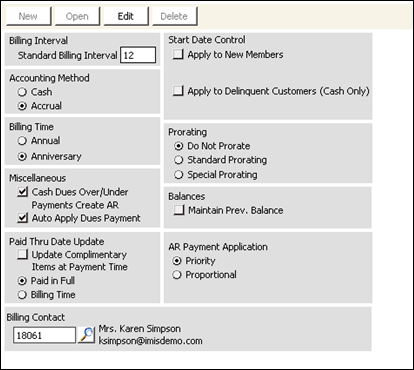

General options window

Billing Interval

Standard Billing Interval - The billing interval controls the frequency with which you will normally generate bills. You can override the billing interval at the individual customer level, at the product level, or at the individual subscription level. Choose the billing interval as a number of months from 1(monthly), 2(bimonthly), 3(quarterly), 6 (semi-annual), 12 (yearly), or 24 (every 2 years).

Note: The number entered in the Standard Billing Interval field affects billing rates. Unless the billing interval is overridden at the product level, the dollar amounts entered for the products should be in accordance with the Standard Billing Interval. See Set up products window for detailed information on products.

Accounting Method

- Cash - Enable this accounting method to set up the billing system to recognize income when payment (cash) is received regardless of when bills or invoices were generated. The cash method is preferred for the Billing module.

- Accrual - Enable this accounting method to recognize income by creating open accounts receivable items when bills and invoices are generated.

Note: After you change the accounting method, you must restart iMIS Desktop and ensure that your iMIS Administrator stops and restarts all websites that contain your iMIS 15 applications in order to see the changes in the left navigation area. If restarting the websites is problematic, you can wait for the cache to refresh (default is 15 minutes wait time, designated by the refresh cache interval), and then your changes appear.

Start Date Control

Note: If there are no Start Date Control options implemented, the New Bill From field on the Dues/Subscription Payments window (from Billing, select Enter and edit payments) defaults to the first day of the current month. See Date Usage in iMIS.

Determines whether the Bill Begin date should be advanced by one month. Start Date Control can be used to advance the start date of newly billed items or to specify a grace period for delinquent customer products. If implemented, the Bill Begin date will be controlled according to the following options:

- Apply to New Members - This option enables you to automatically advance the subscription begin date for new customers according to the parameter set in the Advance Start Month as of field.

- Advance Start Month as of - (Displays once you enable the Apply to New Members or Apply to Delinquent Customers option.) This option is a user-defined parameter used with the Apply to New Members option to allow you to set a specific day of the month on which to advance the begin date for new customers. Valid entries range from 0-28. If the value is 0 or 1, the Bill Begin date will always advance to the beginning of the next month.

- Apply to Delinquent Customers - (Applies to Cash basis and Anniversary items only) This option allows for the calculation of a new billing term when payment is posted to an existing billing record after the Bill Begin date. The new term begin date is determined by the value of the Advance Start Month as of field. If the value is 0 or 1, the new term will always advance to the beginning of the next month.

- Grace Period in Months - (Applies to Cash basis and Anniversary items only and displays only when the Apply to Delinquent Customers option is enabled.) This option refers to the grace period that is allowed for payment after the Bill Begin date.

For example, if the Advance Start Month as of field is set to 15 and the Apply to New Members option is enabled, all new customers joining on August 15 will have their billing Begin Date set to 09/01.

For example, the Advance Start Month as of field is set to 15, the Apply to Delinquent Member option is enabled, and the Grace Period in Months is set to 3. A customer with a Paid Thru date of 12/31/2001 is billed for a renewal term of 01/01/2002 to 12/31/2002. The customer does not pay until 04/15/2002. The payment transaction date of 04/15/2002 exceeds the Bill Begin date of 01/01/02, and it also exceeds the three-month grace period from the Bill Begin date of 01/01/2002. Therefore, a new product term will be calculated by comparing the payment transaction date to the value of the Advance Start Month as of field. In this example, the payment transaction date of 15 is equal to the value set in the Advance Start Month as of field, and the new term will be calculated as 05/01/2002 to 04/30/2003.

Billing Time

The billing time is a method selected to control the start and end time of a customer or product term.

- Annual - Fixed annual customer term. All customers have the same billing term. The customer term coincides with the fiscal year (begin in any month). Annual fees are commonly prorated for new customers. Different prorating rules apply depending on when a customer joins. For example, if new customers join in July and you renew annually on the calendar year, you might want to prorate their fees by 50 percent.

- Anniversary - Individual renewal date that fluctuates based on each customer's Join Date. For example, if a customer joins on July 1, his or her term would be from July 1-June 30 of the following year. If you select an anniversary billing time, terms will initially default to a year (or other specified billing interval) from the Join Date, if it exists, or the Effective Date you specified during billing.

Note: If you select Annual as the billing time, you will need to set up the first month of the fixed term or fiscal year on the AR/Cash Set up module window (from AR/Cash, select Set up module). Enter the calendar month (numeric) that represents either your fixed term or fiscal year in the First Month of Fiscal Year (Number) field. The value in the First Month of the Fiscal Year (Number) field auto-populates the Effective Date. If this field does not have a value greater than zero, then the Effective Date must be manually entered on the Process billing window (from Billing, select Process billing).

Miscellaneous

Cash Dues Over/Under Payments Create AR - When you enable this option, overpayments are tracked in the AR/Cash system to allow the credit to appear on the Credit Invoices window (from AR/Cash, select Process month-end-procedures, and click Credit Invoices). Underpayments are also tracked in AR by considering the item fully paid and maintaining an outstanding balance. Overpayment or underpayment to AR creates an open credit or debit item for that customer. For example, if the customer paid $150 and had been billed $100, a payment of $150 can be entered but only $100 applied. iMIS would create an open credit of $50 for that customer in AR. A full payment of line items advances the Paid Thru date on those items. Credit (overpayments) and outstanding debit (underpayments) balances are maintained by the AR system. In Billing, the item will be treated as fully paid.

Auto Apply Dues Payment - This option is enabled by default. When you disable this option, dues payments are not applied automatically.

Prorating

Prorating applies only to organizations that bill on an annual or fixed-term basis, as opposed to an anniversary or rotating-term basis.

- Do Not Prorate - Enable to specify that fees are the same regardless of when a customer joins the organization.

- Standard Prorating - Enable to specify a global setting that prorates all products for the current year (depends on the billing interval). The following example relates to a billing interval of 12. If a customer joins during a term, iMIS reduces the initial fees based on a standard 12-month calculation. For example, if a customer joins in month 7 and the annual fees are $200, the calculated fees would be 6/12 of the total fees, or $100.

- Special Prorating - Enable to specify user-defined prorating rules according to the needs of your organization. This rule is a per product setting and must be defined and assigned to individual products. Specify prorating rules on the Prorating window (from Billing, select Set up module > Products, and click Prorate Rules). See Defining prorating rules for detailed information.

Note: When a former member, who is still marked as active in the system, rejoins your organization, the rejoin is processed as a renewal and prorating does not apply. See Defining prorating rules for more detailed information about how prorating is applied to rejoins.

Balances

Maintain Prev Balance - If this option is enabled, iMIS maintains the previous balances on customers who have made a partial payment or no payment. Previous balances are usually maintained in conjunction with a low Standard Billing Interval. For example, if annual fees were $100 and the customer paid only $80, iMIS would retain a balance of $20. When the customer is billed next year, iMIS would add the previous balance of $20 to the customer's total balance.

Note: The Maintain Prev Balance option applies only to cash-based dues. For accrual-based fees, previous fee balances can be viewed in the individual's AR window because accrual fees billings create invoice records. The PREVIOUS_BALANCE field in the Subscriptions table will not be populated for an accrual fees billing even if the Maintain Prev Balance option has been checked.

Note: The Maintain Prev Balance option must be enabled for a _CREDIT (user-defined credit) to display on a Renewal Notice.

Note: This option does not apply to voluntary contributions (VOL).

Paid Thru Date Update

The options set in this section set the preference for when the Paid Thru date information is to be updated. The Paid Thru date for the cash accounting method is updated with payment in full.

- Update Complimentary Items at Payment Time - Enable to specify that the Paid Thru date for complimentary items (no charge products) be updated at payment time instead of billing time.

- Paid in Full - (This option displays when the Accrual accounting method is enabled.) Enable to specify that the Paid Thru date be updated when full payment of the associated line item is received.

- Billing Time - (This option displays when the Accrual accounting method is enabled.) Enable to specify that the Paid Thru date will be updated when the initial accrual fees billing is performed.

AR Payment Application

(This option displays when the Accrual accounting method is enabled.) Enable to sets the preference for distribution of partial payments across multiple-fee line items on the Enter and edit cash receipts window (from AR/Cash, select Enter and edit transactions > Cash receipts). This option allows the choice of whether a partial payment will be applied based on priority established at the product code level or evenly distributed across each fee-based product billed.

- Priority - (default) Enable to apply payments to each open line item in payment priority order until all open line items are paid. If no pay Priority has been set for the products defined on the Set up products window (from Billing, select Set up module > Products), partial payment will be applied to products in alphabetical order.

- Proportional - Enable to apply payments across all the open line items in direct proportion to each line's amount.

Billing Contact

Enter the iMIS ID for the person who would like to receive an email message each time someone makes a Billing-related purchase. The email messages is similar to the one the Event Contact receives for an Event purchase.

To set up general billing options

- From the Configure billing options window, click Edit.

- Enter the Standard Billing Interval in months.

- Select a Billing Time.

- Select an appropriate Prorating option.

- Select an Accounting Method. If Accrual is selected, additional options display in the Paid Thru Date Update section and the AR Payment Application section displays. You must make selections in these areas.

- (optional) Enable the Update Complimentary Items at Payment Time option if you want to advance the Paid Thru date of complimentary products at payment time instead of at billing time.

- (optional) Select the Start Date Control options to advance the Bill Begin day by one month and create a new billing term.

- Enable or disable the Cash Dues Over/Under Payments Create AR option.

- Enable or disable the Maintain Prev. Balance option.

- Click Save.

Note: Prorating applies only when you want to bill on an annual or fixed-term basis, as opposed to an anniversary or rotating term basis. If billing is done for all products (for example, all fees and product billings) on an anniversary basis, you must enable the Do Not Prorate option.

Warning!

If Annual is chosen as the Billing Time, be sure to open the AR/Cash Set up module window (from AR/Cash, select Set up module) and enter the calendar month (numeric) that represents either your fixed-term or fiscal year in the First Month of Fiscal Year (Number) field.

If Special Prorating is selected, define the product codes as discussed previously and then see Defining prorating rules to establish the special prorating table rules.