International Taxation

Canadian Taxation (GST and HST)

Enabling Canadian taxation for the Default Organization

Defining the default tax authority

Defining the GSTINC tax authority (Asia-Pacific)

Enabling Canadian taxation for countries

Applying Canadian taxation to Events

Applying Canadian taxation to Orders

Modifying reports for Canadian taxation

Setting VAT tab data for a contact

Overriding VAT for a registrant (event attendee)

Modifying reports and invoices for VAT

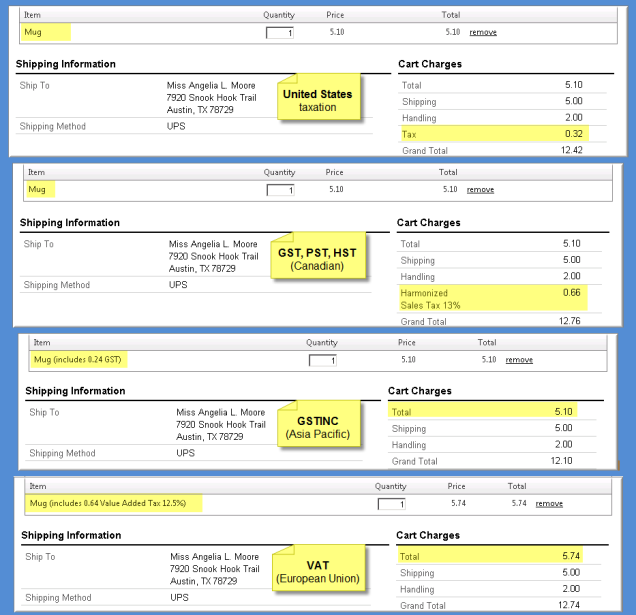

International taxation changes how shopping carts appear to users in different regions. This is how iMIS shows the same product across various taxation methods:

More:

Canadian Taxation (GST and HST)

European Taxation (VAT)