Last updated on: January 27, 2026

Gift Aid declarations allow a donor to give a charity or CASC permission to claim tax back on eligible donations. A Gift Aid declaration can be made by a donor in writing, verbally, or online. This is the way the donor can give the organisation explicit permission to claim tax back on donations.

Note: To have access to the Gift Aid navigation in the Staff site, you must be a system administrator or a staff user with Fundraising: 3 module-level permissions.

In This Article

Important information about Gift Aid declarations

Recording Gift Aid declarations

There are three scenarios where Gift Aid declarations can be added:

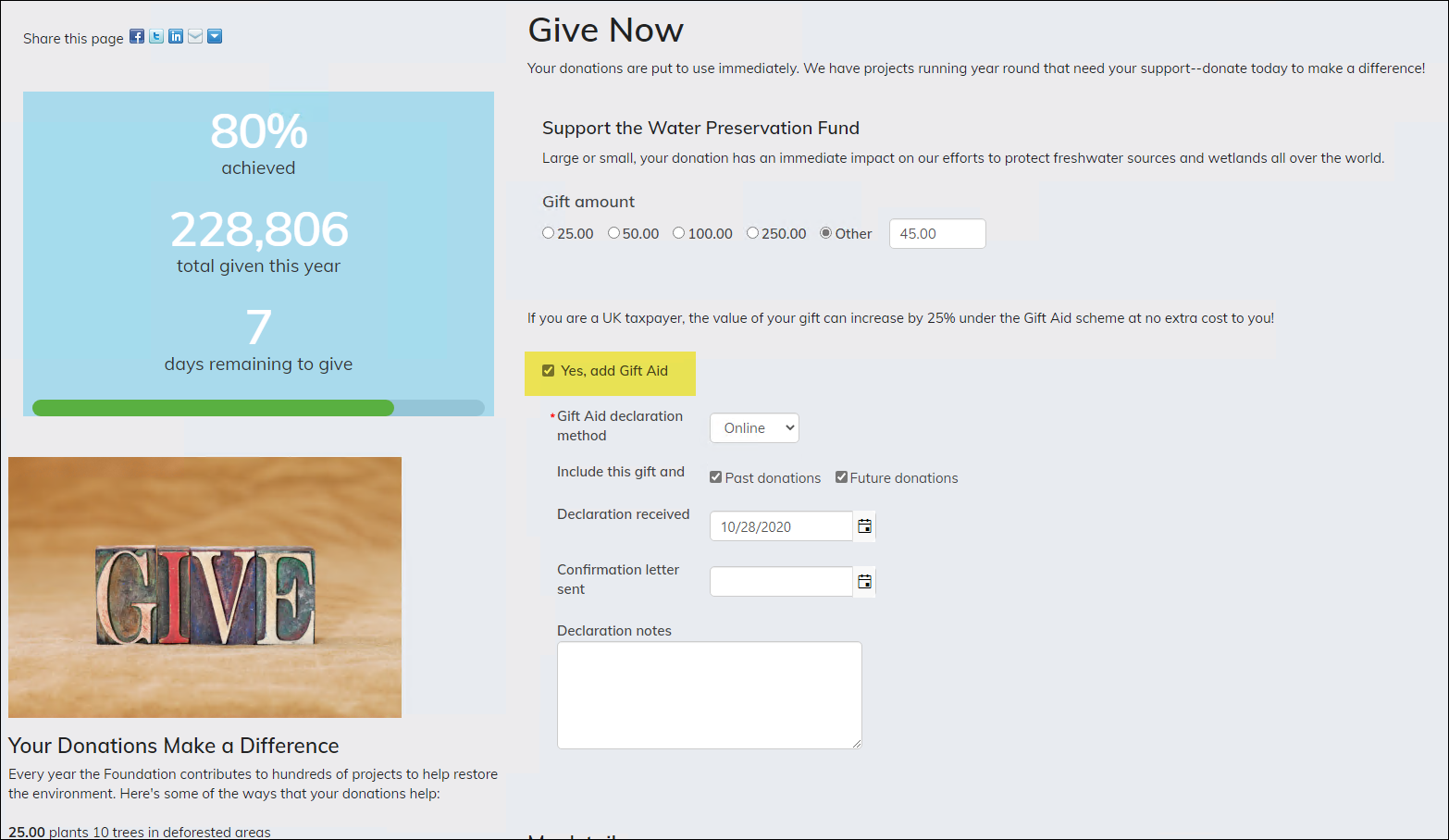

- Donor elects to add Gift Aid from a Give Now page

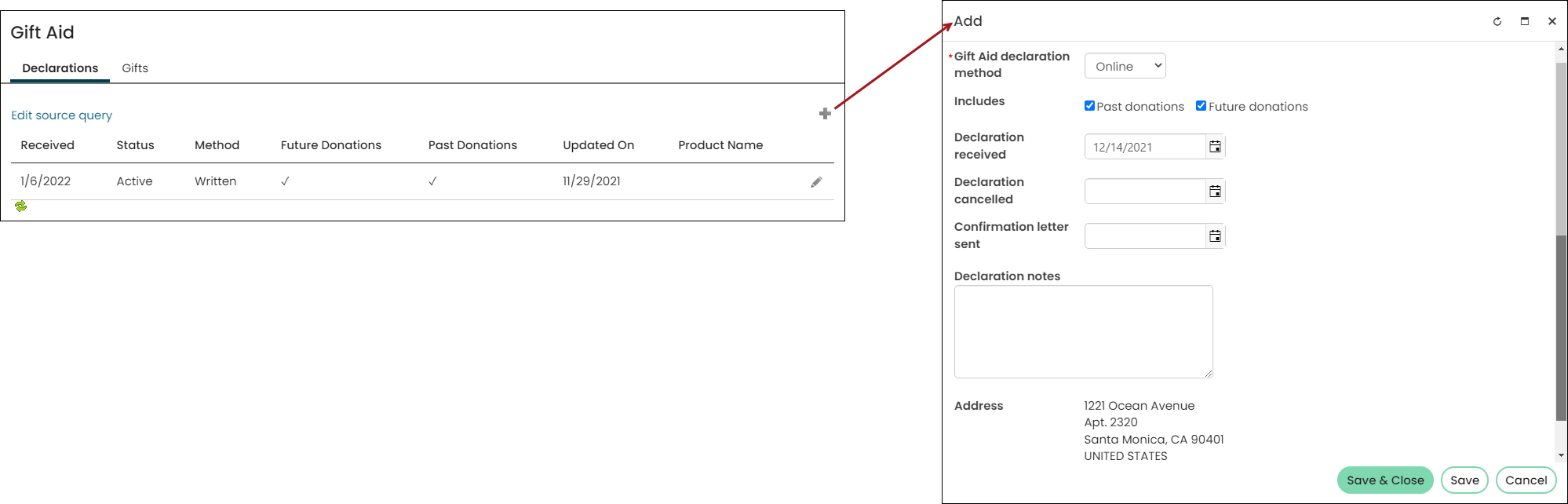

- Staff adds the declaration from a donor's account page

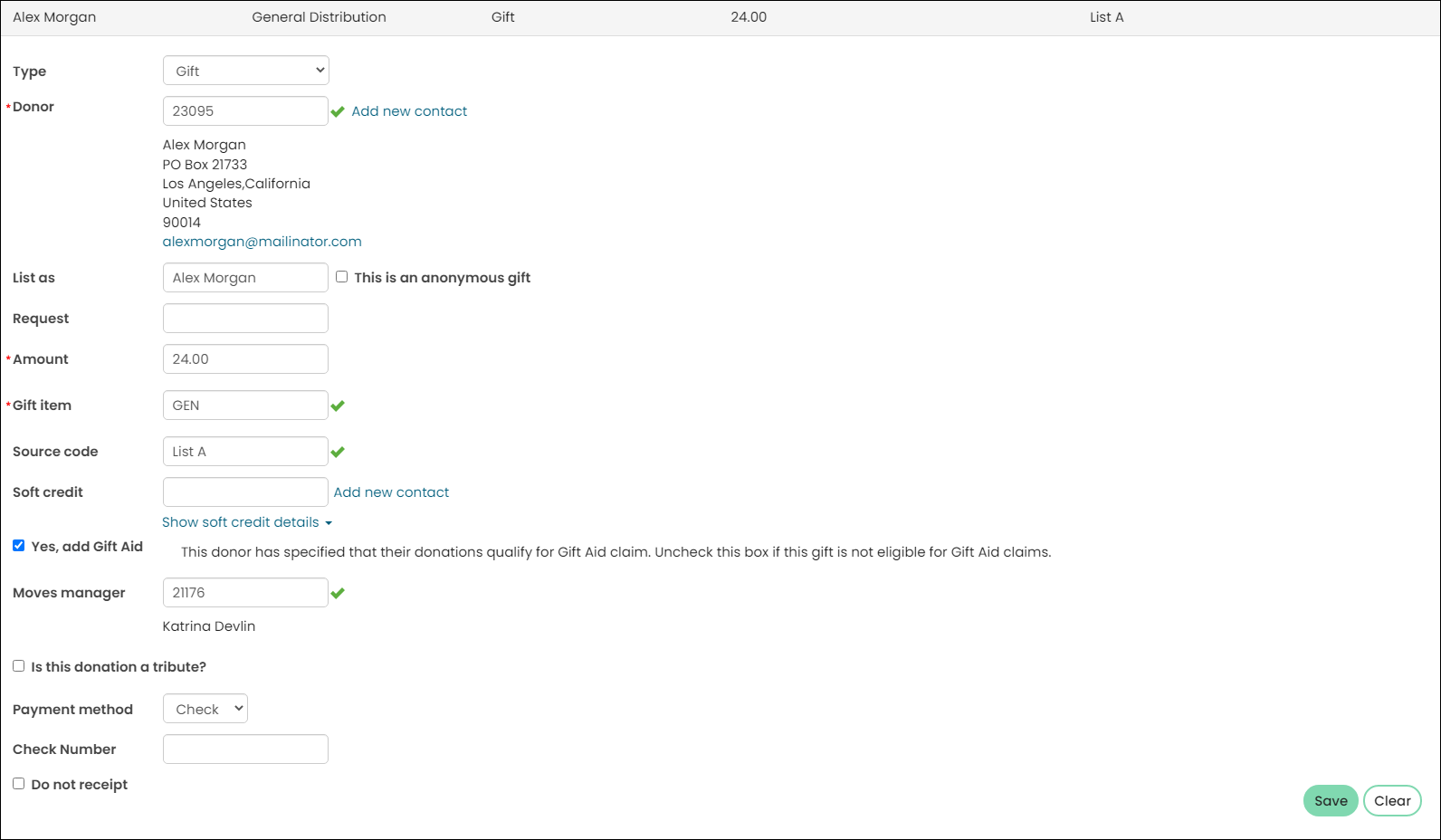

- Staff enters a new donation on behalf of a donor from the Enter Gifts window

Donors create a Gift Aid declaration by selecting the Yes, add Gift Aid checkbox located on donation pages (when the Gift Aid Declaration content item is on the donation page). In this scenario, the Gift Aid declaration defaults to an enduring declaration (the Past donations and Future donations options are selected), and the declaration method is Online. Staff users have access to detailed Gift Aid declaration properties.

Staff users can add a Gift Aid declaration directly from a donor's account page. In this scenario, the donor calls or writes to the staff person about adding the Gift Aid to their existing donation. The staff person can add donations from the Giving tab on user account pages.

This Gift Aid declaration defaults to an enduring declaration (the Past donations and Future donations options are selected). The Staff user can identify the correct Gift Aid declaration method.

Staff users can enter new donations on behalf of donors from Fundraising > Enter gifts. From the Enter gifts window, the staff person can choose to add Gift Aid to the donation. In this scenario, the donor has given written or verbal confirmation that they would like to add Gift Aid to their donation.

Staff users can choose the Gift Aid declaration method when adding Gift Aid on behlaf of a donor. The following are the available Gift Aid declaration methods:

- Online - A donor has created a declaration directly on an organisation's website.

- Written - A donor has filled out a form requesting Gift Aid for a donation and mailed it to an organisation.

- Verbal - A donor has communicated with an organisation over the phone.

A Staff user should never create an online (electronic) Gift Aid declaration on behalf of a contact.

An online Gift Aid declaration is created when the donor logs into your website to make a donation and they select the Yes, add Gift Aid box. By logging in and selecting this option, the donor is essentially signing the Gift Aid declaration.

The original paper Gift Aid declaration needs to be kept by the organisation.

A written declaration is created when the donor has filled out and signed a paper form, and has provided the signed form to the organisation which is claiming the Gift Aid.

An example of a written Gift Aid declaration can be found on the HMRC website. The organisation must retain a copy of the written declaration for its records.

A confirmation letter must be sent for phone Gift Aid declarations. Staff users should not claim any money back using these Gift Aid declarations until 30 days after the date the confirmation letter was sent. This is an HMRC-mandated waiting period. A donor has 30 days to cancel the declaration before the organisation can use it.

A verbal declaration is a declaration made by a donor to an organisation staff member over the phone. Organisations do not have a signed declaration, either electronic or on paper, to show that the donor agreed to a Gift Aid declaration. Therefore, HMRC requires a waiting period. An organisation must send out a letter confirming the Gift Aid declaration, and the donor then has 30 days in which to cancel, starting on the day the confirmation letter was sent. When the organisation sends the confirmation letter, the organisation also updates the letter-sent date. At the end of the 30-day waiting period, the Gift Aid declaration is active.

Gift Aid declaration constraints

There are four constraints that affect how a Gift Aid declaration can be applied:

- Past (applies to the past four tax years)

- Future

- Today

- Single gift

Note: A Gift Aid declaration only has to be completed once for your charity, and can be valid for as long as the donor remains a taxpayer. It is the donor’s responsibility to inform an organisation when the donor is no longer eligible for Gift Aid. Many organisations contact donors periodically to check that the donors are still taxpayers, and use an arbitrary declaration length of four or five years.

When a donor submits a donation and selects the Yes, add Gift Aid box, it is the most common and most valuable Gift Aid declaration because it covers all possible scenarios. It means past gifts, the current gift, and any future gifts can be claimed.

If the donor changes their mind, they can call in and cancel the Gift Aid declaration for any future gifts. A Staff user can edit the donor’s account and set the Cancelled date. The status for the declaration refreshes to Cancelled.

Applying Gift Aid to a donation

When you make a donation on behalf of a donor, all you need to do is elect to add Gift Aid. When you add Gift Aid to a single donation on behalf of a donor, future donations for that donor will have Gift Aid enabled by default. If you make a donation on behalf of a donor without a Gift Aid declaration, you can deselect the Yes, add Gift Aid checkbox for that specific donation. All future donations for that donor will continue to have Gift Aid enabled by default.

Note: If both Past donations and Future donations remain unselected, the Gift Aid declaration only applies to the current gift for which the declaration was created.

Canceling Gift Aid declarations

A cancelled Gift Aid declaration cannot be retroactively applied to any gift made during the original Gift Aid declaration’s effective timeframe.

If the donor changes their mind, they can call in and cancel the Gift Aid declaration for any future gifts. A Staff user can edit the donor’s account and set the Cancelled date. The status for the declaration refreshes to Cancelled. When a Gift Aid declaration is cancelled, it can no longer be used to submit Gift Aid claims even if there are unclaimed gifts that were eligible within the timeframe the Gift Aid declaration existed and was active. If Gift Aid was not claimed for the gift while the Gift Aid declaration was active, then a new Gift Aid declaration is necessary.

Creating one-time and enduring gifts

Staff users can define whether the Gift Aid declaration is a one-time declaration or an enduring declaration. A one-time declaration only applies to the gift for which the declaration was created. Enduring declarations can be applied to past, current, and/or future donations.

One-time Gift Aid declarations

A one-time Gift Aid declaration can only be created at the time a gift is made. A staff user needs to deselect both Past donations and Future donations at the time the gift is made. This will tie the one-time declaration to the gift. (link to show more details - includes seeing the one-time Gift Aid declarations on the Account page - it links to the gift it is tied to).

Note: There must be a connection made between the Gift Aid Declaration content item and the Donation Creator content item in order for a one-time donation to be made, without creating a Gift Aid declaration that carries forward.

Enduring Gift Aid declarations

Enduring Gift Aid declarations can be created at any point. They are created by the donor when the donor selects the Yes, add Gift Aid checkbox. Staff users can create declarations when entering a gift on behalf of a donor and a staff user can create an enduring declaration on the donor’s Account page.

If Past donations is selected, then the new declaration applies to the current gift as well as past gifts. Also, if a donor does not have a Gift Aid declaration and the Yes, add Gift Aid option is not selected, the donation can still be claimed at a later time if a Past donations Gift Aid declaration is created.

If a Staff user selects Future donations, then the Gift Aid declaration applies to the current gift as well as gifts going forward. If the Staff user attempts to make a donation on behalf of the same donor again, the Staff user will not have an option to create a new Gift Aid declaration. The previous Gift Aid declaration will cover this gift and all gifts going forward.

Other Gift Aid declaration properties to set

The Staff user can record the date the Gift Aid declaration was received from the donor, as well as the date a confirmation letter was sent.

Managing Gift Aid declarations

Adding or modifying existing Gift Aid declarations

Staff users can manage the Gift Aid declarations of members and donors. To manage Gift Aid declarations, do the following:

- Go to the profile page of the donor for whom you want to manage a Gift Aid declaration.

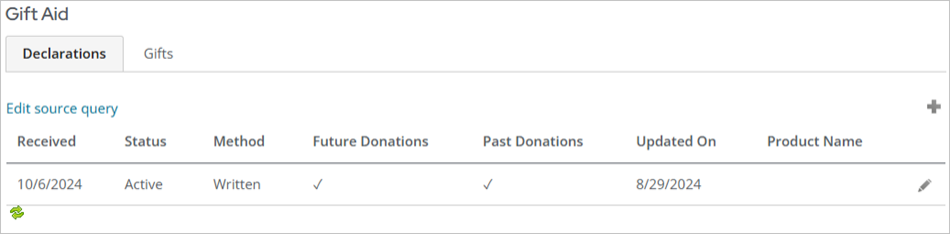

- Select the Giving tab, then scroll down to the bottom. You will see a Gift Aid panel.

- Select the Declarations tab to view the following information about a Gift Aid declaration (if a declaration exists):

- Received - The date the initial declaration was received.

- Status - The status of the Gift Aid declaration:

- Active

- Cancelled

- Pending

- Method - How the declaration was originally made:

- Online

- Written

- Verbal

- Future Donations - Indicates whether this declaration should apply to future donations.

- Past Donations - Indicates whether this declaration can apply to past donations.

- Updated On - The date when the declaration last had an action associated with it.

- Product Name - If both Past donations and Future donations were unselected when a donation was made on behalf of a donor by a Staff user on a Give Now page, the Gift Aid declaration applied only to that single gift. Click the hyperlinked Product Name to view that one-time donation.

Note: The ability to specify a one-time Gift Aid gift is available only at the moment a donation is made. A Gift Aid declaration cannot be retroactively changed to a one-time donation.

- Add a new declaration or edit an existing declaration:

- To edit the declaration, click the Edit Declaration icon. Add a cancellation date to the declaration to cancel the declaration. The status in the Declarations tab will display as Cancelled.

- To add a declaration, click the Add a new item icon. For more information about adding Gift Aid declarations, see Gift Aid declarations.

- Select the Gifts tab to review the claim history for Gift Aid-eligible gifts made by a donor:

- The Unclaimed panel lists those Gift Aid-eligible gifts for which a claim has not yet been made to the HMRC.

- The Claimed panel lists those Gift Aid-eligible gifts for which a claim has been made to the HMRC.

- The Gifts tab will display the tax year in which the gift was originally made, the amount of the original gift, and the subsequent amount that can be claimed from HMRC for Gift Aid.

- When you are finished adding or editing the Gift Aid declaration, click Save & Close.

Note: If you do not see a Gift Aid panel, make sure Show Gift Aid is enabled (Settings > Fundraising > Gift Aid (UK)). See Setting up Gift Aid for more information.

Reporting on Gift Aid declarations

Staff users have access to several IQA reports to help manage Gift Aid declarations. Staff users can:

- Review (by tax year or by donor) Gift Aid-eligible gifts that require Gift Aid declarations in order to be claimed.

- Review contact information for those donors who do not currently have Gift Aid declarations for their Gift Aid-eligible donations.

- Review any verbal Gift Aid declarations that do not have recorded confirmations.

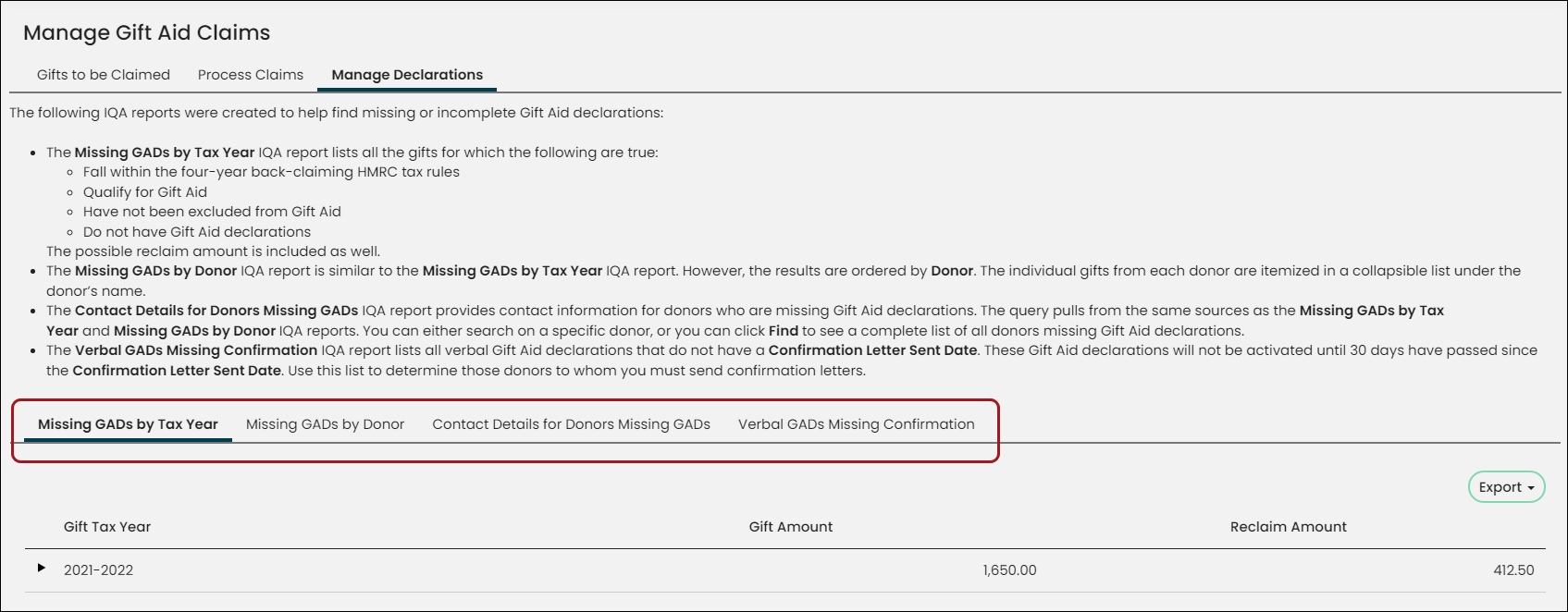

Go to Fundraising > Gift Aid, and select the Manage Declarations tab.

You can review the following IQA reports:

- Missing GADs by Tax Year – Review all the gifts for which the following are true:

- Fall within the four-year back-claiming HMRC tax rules

- Qualify for Gift Aid

- Have not been excluded from Gift Aid

- Do not have Gift Aid declarations

You can also review the amount of Gift Aid that is still available to be claimed on those gifts.

- Missing GADs by Donor – Search by the name of a specific donor to review outstanding donations that do not have applicable active Gift Aid declarations. For each donor, you can see their individual donations made to your organisation.

- Contact Details for Donors Missing GADs – Review contact information for donors who are missing Gift Aid declarations. The report pulls from the same sources as the Missing GADs by Tax Year and Missing GADs by Donor IQA reports. You can either search on a specific donor, or you can click Find to see a complete list of all donors missing Gift Aid declarations.

- Verbal GADs missing Confirmation – Review all verbal Gift Aid declarations that do not have a Confirmation Letter Sent Date. These Gift Aid declarations will not be activated until 30 days have passed since the Confirmation Letter Sent Date. Use this report to determine those donors to whom you must send confirmation letters. You must obtain confirmation of the declaration from the donor before any tax can be reclaimed.

Note: The results in this query do not indicate the taxpayer status. Some gifts might not have a Gift Aid declaration due to the fact that the donor is ineligible to claim Gift Aid as they are not UK taxpayers. Review the query results carefully.

Creating custom queries for Gift Aid reporting

To create custom queries for Gift Aid reporting, use the GiftAidGiftsOnly business object.

The GiftAidGiftsOnly business object includes filters that do the following:

- Exclude gifts that have already been claimed

- Exclude gifts given by a company

- Includes gifts that fall within the four-year HMRC back claiming rules, which are dependent on the organisation's tax year settings (Settings > Finance > Gift Aid UK).

Using other Gift Aid business objects may result in slow query performance.