Deferred income provides delayed recognition of income to coincide with when the income is earned to match when the related expenses are incurred, rather than when the invoice is generated or the funds are received. Deferred income credits a user-specified deferred income liability account rather than the regular income account when the transaction is initially entered. iMIS manages the recognition of the appropriate income amounts as the income is earned, and generates the corresponding entries to transfer those amounts from the deferred income account to the regular income account in the general ledger.

Note: Deferred income is a licensed feature. For more information, contact your AiSP or ASI Technical Support.

The deferred income feature is transparent to the user. Tracking and processing can be automatically triggered for billing products and event registrations, and after your setup is complete. The following terms are unique to the deferred income process:

- Deferred income - Money that is credited to a liability account until it is recognized and transferred to the regular income account.

- Earned income - Income that is recognized during a specific accounting period.

iMIS processes deferred income arising from billing products differently than event registrations. iMIS uses the following deferral methods to handle these transactions:

- Incremental - Deferred income for billing products is recognized in equal monthly increments over the number of months in the billing product term, starting with the begin date. iMIS calculates the term from the beginning and ending dates of the billing product term.

- Lump Sum - Deferred income for event registration orders is recognized in the month that the event occurs.

Example: For a normal 12-month subscription, iMIS recognizes one-twelfth of the income during each month of the subscription term.

Example: If the Begin Date of an event is 12/10/2016, iMIS recognizes the entire amount of income on the first day of the month of the Begin Date, 12/01/2016.

When the deferred income account is referenced for a billing or event product, the full amount charged or received will be booked as deferred income. Each time the general ledger export runs iMIS analyzes which deferred balances can be completely or partially identified as earned income. When iMIS finds deferred income amounts, it automatically generates journal entries to transfer earned income amounts out of deferred income.

To set up deferred income processing, you must select a deferred income account number in addition to the regular income account number for billing products and for events.

Billing products

Do the following to define a deferred income account for a billing product:

- From the Staff site, go to Membership > Billing products.

- Select the billing product Name for which you wish to define a deferred income account. For more information about creating a new billing product, see Defining billing products.

- From the Accounting section, define the Income and Deferred Income accounts:

- Income - The account the deferred income will be transferred to.

- Deferred Income - The liability account that income resides until it is recognized and transferred to the regular Income account.

- Click Save & Exit.

Events

Do the following to define a deferred income account for event registration options and program items:

- From the Staff site, go to Events > Find events.

- Locate and open the event.

- Define deferred income accounts for the event's program items:

- Select a program item for which you wish to define a deferred income account.

- Select Edit.

- Click the Accounting tab.

- Select the Income and Deferred income accounts.

- Click Save & Close.

- Continue the same process for each program item.

- Define deferred income accounts for the event's registration options:

- Open an event for edit.

- Click the Pricing tab.

- Select the Registration option for which you wish to define a deferred income account.

- Click the Accounting tab.

- Select the Income and Deferred income accounts.

- Click Save & Close.

- Continue the same process for each registration option.

Although the entries to record deferred income and subsequently recognize income are generated during the general ledger export procedure, the determination of when the income will be recognized occurs as you process each transaction. Deferred income processing requires the following information:

- Deferred income account codes - The deferred income account must be selected for each billing product, and for each event program item and registration option recognizing deferred income. You must specify these accounts to enable deferred income processing.

- Verification of Begin Date and Term - For event registration transactions, verify that the event's Begin Date is correct. For billing products, verify that the billing term on each customer/subscriber's deferred line item is correct.

Billing products

Successful processing of billing product deferred income transactions depends on products with a defined deferred income account number. Both cash dues and accrual dues use deferred income, but the time frame for the deferral varies based on the accounting method used. Cash dues defer income when payments are recorded or reversals are processed. Accrual dues defer income at billing time, or when recording credit memos and debit adjustments. The beginning period and term period over which the income is recognized coincides with the beginning and ending date of the dues or subscription term.

Events

As event registrations are processed and functions are selected which have a defined deferred income account, the income for these functions is automatically triggered for deferral until the month of the event, at which time 100% of the income is recognized.

A critical step in processing deferred income transactions is verifying the deferral term before running the general ledger export. The Begin Date on which the deferred income transaction goes into effect and the Paid Thru ending date (when the term expires) determine the deferral term for any single line item.

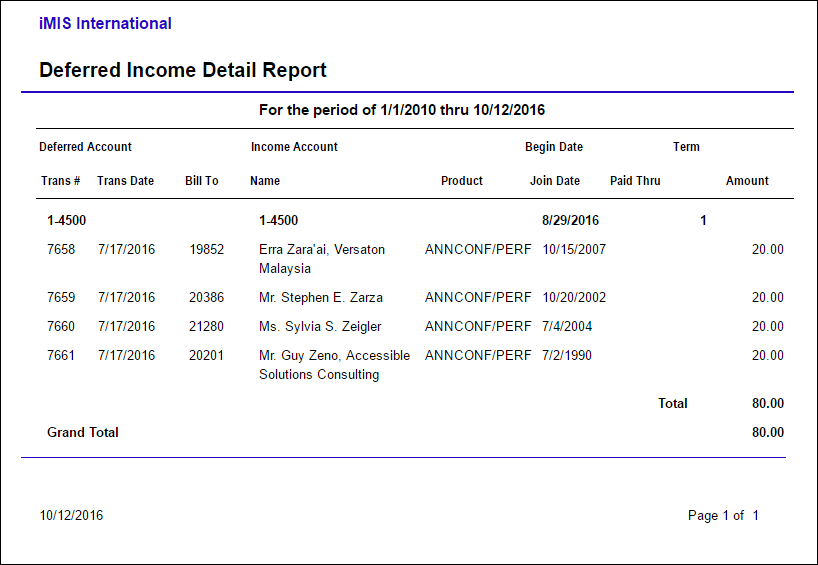

To view each transaction, you must run the Deferred Income Detail report. To run the report, do the following:

- From the Staff site, go to Continuum > Accounting reports.

- Select the Deferred Income Detail report, then click Run.

- Enter the Begin Date and End Date range for the deferred income transactions you wish to review.

- Click Refresh.

- Verify the accuracy of the data and make modifications as needed before running the general ledger export.

iMIS processes individual deferred income transactions through the general ledger export. To generate a general ledger export file, see Creating the general ledger journal.

Cancellations, reversals, or adjustments of previously deferred billing product income should be processed with the appropriate beginning period and term.

The general ledger export procedure will automatically adjust the deferred income matrix for these transactions in iMIS and create the necessary entries to adjust the deferred income and earned income amounts in the General Ledger.

For information on adjustments when using cash dues, see Reversing and Canceling Payment Transactions.

For information on adjustments when using accrual dues, see Processing Adjustments.

When you begin using iMIS to manage your deferred income, you will need to continue dealing with any pre-existing balances in the deferred income accounts by creating manual deferred income-to-regular income transfer entries only for the amounts that existed before using iMIS for deferred income until all of those amounts are recognized.

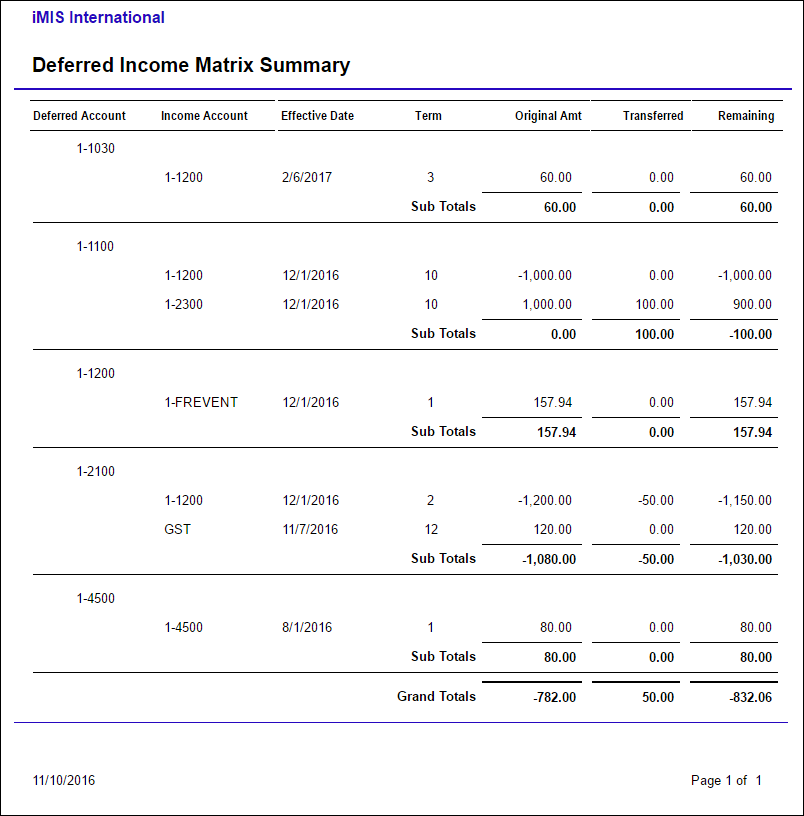

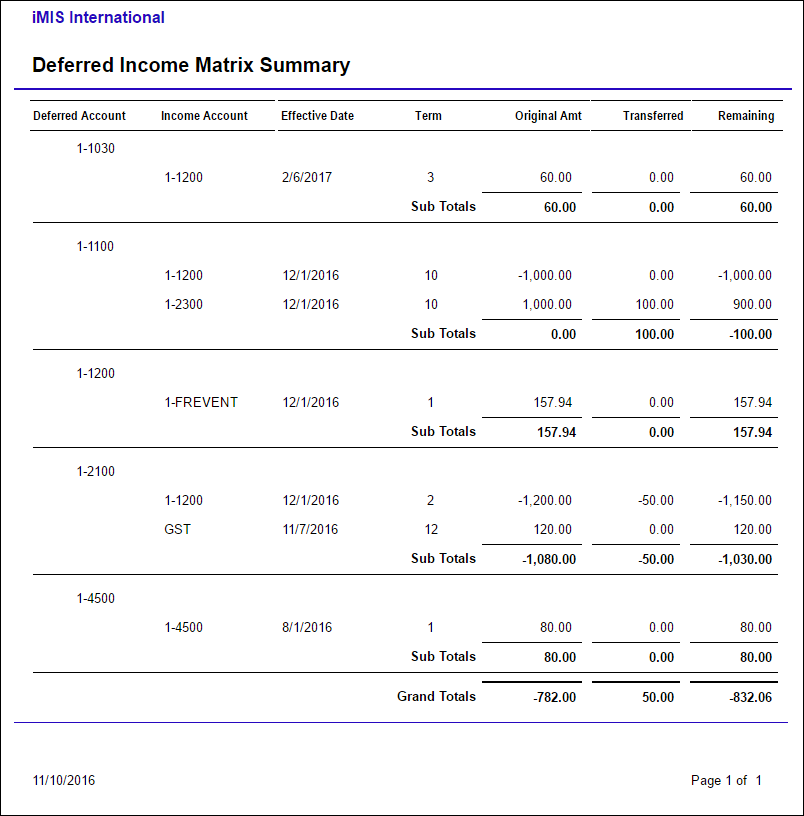

As iMIS processes individual deferred income transactions through the general ledger export, the deferred income amounts are posted to a summarized Deferred Income Matrix Summary report (Continuum > Accounting reports). This report keeps track of the total balance in the deferred income account(s), which are divided into the following summary columns:

- Deferred Account - Deferred income account number

- Income Account - Income Account number

- Effective Date - (for example, month-year) Date to begin income recognition

- Term - (for example, number of months) Time frame over which to spread income

- Original Amount - The original amount of currency in the deferred accout

- Transferred - Amount transferred from the deferred account to the income account

- Remaining - The amount remaining in the deferred account

A row is created in this report for each combination of the provided columns. From this structure, iMIS determines and generates the necessary entries to transfer amounts from deferred income to regular income. The general ledger export procedure performs the work related to deferred income processing as follows:

- Creates a deferred income entry to credit the deferred income account instead of the regular income account for the full amount for all deferred income transactions

- Updates the deferred income matrix table for the combined dollar amount of the transactions involved

- Analyzes the deferred income matrix and creates the appropriate transfer entries to recognize income

Note: In some cases, transfer entries work in a catch-up mode. For example, if late cash-basis subscription payments are received and processed after the subscription term has begun, iMIS immediately recognizes the full amount due to be recognized as the accounting period being processed (that is, if a payment entry is recorded six months after a subscription started, iMIS generates an entry to recognize or transfer one-half (6 , 12) of the subscription income amount).

The following is an example of a general ledger export file. Lines 3 and 4 create a deferred income entry to credit the deferred income accounts, and lines 5 and 6 analyze the deferred income matrix and create the transfer entries to recognize income:

01/01/2016 1-1100 PAY,DEMO-DUES-PAY 1200.00

01/01/2016 1-1200 AR,DEMO-MEETING-AR 500.00

01/01/2016 1-2100 DIST,DEMO-DUES-BASIC -1200.00

01/01/2016 1-2200 DIST,DEMO-MEETING-TECX/MAIN -500.00

01/01/2016 1-4200 Deferred Income Transfer -100.00

01/01/2016 1-2100 Deferred Income Transfer 100.00

Several summary and detail level reports let you review the status of deferred income. From the Staff site, go to Continuum > Accounting:

Provides a report of transactions to be posted to deferred income. This report should be printed prior to running the GL export. Verify the accuracy of the data and make modifications as needed before running the GL export.

Provides the current status of deferred income grouped by account. Includes the totals that were originally posted to deferred income, how much has been recognized to date, and the amount that remains to be recognized in future months.

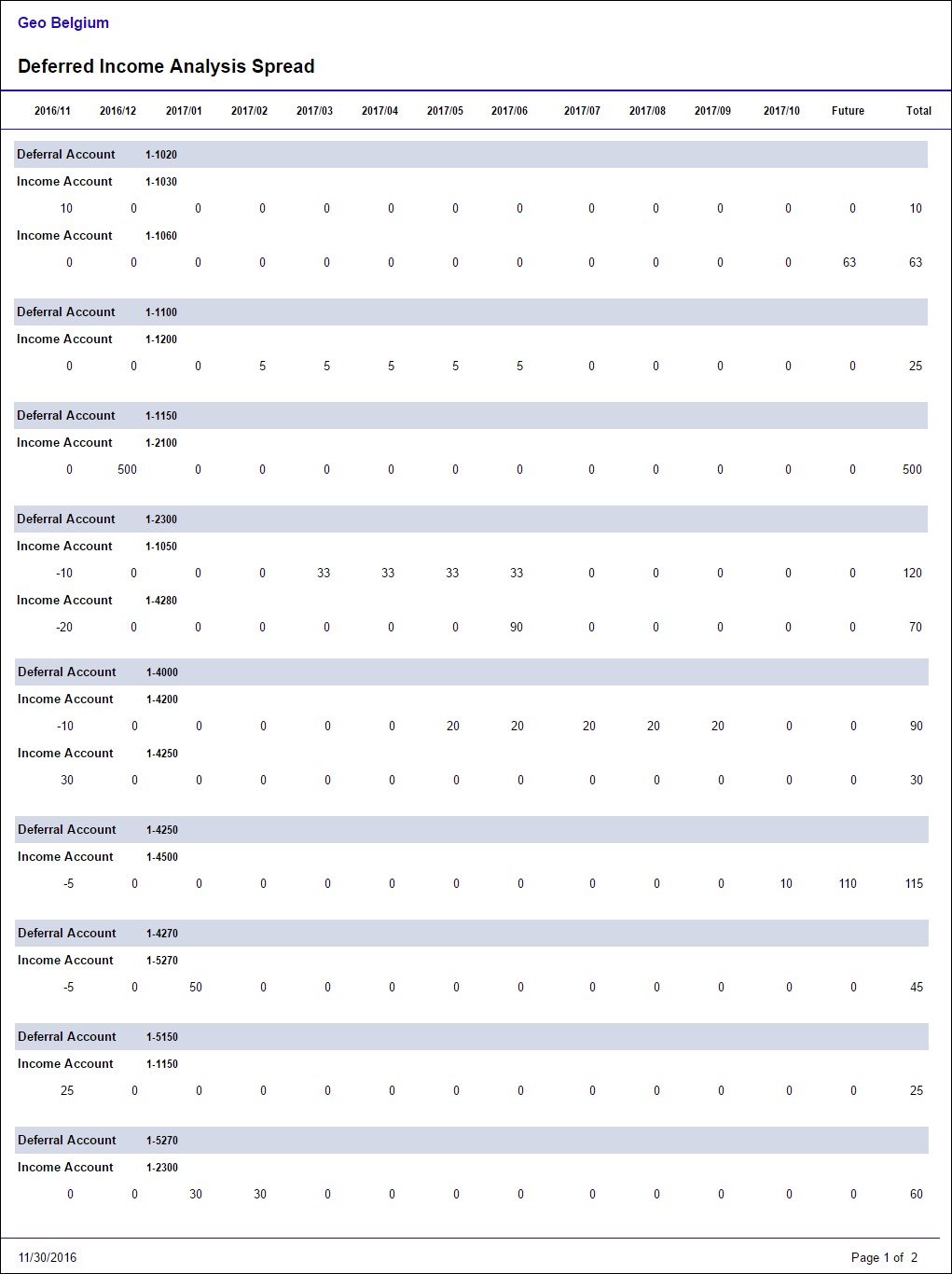

Provides a projection of how the current balances in deferred income will be recognized in each future period. Includes 12 months of projections as well as a summary of projections beyond that.

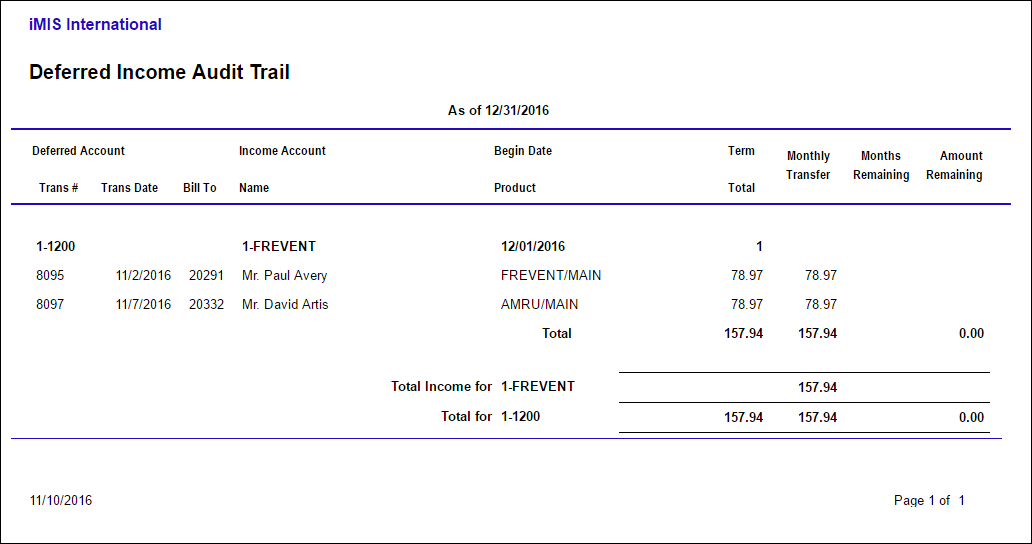

Provides an audit trail to simulate the income that was recognized and the deferred income balance(s) that remained for a specific monthly period (any month for which the GL Export has already been run). The report is designed as an audit trail report to simulate the income that was recognized, as well as the deferred income balances that remain at the end of the reporting period.

Note: This report is generated using the specified Effective Date. Only transactions equal to or less than the report's Effective Date are included. It is important to always enter the last day of the month.

This report is based on deferred income transactions for which the deferral/recognition timeframe is still in effect as of the beginning of the month being reported on (residual income is yet to be recognized either during the report month and/or in a future month).

This report simulates the process that iMIS uses to generate the deferral to income transfer entries with one exception. It depicts the income recognition at the individual detail transaction level, as opposed to the matrix summary level that iMIS uses to generate the actual entries. As a result, the reported income amounts will most likely be different from the actual amounts by small rounding differences. Nonetheless, the report should give a close approximation of the actual transfer amounts per month as well as the residual balance at the end.

This report is structured as follows:

- The report is based on all transactions dated on or before the reporting effective date that have been posted to the deferred income matrix.

- The transactions are grouped, sorted, and subtotaled by the four key deferral matrix elements (Deferred Account, Income Account, Begin Date, and Term).

- For identification and cross reference, the Trans #, Trans Date, Bill To ID, Bill To Name, and Product code are listed.

- The transaction amount is listed and subtotaled at the matrix summary level. This subtotal should agree with the original amount on the Deferred Income Matrix Summary report as of the end date of the report (the sign is shown as positive instead of the normal credit balance for easier use of the report).

- For each detail line, the monthly transfer column will show the portion of the income that should have been transferred during the reporting month. In most cases, if the begin date is equal to or less than the reporting period, this will be the transaction amount divided by the term, with appropriate rounding. In some cases, the amount may be more if the transaction date falls within the reporting date and the deferral begin date was within an earlier period. In this case, iMIS works in a catch-up mode on income that needs to be recognized by the reporting date. If the reporting period is the last period within the deferral term, the amount may be smaller or larger to account for any cumulative rounding differential. The transfer amount is summarized at the matrix level and is also subtotaled for each income account. The actual transfer amount can be compared to the total income from transfer for the reporting period.

- The Months Remaining in the deferral term beyond the reporting month is shown for each transaction.

- The deferred income Amount Remaining is shown at the individual transaction level, matrix summary level, and the Total amount by the deferred GL account. It can be compared to the GL balance and/or the Deferred Income Matrix Summary report as of the end of the reporting month. Again, due to the detail basis of the report, this balance will only be an approximation, which may be off by a rounding difference.

Note: If the actual transfer amount differs substantially from the report amount, this may be due to timing issues where the income for certain transactions was not recognized because a future month's general ledger export was processed before the affected transactions were processed through an GL cycle.