Last updated on: January 27, 2026

Global Payments FAQ

Is there contact information for Global Payments? Yes. Global Payments Integrated can be reached at 800-774-6462, and customerservice@openedgepay.com.

Which cards does the Global Payments gateway accept? All major credit/debit cards: Visa, MasterCard, Discover, AMEX, Diners, JCB, Union Pay, Maestro etc.

Does the Global Payments gateway support ACH/eCheck transactions? Yes. Global Payments offers fully integrated direct debit ACH processing.

Can I set-up multiple Global Payment merchant accounts? Yes. Global Payments gives you the ability to link certain data, like credit cards on file, across multiple locations providing a seamless user experience for you and your customers.

Note: It is recommended to use one merchant account per website.

Do I need to keep my current accounts with Visa/MC/AMEX when using Global Payments? No. The benefit of using Global Payments is that it gives you a complete end-to-end payment solution with one point of contact--- all at no additional cost. You can count Global Payments for anything merchant services related.

Can I keep my relationship with my local bank? Yes. Global Payments supports next day funding directly to your bank account.

Can Global Payments save my staff time on credit card processing? Absolutely! You’ll save countless hours by not having to work between two separate systems to run your business and manage your payments. You have the capabilities to store cards on file and charge them automatically. In conjunction, with Decline Minimizer you no longer have to worry outdated credit card information, which has expiration dates and reissuance.

What currencies does Global Payments process? United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar and New Zealand Dollar

When can I expect to receive my deposits?With the possible exception of your first deposit, you can expect each daily deposit within 48 hours after your daily automated settlement (subject to the funding timeframe of your receiving bank). If the 48-hour timeframe falls on a weekend or holiday, the deposit will be made the next business day. Depending on your receiving bank, the funding may be as follows — transactions run Thursday may be deposited on Monday, while Friday, Saturday and Sunday’s batches would deposit as separate, individual transactions on Tuesday.

Can I accept credit card payments with my mobile phone or tablet? Absolutely. Global Payments supports transactions on your iPhone, iPad and Android device.

Can I process transactions remotely at any time? Yes. Using Global Payments from your computer, tablet or mobile device you’ll have unlimited access for processing payments 24/7/365. Global Payments even offers “Offline Processing” in certain countries, allowing you to continue processing payments even without internet/cellular connection.

Which mobile phones and tablets are compatible with Global Payments? Global Payments supports current and previous iOS operating systems for iPhone, iPad, and iPod Touch. Global Payments also supports current and previous operating systems for all Android mobile phones and tablets.

Does Global Payments provide the end customer with a receipt or confirmation of payments? Yes. Global Payments can provide physical printed receipts, as well as email receipt confirmations. Global Payments will store a copy of all transactions, allowing you to retrieve and resend receipts at any time.

What type of reporting is available? Global Payments provides unlimited 27/7/365 access to a secure, online portal allowing you to view transaction details in real time, run customized reports, view batch and settlement history, and reconcile bank statements.

Is it safe to use Global Payments? Absolutely. Global Payments is PCI 3.0 certified and maintains the highest level of security in the industry. Global Payments utilizes end-to-end encryption for all card present and card not present transactions. Card data saved on file is tokenized and stored offsite in the Pay Central Service, which is a secure Token Vault. Global Payments users are also eligible to receive $100,000 in breach protection through our PCI Assure program.

Is Global Payments mobile credit card data secure? Yes. Global Payments Mobile supports PCI compliant encrypted EMV credit card readers, ensuring that sensitive credit card data is never stored, processed or transmitted through your phone, tablets or servers.

What fraud-prevention features are available in Global Payments?Global Payment's security team provides 24/7/365 fraud and risk monitoring. Global Payment's Fraud Awareness Program is also available to assist in preventing fraud before it ever happens. Unlike several of our competitors, the Global Payments gateway delivers enhanced fraud monitoring at no additional cost.

Can I process recurring transactions with Global Payments? Absolutely. Single transactions, as well as repeat and recurring transactions are supported with Global Payments.

How can Global Payments help me keep credit card data, such as expiration dates, current? Global Payments offers an all-inclusive Account Updater service called Decline Minimizer. Decline Minimizer analyzes your credit card data on a nightly basis, looking for expired, lost and reissued cards. Global Payments seamlessly updates outdated credit card information every day--- without any involvement on your end.

Note: Decline minimizer is supported in North America but is not supported in Australia or New Zealand.

How do I sign up for the Credit Card Updater? No additional work is required on your end. The Credit Card Updater service is already included with your Global Payments account.

How do I complete my end-of-day settlement? Your batch is settled automatically every day. By default, this time is 2:00 a.m. Pacific Time (UTC-8) each day. You do not have to initiate the settlement yourself. You can even turn off your computers without interfering with the automated settlement. Your transaction and batch reports can be accessed through OpenEdge View directly.

Do I need to notify my bank that I have a new processor? In most cases, your bank will not need any additional information in order for you to begin receiving your deposits. However, it’s always good practice to notify them that Global Payments Integrated is your new processor and confirm that there are no holds or blocks that need to be removed. The deposits will be coming from Global Payments, and will be identified by your Merchant ID.

Where can I go to confirm my transactions went through or get daily batch totals? OpenEdge View is a powerful tool that will allow you to view a transaction’s status in real time. Within seconds of the transaction being completed in iMIS, you will see the transaction appear in OpenEdge View. There is a report specifically dedicated to your end-day batch report —depending on your settings, this may reflect the amount that will be deposited into your account. OpenEdge View also has customizable reporting that lets you look at transactions from any period of time or specific card brands and allows you to make custom filters that you can add into the reporting.

Where can I see my monthly statements? Each month, Global Payments will mail you a paper statement. In addition, they have a powerful tool where you can access electronic statements online. This resource provides a wide array of processing information, including statements, deposits and chargeback cases — all available at your convenience, 24/7.

Where can I view my or deposit information? To view a batch that was deposited into your account, please visit the Global Merchant Portal.

Where can I view and contest chargebacks? Any chargebacks can be found on the Global Merchant Portal. You will receive notifications of any disputes and can address them via the Dispute Manager system.

What is the difference between Global Payments, OpenEdge, Ezidebit, and Pay Central Service?

- Global Payments (formerly known as iMIS Pay) is the name of the gateway provider and is also the name of the gateway that you set up in iMIS.

- OpenEdge is the North American subsidiary of Global Payments.

- Ezidebit is the Asia Pacific subsidiary of Global Payments.

- Pay Central Service is the new name for DataVault. This is the secure, centralized repository designed to store sensitive payment information, such as credit card numbers, bank account details, and transaction data. It serves several critical functions in the payment processing ecosystem.

What are the costs associated with the transition? After you have filled out the form with OpenEdge or Ezidebit, an analyst will contact you to review the costs.

(North America only) What do I need to go to the Global Payments portal for?

- For reporting, go to the Global Payments portal to view transactions and run reports as necessary. Go to the Global Payments portal and log in with your username and password (assigned during installation).

- To view transactions from the portal, select the Transaction tab.

- To generate reports, select the Reports tab. Review the features and functions of Global Payments video for more information.

Do I need a license for AutoPay when using the Global Payments gateway? You will only need an AutoPay license if you need to process recurring transactions.

What happens to my automatic enrollments? All cards used in AutoPay are encrypted in the Pay Central Service (previously known as DataVault) and will remain encrypted in the Pay Central Service when you transfer to the Global Payments gateway. Automatic enrollments will continue as scheduled.

How are refunds performed in the Global Payments gateway? Refunds are performed directly from the iMIS Staff site. See Refunding payments for more information.

Is there a payment privacy policy? Yes, the following are just a few of the security standards that ASI adheres to:

- iMIS does not maintain any card data after the initial purchase or donation. For recurring payments, such as membership renewals or donations, the card data is tokenized before the card data is destroyed. This token is then used for the ongoing gifts or memberships.

- iMIS does not process, store, or transmit cardholder data. Therefore, PCI compliance of the application is not required. Cardholder data is only handled by the Pay Central Service that is hosted by ASI, which is audited for compliance annually by a QSA company.

- Global Payments is PCI compliant. For more information, see PCI Assure.

- iMIS (including the Pay Central Service) is GDPR compliant.

- Global Payments is ISO/IEC 27001:2013 certified.

For more information regarding security or privacy, please visit the ASI Data Protection Center.

Is there a limit on cardholder name length? Yes. According to ISO IEC 7813:2006 the cardholder's name length must be 2 to 26 characters including first name, last name and spaces. iMIS will use the customer’s name by default and issue a warning if it does not meet the length criteria.

How are my payments processed? iMIS contacts the gateway and gets a confirmation back immediately regarding the payment; this confirmation is a request to take the payment, not a confirmation of the payment being taken. As such, it is advised that you check both iMIS and the gateway portal to ensure that the payment has settled successfully.

Can Global Payments act as a passthrough gateway? No. The Global Payments gateway cannot be used as a passthrough or connection to other payment gateway providers.

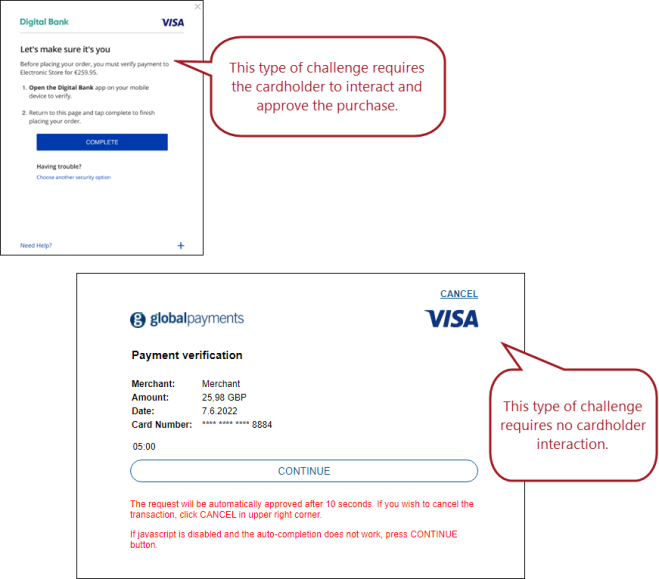

Why did I get a pop-up asking me for approval? Customers may see a “challenge window” when making purchases through the Global Payments gateway. This is an added 3D Secure measure to ensure your payments are protected. Although most transactions will follow the “frictionless flow” where no challenge window is presented, your bank may opt for the “challenge flow” if they believe there is an increased risk. See the image below for different types of challenge windows.

Note: The challenge window presented to the cardholder varies by bank, so your challenge window may look different than the images below.

When do my batches settle? Global Payments automatically settles batches at 2:00 a.m. Pacific Time (UTC-8) each day.

Can I pass along on credit card surcharges to those that use credit cards? No, there is no native functionality that allows you to charge a surcharge for credit card payments processed through iMIS. Review the iMIS Marketplace to review integrations that offer this functionality.