Events Accounting

When you finish entering a new event registration or updating an existing one, files are simultaneously updated (unless you have enabled the Separate Posting Cycle Required option on the AR/Cash Batch Control window).

Orders and Order_Lines

A record in Orders (header record) is generated for each new event/registrant combination, and one Order_Lines record is generated for each function for which a customer registers.

Note: Existing order lines do not change if a function's Entity, Appeal, Campaign, and Fair Market Value are changed unless the customer un-registers for that function and re-registers after the new values are in place.

Trans

When you enter a new registration, a multiple-line/record transaction entry is generated for each of the following:

- Payment in Full - Generates a debit to cash for the amount of the payment and a credit to income/deferred for total amount of fees

- No Payment - Generates a debit to the default AR account and a credit to income/deferred in the amount of the total fees

- Under Payment - Generates a debit to cash for the amount of the payment, a credit to income/deferred for the total amount of fees, and an additional debit to the default AR account for the remaining amount owed

- Over Payment - Generates a debit to cash for the payment amount, a credit to income/deferred for the total amount of fees, and an additional credit to the default AR account for the amount overpaid.

Invoice (for registration)

One record is generated for each registration, showing the overall balance, if any. Changes made to an existing registration, such as payments, functions, or cancellations, generate a set of new Trans entries and update pre-existing records in the Orders, Order_Lines and Invoice Tables.

Note: Unlike other accounting software, direct payments made through AR/Cash (direct Trans Table entries) post to the payment accumulator in both the related Invoice and the orders record, to keep the balances synchronized. Using this feature, you can process late event-related payments efficiently on the Enter and edit cash receipts window (from AR/Cash, select Enter and edit transactions> Cash receipts).

Invoices for event adjustments

Note: This option is currently only available to organizations whose Taxation Method is set to VAT.

The new Event System Preferences option to Create Separate Invoices for Events Adjustments makes it easier to track and print registration adjustments for both online and on-site events, to help you comply with regulations related to VAT invoicing. With this option, every adjustment generates a new invoice document (credit note or positive adjustment), which uses the date of the adjustment, lists any credits or debits, and references the original invoice.

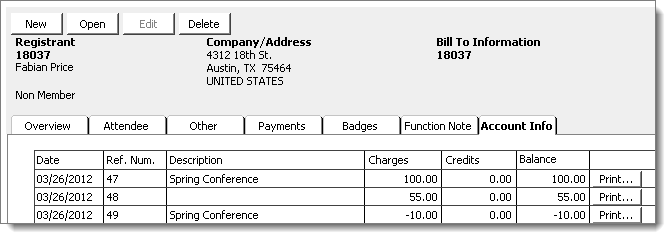

This option links multiple invoices to a single user event registration, so that, when a user registers for an event, any billing information is associated with an initial invoice. Once that invoice is printed, any subsequent changes are then associated with a new invoice. You can view and print these invoices from Events > Register a customer > Account Info tab. Double-click the line to view a full transaction ledger for each invoice, including any event transfers or substitutions.

Note that enabling this option affects new event registrations only; existing registrations retain their consolidated, single invoice.

Note: Only Crystal Reports currently support event adjustment invoices.