Last updated on: January 27, 2026

After VAT has been properly configured in iMIS, you can begin setting up events, orders, and contacts for VAT as well.

In This Article

- Setting up VAT for events

Setting up VAT for commerce transactions

Setting up VAT data for a contact

Setting up VAT for events

VAT taxation for an event involves applying VAT to event functions and hotel rooms. After defining VAT tax codes, you can enter the tax codes for individual event functions and hotel rooms.

Note: Because services are consumed in the country in which they are delivered, all customers are considered taxable.

Before you begin

- Enable the VAT method.

- Define the VAT codes.

- Define the VAT tax categories. This is only required if you intend to use Tax by Location functionality.

- Verify the Default country for the website (in the Staff site, go to Settings > Contacts > General).

Applying VAT to an event function

Do the following to apply VAT to an event function:

- Go to Events > Find events.

- Open the desired VAT event.

- To apply VAT to an event registration option, do the following:

- Select Edit for the overall event.

- Click the Pricing tab.

- Select the desired registration option.

- Click the Accounting tab.

- To apply VAT to an event program item, do the following:

- Scroll down to the program items, then select the desired VAT program item.

- Select Edit.

- Click the Accounting tab.

- Enable Taxable to display the VAT tax code drop-down.

- Select a Tax mode:

- Based on customer location - Uses the VAT taxation rate of the customer's country.

- Select a VAT tax category for the event function. This is required if the event function is taxable and taxed by customer location. Otherwise, the option is disabled.

- Based on fixed location - Uses the tax based on the selected VAT tax code.

- Select a VAT tax code. This is required if the event function is taxable but not tax by customer location, or if the product is taxable by location and the system pricing is defined VAT inclusive. Otherwise, the option is disabled.

- Based on customer location - Uses the VAT taxation rate of the customer's country.

- Click Save & Close.

Setting up VAT for commerce transactions

VAT taxation for commerce involves applying VAT to product categories, individual products, and shipping and handling charges. Unless a customer has a nontaxable status, VAT shipping and handling taxes are calculated on both taxable and nontaxable product purchases. Whether tax applies depends on the location of the customer relative to the organization:

- If the customer is in the same EU country, VAT applies.

- If the customer is in a different EU country but has no VAT number (private person, some types of organizations), VAT applies.

- If the customer is in a different EU and has a VAT number, VAT does not apply.

- If the customer is outside the EU, VAT does not apply.

Warning! Tax settings at the product level override those at the category level. That is, if you enable taxes for a category but not for a product in that category, no taxes are calculated. If you disable taxes for a category but enable them for a product in that category, taxes are calculated.

Tip: Before applying VAT tax codes to products and product categories, consult with an expert on VAT rules and regulations.

Note: You can override any applied VAT taxes at order entry.

Before you begin

- Enable the VAT method.

- Define the VAT codes.

- Define the VAT tax categories. This is only required if you intend to use Tax by Location functionality.

- Verify the Default country for the website (in the Staff site, go to Settings > Contacts > General).

Applying taxation to a product

Do the following to apply taxation to a product:

- Go to Commerce > Find products.

- Select the desired product, then select Edit.

- Click the Accounting tab.

- Enable Taxable.

- Select a Tax mode:

- Based on customer location - Uses the VAT taxation rate of the customer's country.

- Select a VAT tax category for the event function. This is required if the event function is taxable and taxed by customer location. Otherwise, the option is disabled.

- Based on fixed location - Uses the tax based on the selected VAT tax code.

- Select a VAT tax code. This is required if the event function is taxable but not tax by customer location, or if the product is taxable by location and the system pricing is defined VAT inclusive. Otherwise, the option is disabled.

- Based on customer location - Uses the VAT taxation rate of the customer's country.

- Click Save & Close.

Applying taxation to a product category

Do the following to apply taxation to a product category:

- Go to Settings > Commerce > Product categories.

- Select the edit icon for an existing Product Category.

- Enable Taxable. The Tax code field is displayed.

- Select a VAT Tax code for the product category.

- Click Save.

Applying taxation to a single product

Do the following to apply taxation to a single product:

- Go to Commerce > Find products.

- Search for and open the desired product, then select Edit.

- Click the Accounting tab, then enable Taxable.

- Select a Tax mode:

- Based on customer location - Uses the VAT taxation rate of the customer's country.

- Select a VAT tax category for the event function. This is required if the event function is taxable and taxed by customer location. Otherwise, the option is disabled.

- Based on fixed location - Uses the tax based on the selected VAT tax code.

- Select a VAT tax code. This is required if the event function is taxable but not tax by customer location, or if the product is taxable by location and the system pricing is defined VAT inclusive. Otherwise, the option is disabled.

- Based on customer location - Uses the VAT taxation rate of the customer's country.

- Click Save & Close.

Applying taxation to shipping and handling charges

- Go to Settings > Commerce > System options.

- Scroll down to the Add-on charges area.

- Enable Apply sales tax to shipping charges and Apply sales tax to handling charges.

- Click Save.

Setting VAT data for a contact

Before entering an order for a customer, you need to enter the VAT details for the customer on the Financial tab on a contact's account page. This ensures that these details print on invoices.

Do the following to enter VAT details for a contact:

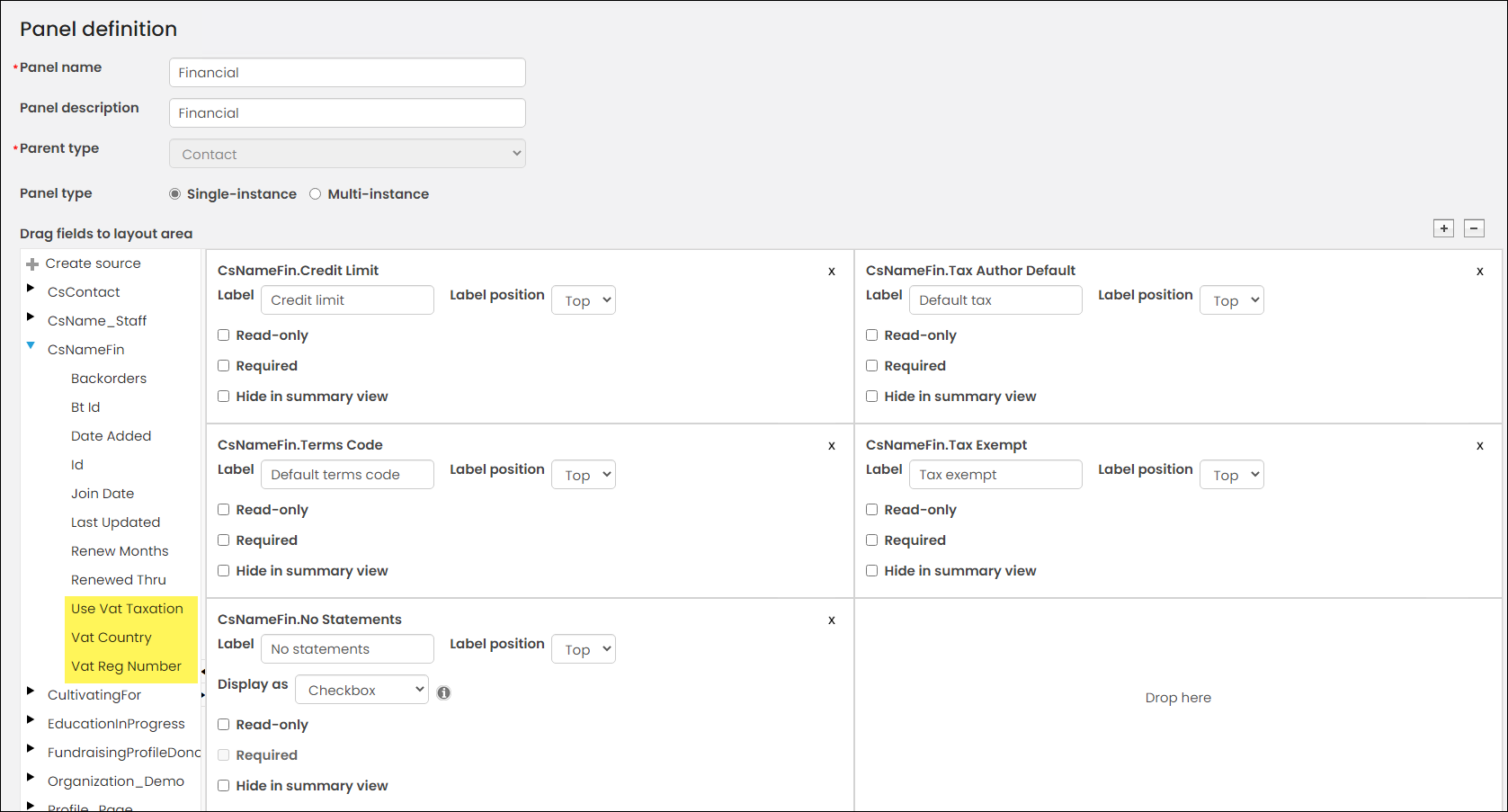

- Go to RiSE > Panel Designer > Panel definitions.

- Open the Financial panel.

- Expand the CsNameFin source in the list.

- Drag the following fields to the layout area:

- Use VAT Taxation - Enable if this customer is not exempt from VAT in all cases, regardless of VAT Rules.

- VAT Reg Number - Enter the VAT Registration Number for the customer. The VAT Registration Number on the VAT tab corresponds with a customer’s VAT exempt status. If a value is entered in the VAT Reg Number field, a customer will be considered exempt and will not be charged VAT.

- VAT Country - Select the VAT country from the drop-down list.

Note: iMIS only processes VAT Registration Numbers issued by countries within the EU. If you enter a VAT Registration Number for a country outside the EU, VAT processing will be incorrect.