Last updated on: February 13, 2026

In order to charge sales tax in the US, tax codes must first be configured for each tax authority that your organization is obligated to collect tax for.

Important! Do not change the Taxation method for existing financial entities. Instead, create a new financial entity with the appropriate tax method

In This Article

- Determining online sales tax

Configuring destination-based taxes

Configuring the web sales tax authority

Viewing the tax added to an order

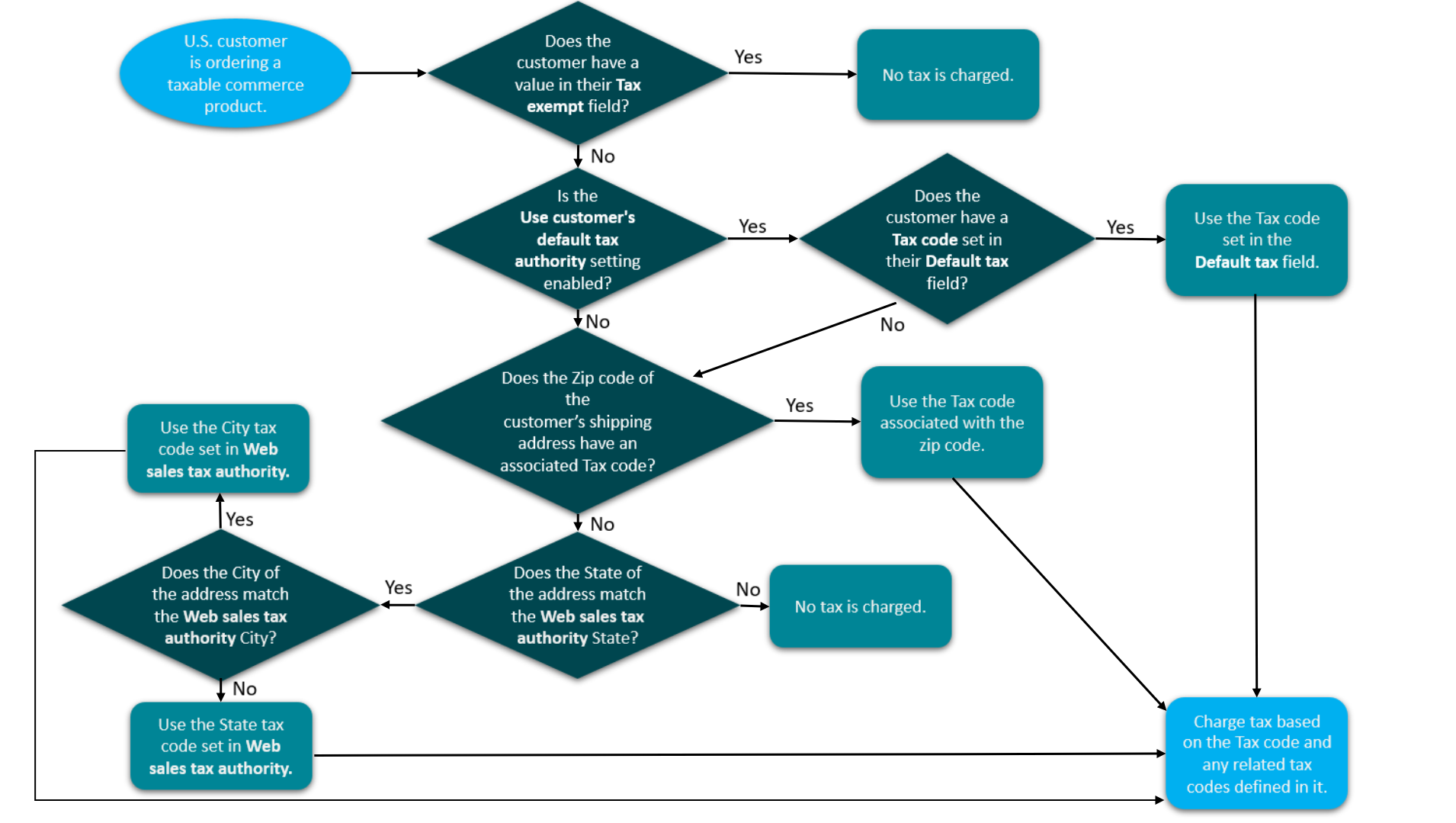

Determining online sales tax

The following outlines how iMIS determines a customer's online sales tax:

- Tax exempt: If the customer has the Tax exempt property populated, then they are exempt from all sales tax. Out-of-the-box, the Tax exempt property (CsNameFin.Tax Exempt) is located on the About tab in the Financial information panel.

- Using the default tax authority: When Use customer's default tax authority is enabled (Settings > Commerce > System options), iMIS automatically calculates taxes for product orders based on the customer’s Default tax code. Out-of-the-box, the Default tax property (CsNameFin.Tax Author Default) is located on the About tab in the Financial information panel.

- Destination-based taxation: If the Default tax property is blank, the system examines the customer’s shipping address zip code to see if it is associated with a tax code. The customer’s default address will be used if there is no shipping address selected in the cart. If there is a tax code found for the applicable zip code, then the rate for that tax code is applied. Any other related sales tax codes are also applied.

- Seller-based taxation: If the Default tax property is blank and the customer’s shipping address zip code does not have an associated tax code, then the calculation is based on the Web sales tax authority options (Settings > Commerce > System options). The logic behind this is that the shopper is assessed taxes if the organization they are ordering from is located in the same city or state:

- The City tax code is used when the ship-to city and state match.

- The State tax code is used when only the ship-to state matches.

- If there is no match for ship-to city or ship-to state and/or the tax codes are unassigned, no tax is applied.

Note: The State/province and State tax code must both be populated to have a tax calculation based on the State/province, and the State tax code must be configured in the Tax codes.

Figure 1: Determining online sales tax

Configuring destination-based taxes

Standard taxation can be configured for online orders of commerce products for customers in the United States when their shipping address zip code is associated with the corresponding tax code. A customer’s default address will be used if there is no shipping address selected in the cart. Any other related sales tax codes are also applied.

To associate zip codes with tax codes, do one of the following:

- Import tax codes and zip codes: Import a tab-delimited file with columns for the zip codes and related tax codes.

- Manually associate zip codes and tax codes: Manually associate zip codes and tax codes from Settings > Finance > Tax by zip code.

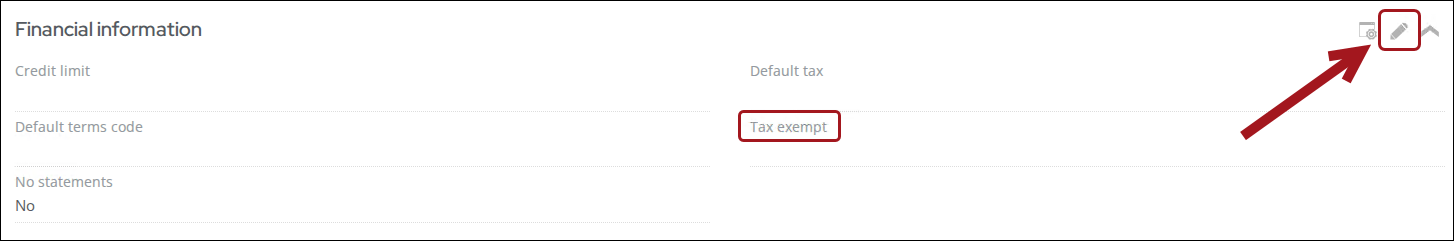

Enabling tax exempt status for a contact

Some contacts may qualify for tax-exempt status based on their organization type or purpose. For example, a non-profit or government entity. You can record this exemption in their contact profile.

Do the following to enable the tax-exempt status for a contact:

- Go to the contact’s account page and click the About tab.

- Scroll down to the Financial information panel and click the edit icon.

- Enter the tax exemption information.

- Click Save.

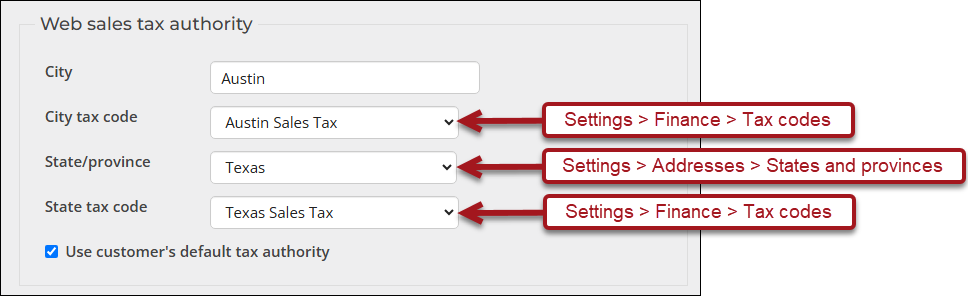

Configuring the web sales tax authority options

Do the following to configure the Web sales tax authority options:

- Go to Settings > Commerce > System options.

- Locate the Web sales tax authority section.

- Configure the following options:

- City - Enter the city from where web orders are generated.

- City tax code - Select the tax code for the city or municipality entered in the City field if taxes are applicable. Options in this drop-down are defined using the Tax codes window (Settings > Finance > Tax codes).

- State/province - Select the state from where web orders are generated. Options in this drop-down are defined using the States and provinces window (Settings > Addresses > States and provinces), or the STATE general lookup table (Settings > General lookup tables).

- State tax code - Select the tax code for the state or province selected in the State/province field. Options in this drop-down are defined using the Tax codes window (Settings > Finance > Tax codes).

- Use customer's default tax authority - When enabled, iMIS automatically calculates taxes for product orders based on the customer’s Default tax code. If a Default tax code is not defined for the customer, the City tax code is used when the ship-to city and state match. The State tax code is used when only the ship-to state matches.

- Click Save.

Note: You must select a tax authority and a tax code for taxes to be calculated and applied. For example, if you specify a State/province but no State tax code, no tax is calculated.

When this option is disabled, the City tax code is used when the customer's ship-to city and state match. The State tax code is used when only the ship-to state matches. If there is no match for ship-to city or ship-to state and/or the tax codes are unassigned, no tax is applied. When using Canadian or VAT Taxation methods this option will not display.

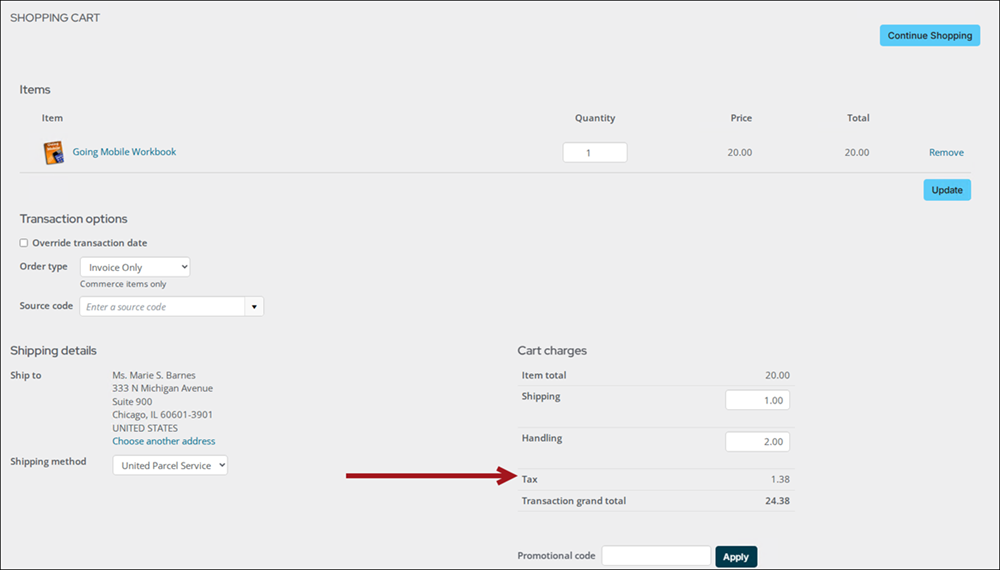

Viewing the tax added to an order

Do the following to view the tax in a customer’s cart:

- Go On behalf of a customer who is eligible to be charged sales tax.

- Go to Commerce > Find products.

- Add at least one taxable product to the customer’s cart.

- Click Proceed to checkout.

The tax is visible under Cart chargesalong with other charges, such as shipping and handling.