Configuring accounting options

Before you configure several of the Accounting features, you must define one or more financial entities in the iMIS system setup. Entities are also known as organizations, or in the case of fundraising financial entities, funds. A fund is an organization or entity that serves as an asset account for fundraising activities.

Configuring accounting features includes setting up the following options:

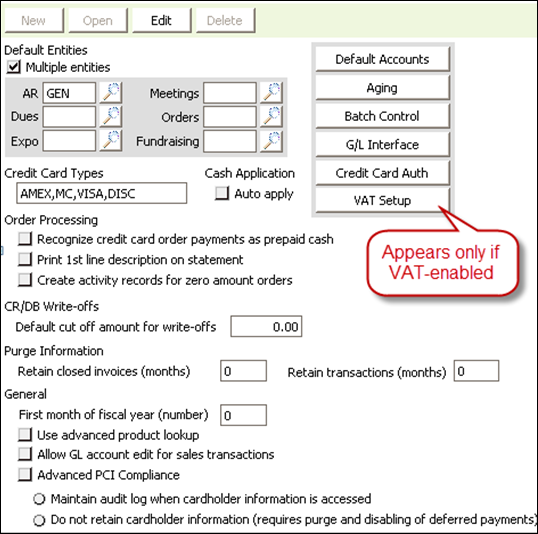

Use the Configure accounting options window to define high-level options. In the Advanced Accounting Console, go to Finance > Options > Configure accounting options:

Multiple Entities – For most organizations, this option should be disabled. When enabled, iMIS separates and processes transactions for multiple financial entities that share a common customer database, and the following fields designate the default entities for their modules:

- AR – entity code for iMIS AR/Cash

- Meetings – entity code for iMIS Events

- Dues – entity code for iMIS Billing

- Orders – entity code for iMIS Orders

- Expo – entity code for iMIS Exposition Management

- Fundraising – entity code for iMIS Fundraising

- Designates a comma-delimited list of acronyms (which iMIS stores as uppercase) for credit cards you accept. Common acronyms include Master Card (MC), Visa (VISA), Discovery (DISC), and American Express (AMEX). If you use iMIS-authorized forms, such as preprinted invoices that contain a credit card payment box, this list is printed in that box, which allows the customer to see the available credit choices.

Note: This does not provide credit card validation or credit card processing within iMIS. See Authorizing credit cards for setup details.

- Auto apply – When enabled, incoming cash receipts are automatically applied to invoices beginning with the oldest outstanding balance on an individual's record. This setting can be overridden when entering cash receipts.

If you have heavy transaction volumes, do not enable this option.

Note: Auto apply only affects the functionality of the Cash receipts window and AR Importer. If Auto apply is disabled, payment records in AR Importer files must contain the invoice number.

- Recognize credit card order payments as prepaid cash – When enabled, iMIS allows the credit card payment to be handled in the same manner as a cash payment and immediately records the payment into the batch, with an immediate debit to Cash and credit to the Prepaid account. When disabled, iMIS follows standard accounting practices and does not recognize cash for credit card payments until an order is shipped.

- Print 1st line description on statement – When enabled, the first line of an order or a user comment is displayed on the Cash receipts window, and it prints on AR Statements. When disabled, only the order number is displayed.

- Create activity records for zero amount orders – When enabled, activity records are created for orders that are no-charge orders.

- Default cut off amount for write-offs – Sets the maximum default amount to be written off. During the write-off process, all debit or credit balances less than or equal to this amount are written off. This value can be overridden during the actual write-off process.

- Retain closed invoices (months) and Retain transactions (months) – Designates how long records can be viewed in iMIS after being closed. Set up your organization's overall purging parameters (months) for the Accounting housekeeping function.

- First month of fiscal year (number) – Designates the first month of your organization's fiscal year. Some GL interface choices will export the fiscal period along with the calendar transaction date of the transactions.

- Use advanced product lookup – When enabled, users can use the lookup icon to find products when entering and editing AR/Cash sales transactions.

- Allow GL account edit for sales transactions – When enabled, allows editing of the GL Account field for each product selected during sales, credit memo, and debit memo transactions. When disabled, the GL Account field cannot be edited on the following windows:

- Sales transactions (in the Advanced Accounting Console, go to Finance > Transactions > Sales transactions)

- Credit memos (in the Advanced Accounting Console, go to Finance > Adjustments > Credit memos)

- Debit memos (in the Advanced Accounting Console, go to Finance > Adjustments > Debit memos)

- Advanced PCI Compliance – Enables iMIS-wide enforcement of the PCI Compliance support option that you choose:

- Maintain audit when cardholder information accessed – Directs iMIS to save encrypted cardholder data and to log every system event in which card information is accessed. The log is kept in the PciAuditLog table.

- Do not retain cardholder information – Directs iMIS to save transactions without storing any cardholder data and to show only gateway reference numbers and authorization codes in windows and reports.

Warning!

To use this option, you must purge existing cardholder data from your database and disable all deferred payment processing in iMIS.

Note: Annual dues uses this field to determine the Effective Date on the Bill membership fees window (in the Advanced Accounting Console, go to Membership > Bill membership fees).

Do the following to assign AR/Cash default accounts codes:

- In the Advanced Accounting Console, go to Finance > Options > Configure accounting options.

- Click Default Accounts to open the AR/Cash Default Accounts window.

- From Org Codes, choose an organizational code.

- Click Edit.

- Enter the account number (or click the lookup icon to select a value) in each field.

- Click Save.

You must define the guidelines for determining the aging groups to use for statements, aged trial balances, and account inquiries. Aging is the length of time an amount is past due for payment on an invoice.

Do the following to define aging groups:

- In the Advanced Accounting Console, go to Finance > Options > Configure accounting options.

- Click Aging to open the AR/Cash Aging window.

- Click Edit.

- Enter the aging information.

- Click Save.

The AR/Cash General Ledger Interface window is used to validate general ledger accounts, configure the general ledger interface type, and configure how refunds for the accounts payable are exported.

Note: The following options only apply if you have purchased a license for the iMIS Financial Systems interface or AP interface.

Do the following to configure the GL interface:

- In the Advanced Accounting Console, go to Finance > Options > Configure accounting options.

- Click G/L Interface to open the AR/Cash General Ledger Interface window.

- Click Edit.

- Select a general ledger accounting package from the GL interface type drop-down.

- Select a level of transaction detail from the Summarize by drop-down.

- Enter the output file path and file name.

- Enable the Refund via AP interface, Send individual refunds to company, and Don't allow file overwrites options as desired.

- Click Save.

See Authorizing credit cards for more information.

See European taxation (VAT) for more information.

If you use one entity's cash account to receive income meant for a different entity, you must set up Due To/Due From accounts to ensure that your accounting records are correct.

iMIS generates Due To/Due From entries for configured entity relationships when transactions are sent to the general ledger. These entries correct balancing problems created by entities receiving cash for which they do not have matching income, and entities receiving income for which they do not have matching cash.

- Due to owner entity - This liability entry is created for the entity that owns the cash account that received the money but is not entitled to the income. This liability entry offsets the cash the entity received but did not own.

- Due from cash entity - This receivable entry is created for the entity that owns the income to make up for the asset it is entitled to but did not receive.

Due To/Due From accounts are set up in the Due to/due from window. Create one entry for each multiple-entity combination where cash will be received by one entity for a transaction that belongs to a different entity.

The Due to/due from window enables you to define the Due To/Due From relationships between your general ledger accounts. In this window, you can set up entries for each multiple-entity combination in which cash is received by one entity for transactions that belong to another entity.

- From the Advanced Accounting Console, go to Finance > Options > Set up tables > Due to/due from.

- Click New.

- Enter the Org Code for the entity that owns the income or accounts receivable in the Owner Entity field, or use the lookup icon to select a value.

- Enter the Org Code for the entity that received the cash in the Cash Entity field, or use the lookup icon to select a value.

- In the Owner Due From Account field, enter the GL account in which to record the intercompany receivable (debit) transaction for the entity that owns the income, or use the lookup icon to select a value.

- In the Cash Due To Account field, enter the GL account in which to record the intercompany payable (credit) transaction for the entity in which the cash account resides (cash entity), or use the lookup icon to select a value.

- Click Save.

See Implementing Advanced PCI Compliance options for more information.