Configuring VAT options in AR/Cash

Because organizations differ in how they need to charge VAT and handle pricing, iMIS gives you several global options that affect tax calculation and pricing of your order processing and events, across Desktop and the web views. These global options are set in AR/Cash.

Note: For technical discussions and examples of VAT issues and scenarios, sign in to iMIS Community: http://www.imiscommunity.com/value_added_taxation_vat.

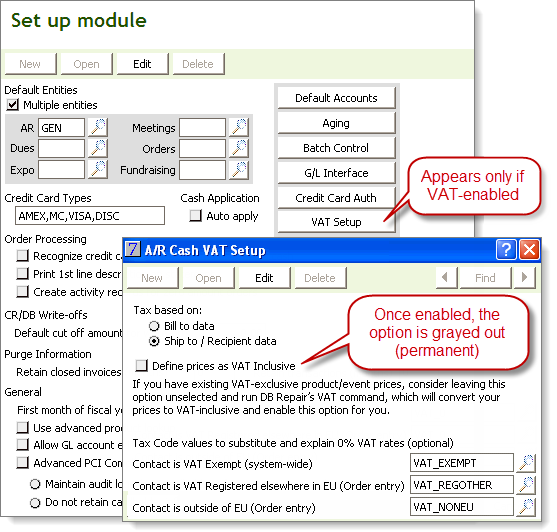

If your default organization is configured for VAT, then you see a VAT Setup button to the right of the AR/Cash > Set up module options:

- Tax based on: — lets you change the method for evaluating taxation.

- Bill to data — Applies VAT based on the Bill to contact’s location and VAT tab settings.

- Ship to / Recipient data — (default) Applies VAT based on the Ship to location and the recipient’s VAT tab settings. This supports point-of-sale requirements for which contacts have different Ship to addresses or make purchases intended for others, such as a manager registering an employee at a different site.

- Define prices as VAT Inclusive – (non-reversible) When enabled, all system-defined prices for taxable products, events, shipping, and handling are considered VAT Inclusive. This means that you can define products and registration fees with the gross (tax-included) amounts that you will advertise to your members and the public. Once you enable VAT-inclusive pricing, the option appears grayed out, because the setting is permanent.

- VAT-inclusive under the hood: Even though VAT-exclusive pricing appears the same as before, all order and registration pricing is now saved as VAT-inclusive. That is, being configured to remain VAT Exclusive just controls how you see and enter the data, converting your net amounts to and from the underlying VAT-inclusive amounts dynamically.

- Upgrading VAT-exclusive order data: Because iMIS now stores all order and order line amounts as VAT-inclusive, DB Upgrader takes care of updating all of your existing order data to be consistent with your new order data. Flags on the record ensure that the update occurs only once, and your original data is backed up (Orders_BAK and Order_Lines_BAK). This universal change to storing order amounts as VAT-inclusive is unrelated to whether you enable Define prices as VAT Inclusive.

- VAT-inclusive public prices: Even if you use VAT-exclusive pricing, the cart on your website will show your shoppers VAT-inclusive product prices and shipping/handling fees (if you enable taxing when defining add-on charges), to comply with sales tax rules. Order data is always stored VAT-inclusive.

- Tax Code values to substitute and explain 0% VAT rates (optional) – If you populate them, these optional fields help you document the reason for VAT exemptions. The look-up lets you select from your existing zero-rated VAT tax codes to specify ones to globally substitute as "reason" codes for each of three situations: the contact is VAT Exempt, is registered in a different EU country, or is outside of the EU altogether. In the same way, Event VAT Rules also let you select a Substitute Tax Code for any rule that prevents taxation (see Defining VAT Rules for Events). These codes allow you to report and document tax exemptions as required.

Note: To upgrade quickly to VAT Inclusive pricing, back up your database and run the DB Maintenance standalone utility, whose VAT tab performs a one-time conversion of your VAT-exclusive product prices and registration fees to be VAT-inclusive. Once your data is converted, the command enables the Define prices as VAT Inclusive setting for you.

Remaining VAT Exclusive: Because some organizations need to handle order and registration prices as VAT-exclusive (such as for B2B sales), iMIS allows you to remain VAT exclusive. In this mode, all of the prices you define or override for events, products, freight, and handling are net amounts that exclude the VAT component, and iMIS adds the VAT separately during product ordering and event registration in Desktop.

Understanding VAT Exclusive:

More:

Taxation based on Bill To versus Ship To

How taxation methods use the VAT tab