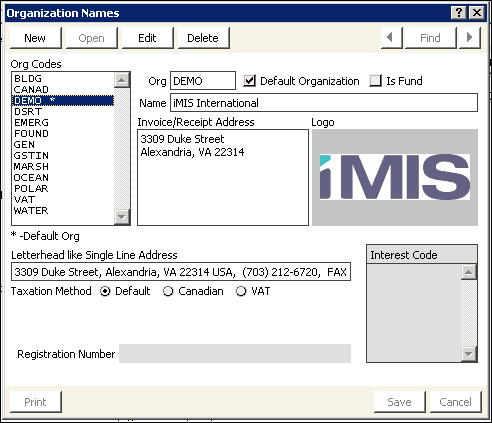

In the Advanced Accounting Console, go to File > System Setup, and click Organization Names.

- Org Codes - List of codes for the available organizations

- Org - (required) Specifies a code for the selected organization

- Default Organization - (optional) Select this option to identify the default organization. An asterisk displays to the right of the default organization in the Org Codes list.

- Is Fund - (optional) Select this option to indicate that the organization is also a fund

- Name - (optional) Specifies the full name of the organization. A maximum of 60 alphanumeric characters can be entered.

- Invoice Mail Address - (optional) Specifies the organization’s complete address where invoices and other correspondence are to be mailed. Used on reports where the name and address display as a block, such as invoices.

- Logo - (optional) Use this field to paste the organization’s logo, which must be a 256-color BMP. The preferred image size is 130 pixels by 125 pixels.

- Letterhead like Single Line Address - (optional) Specifies the organization’s letterhead is in a single line address. This information is used on reports where the address appears in single line, such as event confirmations.

- Taxation Method:

- Default - Enables the default taxation method set up in the AR/Cash module

- Canadian - Enables the Canadian taxation method which includes Goods and Services Tax (GST)/Harmonized Sales Tax (HST) and Provincial Sales Tax (PST) and may be used for other countries that calculate GST

- VAT - Enables taxation method for the European Union

- Registration Number - Specifies the registration number associated with the organization or fund. Fundraising organizations must have a registration number (Canada) or tax identification number (United States) in order to claim and verify their tax-exempt status. This field only displays if you are licensed for Fundraising.

You can enter your organization’s logo to appear on your standard report headings. The company address you enter in the Organization Names window appears on standard invoices, confirmations, and other reports.

If you have multiple financial entities within your organization, you can define multiple entities within iMIS to track their financial records separately.

Note: Although you can have several organizations (entities) defined, you can have only one Default Organization. The default organization is used throughout the product and on printed standard reports.

Organization, Fund, and Entity, in the context of iMIS accounting, all refer to a business unit that maintains separate financial books. A "fund" is specific type of organization or entity whose purpose is to solicit donations.

To define an entity/organization/fund, do the following:

- From the Advanced Accounting Console, go to File > System Setup to open the System Setup window.

- Click Organization Names to open the Organization Names window.

- Click New.

- Enter a unique alphanumeric Org Code to represent the organization.

- Select the Default Organization option if this is the default organization.

- Select the Is Fund option if this organization is also a Fund.

- Enter the full Name of the organization.

- Enter the organization’s Invoice/Receipt Address. Include the full mailing address.

- In the Logo area, paste the graphic, which must be a 256-color BMP. The preferred image size is 130 pixels by 125 pixels.

- Enter the Letterhead like Single Line Address.

- Select the Taxation Method.

- Select as many Interest Codes as applicable.

- Enter the organization’s Registration Number.

- Click Save.

Note: If you plan to create separate GL interface files for each financial entity, be sure to use as few characters as possible when defining your org codes.

Note: You can set only one entity as the default entity for non-accounting reports and other standard uses. The default organization name and address data is used for all non-accounting oriented reports. It also becomes the accounting default in cases where no module-level or other override entity is provided.

Note: You must identify the organization as a fund for it to serve as a fund in the Fundraising module.