How taxation methods use the VAT tab

The VAT tab settings on each contact’s record affect when VAT is applied:

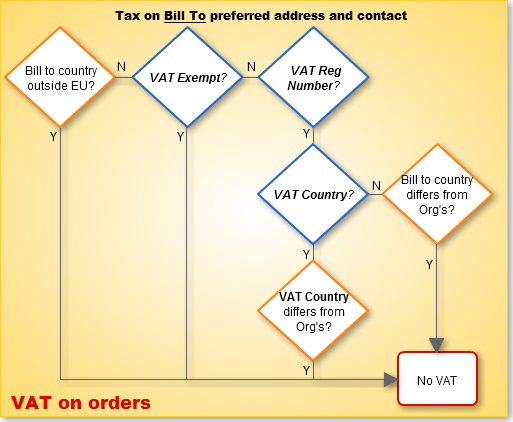

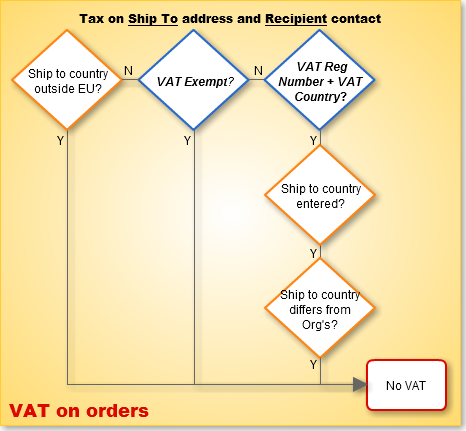

In AR/Cash > Set up module, the Taxation section lets you choose to calculate taxes by Ship to (see Taxation based on Bill To versus Ship To). These diagrams show the essential differences in how the two methods use the values on each contact’s VAT tab:

iMIS calculates VAT based on Ship to just as Amazon.co.uk does, with two exceptions:

- iMIS allows each customer to supply VAT registration for one country only.

- iMIS cannot change rates based on the country to which an item is shipped.