Last updated on: January 27, 2026

Your organisation can process all of your Gift Aid donations for submission to the HMRC. Before you generate your claim you can review the gifts that are available for claiming.

In This Article

Reviewing gifts available for Gift Aid claims

Staff users can review outstanding gifts that are eligible to be submitted to HMRC for Gift Aid.

The Available Gifts for Gift Aid Claims list is populated by the $/Fundraising/DefaultSystem/Queries/GiftAid/Gifts to be Claimed query.

Note: If there is no Claim Reference listed, then you can submit a claim for this gift. See Processing Gift Aid claims for more information.

Processing Gift Aid claims

iMIS uses the Generate Gift Aid Claim query to enable you to search for the date of the gift, your donor's name, the gift amount, and the fund the gift was made to.

Review the Generate Gift Aid Claim query ($/Fundraising/DefaultSystem/Queries/GiftAid/Generate Gift Aid Claim) to ensure that it meets your organisation's needs. The following filters determine whether unclaimed Gift Aid-eligible gifts can be seen in this query:

- Donation was made within the organisation's four-year tax rule

- Donation was not already claimed

- Donor is not an organisation

- Donation qualifies for Gift Aid

- Donation has not been excluded from Gift Aid

If this query must be modified, save a copy to your Shared Content folder and adjust the query as desired. Make sure to update your sitemap and the Gift Aid Claim Manager content item on the Manage Gift Aid Claims content record to reflect your new query.

Note: Your query must contain the GiftTransactionId column with no Alias in the display tab, and two filters with optional prompts of Gifts from and Gifts to, respectively.

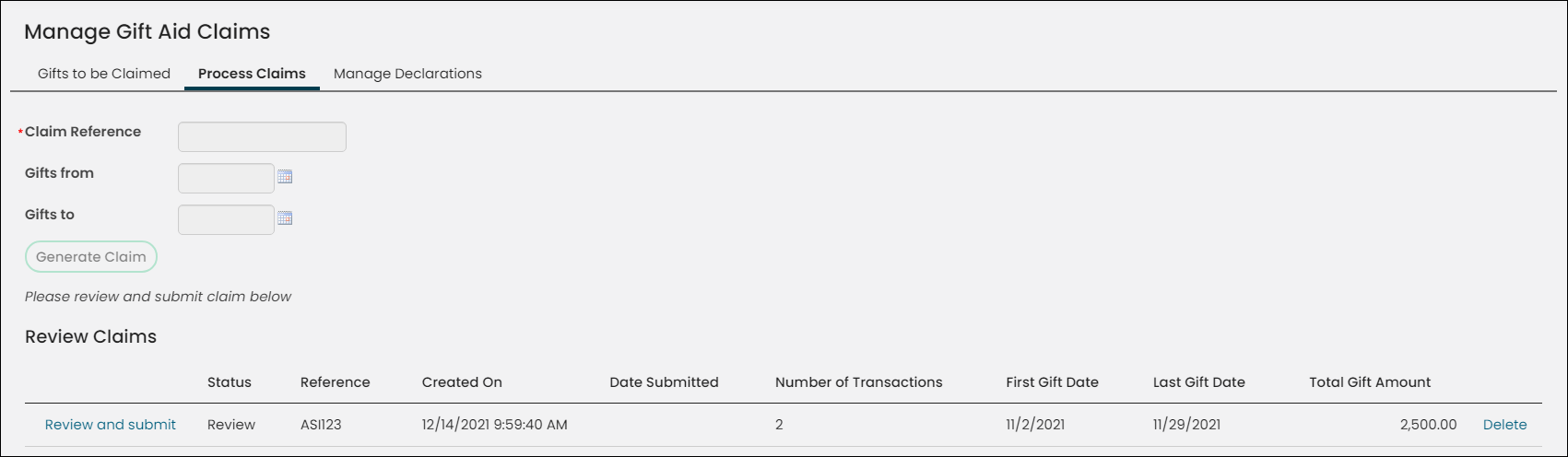

Do the following to process Gift Aid donations:

- Go to Fundraising > Gift Aid, and select the Process Claims tab.

- Enter a Claim Reference number.

- Enter a range of dates to gather all of the Gift Aid-eligible donations made during a particular time frame.

- Click Generate Claim.

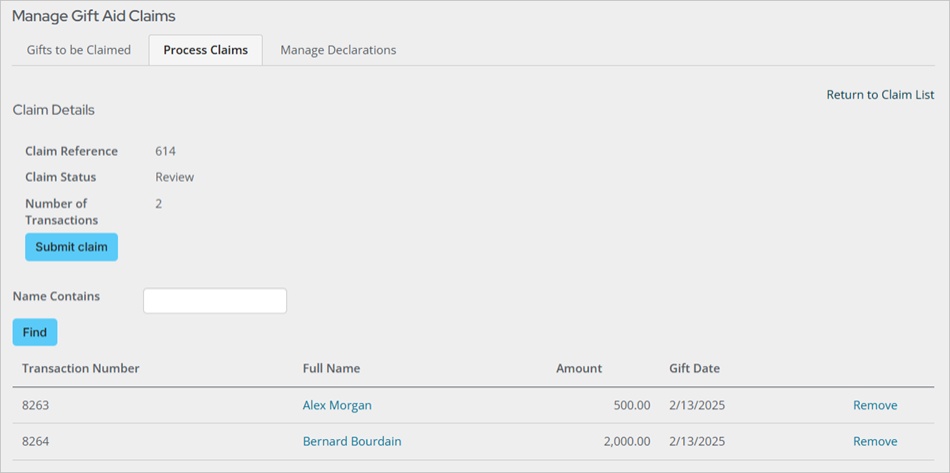

- Click the Review and submit link to view the details of each donation to be included in your Gift Aid claim.

- Your view of the claim can be filtered by the name of the donor to help you review individual donations.

- You can sort your claim results by the Name of the donor, Invoice Number, the Amount of the donation, or by Gift Date range.

- You can remove individual donations from a claim by clicking Remove inline with each order.

- Click on the donor name to review their profile page.

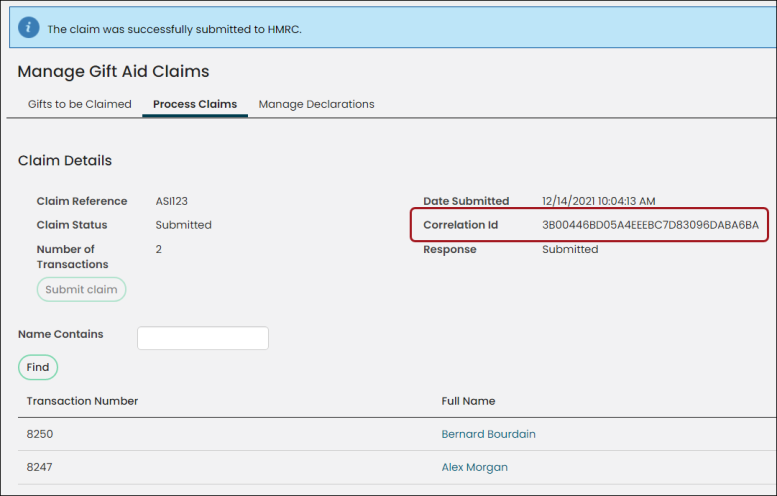

- Click Submit claim to send your Gift Aid claim to HMRC. When your claim is submitted, you will receive a message informing you that your claim was successfully submitted to HMRC.

- Click Return to Claim List.

- Click Review on the Review Claims list. A successful submission will display the Correlation Id.

- Click Return to Claim List. The Status column provides information about your submission to HMRC.

- If you see a status of Submitted, expect to receive a communication from the HMRC and your claimed funds within the month.

- If you see a status of Failed, review the claim submission response for information about the failure.

- If you see a status of Pending, iMIS is attempting to connect to HMRC. Wait a few moments and resubmit your claim.

Note: For more information on HMRC Gift Aid claim processing time, please visit their website.

Note: If a donor has missing address information, you can remove individual donations from your claim and resubmit. When you generate a new claim for a date range that includes a removed donation, the removed donation will be part of your new claim.

You can see the running list of all of the Gift Aid claims that have been submitted on behalf of your organisation. The total gift amount of all of the donations that include a Gift Aid declaration are visible in the Total Gift Amount column.

- Click Check for Status Updates to determine whether or not HMRC has processed your claim successfully.

- Review - Your claim has been generated and is ready to submit to HMRC.

- Pending - You have attempted to submit your claim to HMRC and it is going through the iMIS data check.

- Failed - You should review your claim submission response. Failed submissions are often caused by donor information issues such as incorrect post codes.

- Submitted - iMIS has sent your claim to HMRC, but it is still being processed by HMRC.

- Submission Acknowledged - HMRC has received your submission.

- Error - There was a problem with your submission on the HMRC end.

- Processing Completed - HMRC has received and accepted your Gift Aid claim.

Note: You must define your claim reference number. It must be unique and contain a maximum of 20 characters.

Note: After submitting your claim, wait for several minutes before checking on your claim status. Due to the large number of submissions to HMRC, there can be a time lag between your submission and the status update.