Last updated on: January 27, 2026

Fundraising invoices include gifts, pledges, and installment pledges.

Consider the following scenarios:

- A donor gave your organization a donation of 1,500.00, but the check did not clear. The donor does not intend to provide another check, so this gift must be reversed.

- A staff member entered a gift as a 500.00 check, but the check was only for 50.00. Now, the gift must be corrected.

When these scenarios occur, you can use iMIS to adjust or reverse gift, pledge, and installment pledge invoices. See Adjusting gifts and pledge details for information regarding adjusting gift properties using the Enter gifts window.

In This Article

- Adjusting gift, pledge, and installment pledge invoices

Reversing a gift, pledge, or installment pledge invoice

Reversing multiple open pledge or installment pledge invoices

Adjusting gift, pledge, and installment pledge invoices

The adjustment process is different depending on whether the invoice has been paid.

Adjusting when the invoice has not been paid

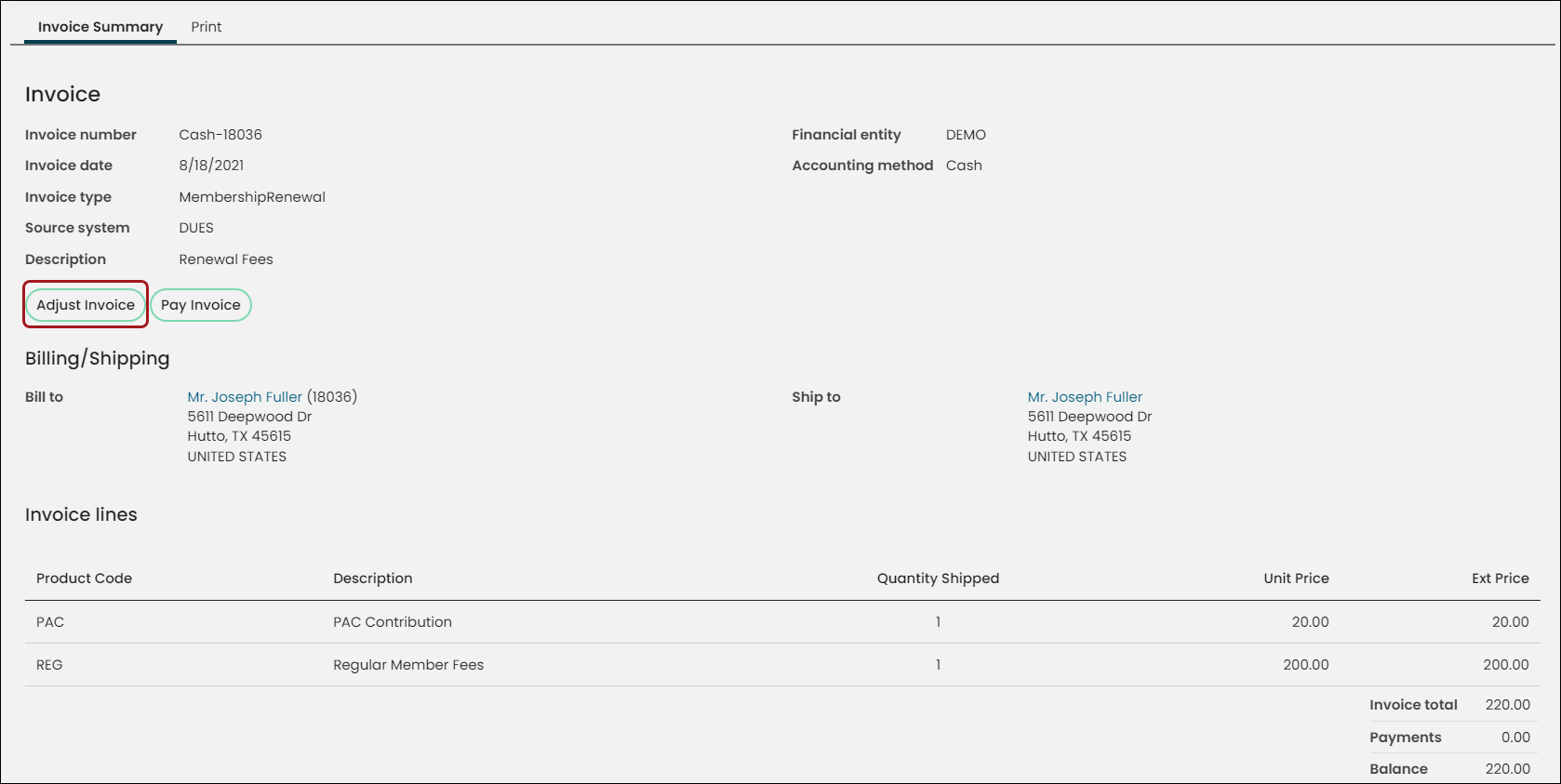

To adjust a fundraising invoice that has not been paid, navigate directly to the invoice and make the adjustments:

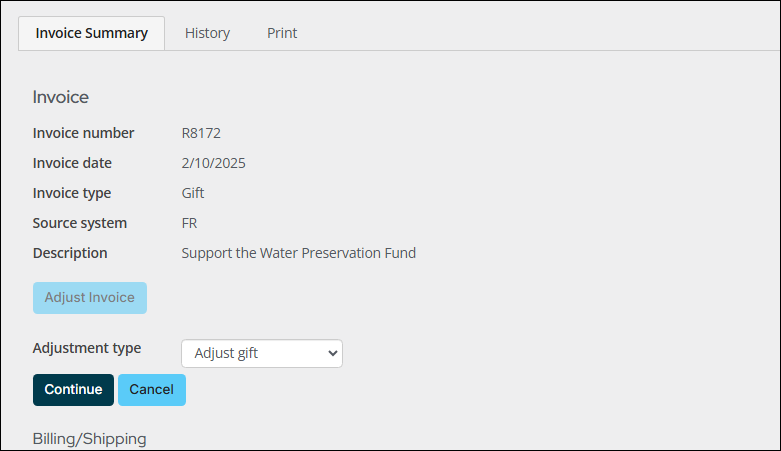

- Go to Finance > Invoices.

- Locate the invoice and select the Invoice Number.

- Click Adjust Invoice.

- From the Adjustment type drop-down, choose either Adjust pledge or Adjust gift.

- Click Continue.

- Make the adjustments, then click Submit.

Adjusting when the invoice has already been paid

Important! Adjusting or reversing a receipted gift payment automatically voids the receipt.

If the invoice has already been paid, you must first unapply the payment before you can adjust the invoice. Do the following to adjust gift, pledge, and installment pledge invoices that have already been paid:

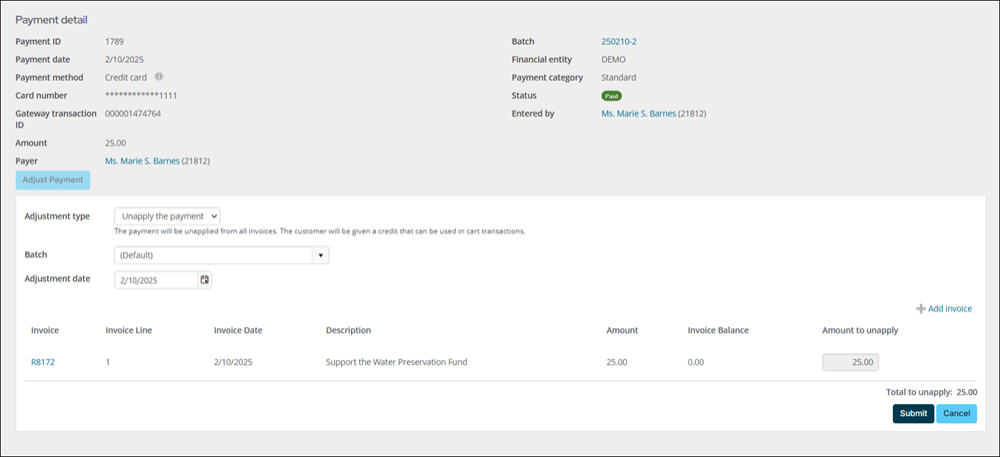

- Go to Finance > Pay Central > Find payments and search for a payment.

- Select the Payment ID.

- Click Adjust Payment.

- From the Adjustment type drop-down, select Unapply the payment.

- Enter an Adjustment date. The Adjustment date must be a date between the payment date and today's date. If the payment date is in the future, you can enter a date between today's date and the future payment date. This value will default to the current date.

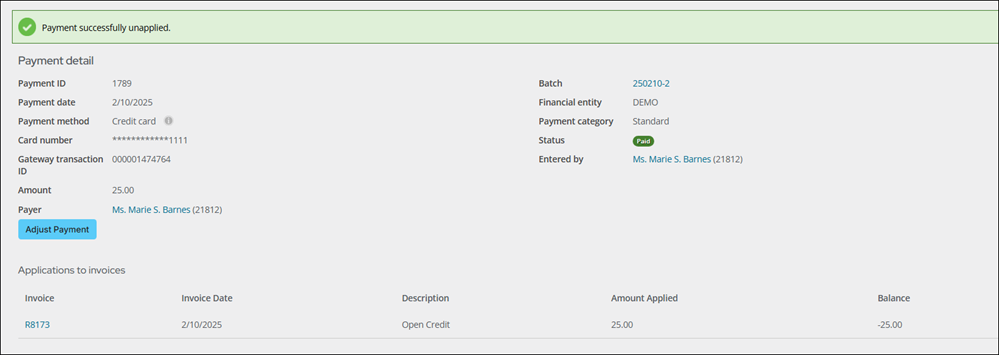

- Click Submit. You will see a Payment successfully unapplied message. A new invoice is created with the open credit amount.

- Go to Finance > Invoices, and search for and open the original invoice.

- Click Adjust Invoice.

- Do one of the following:

- (Pledges and Installment pledges) Click Adjust pledge.

- (Gifts) Click Adjust gift.

Note: If the event is a fundraising event (Charitable item is enabled for the registration option) and the registration needs to be adjusted, you must edit the event registration, not the invoice. See Registering for events for more information.

- Click Continue.

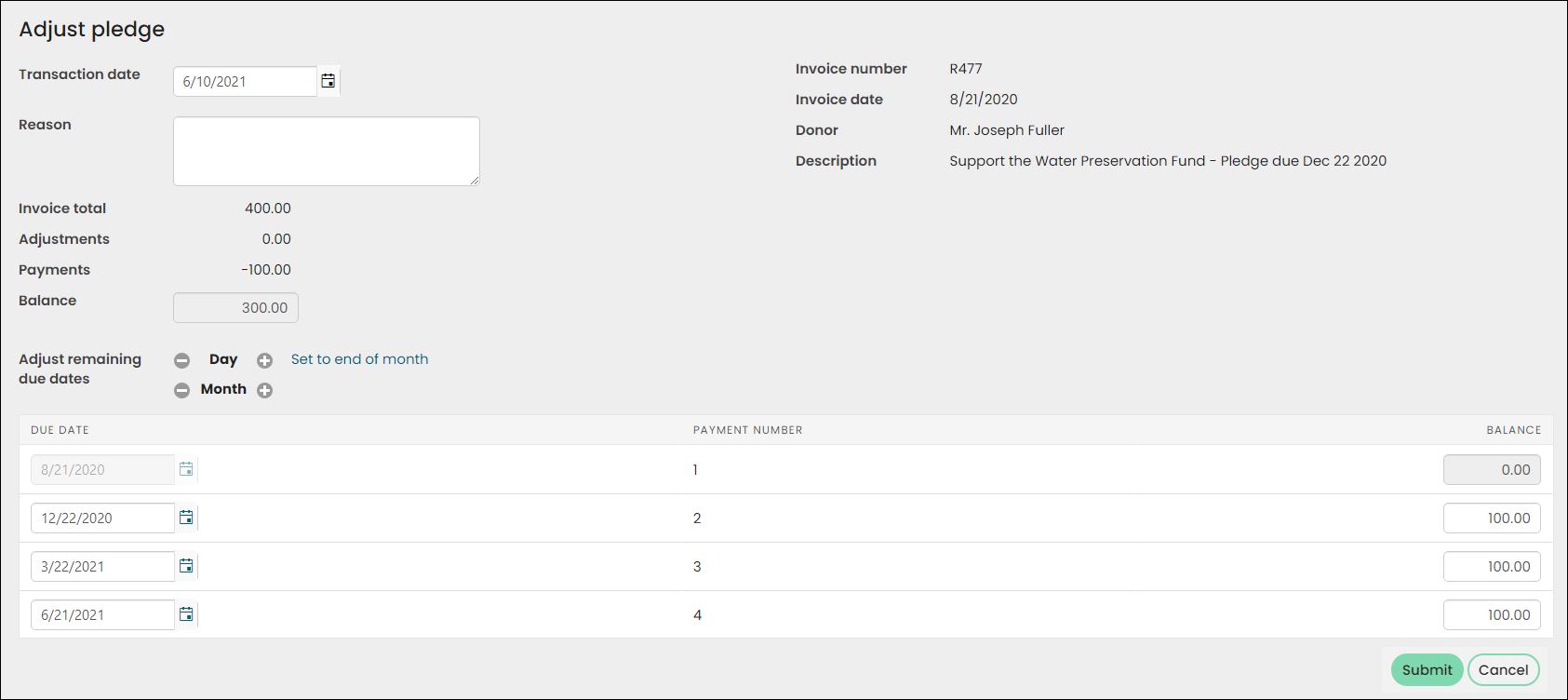

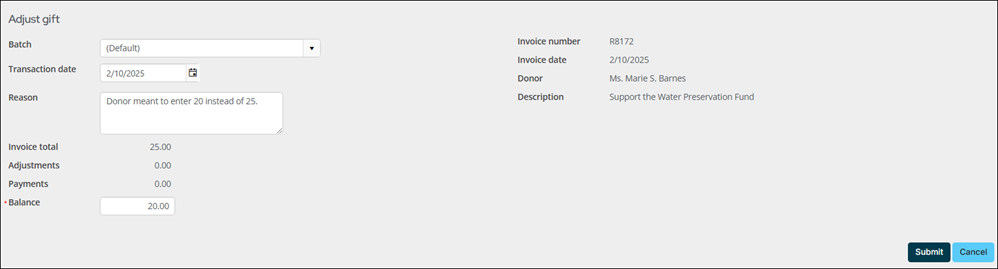

- The Transaction date defaults to today's date, but you can adjust the date. The new date must be between the Invoice date and today's date.

- (optional) Enter an adjustment Reason.

- Enter an adjusted Balance:

- Pledges and Gifts: The adjusted Balance must be greater than zero, and this field cannot be left blank.

- Installment pledges: Enter an adjusted Balance for each individual scheduled payment as necessary. The adjusted Balance must be greater than zero, and this field cannot be left blank.

Note: Pledge and installment pledge invoices cannot have their price or quantity adjusted. Pledge and installment pledge invoices can have their remaining balances adjusted.

- For an installment pledge with multiple installments, you can adjust remaining Due Dates for each scheduled payment that has a balance. You can adjust the day or month that the installment pledge payment is due.

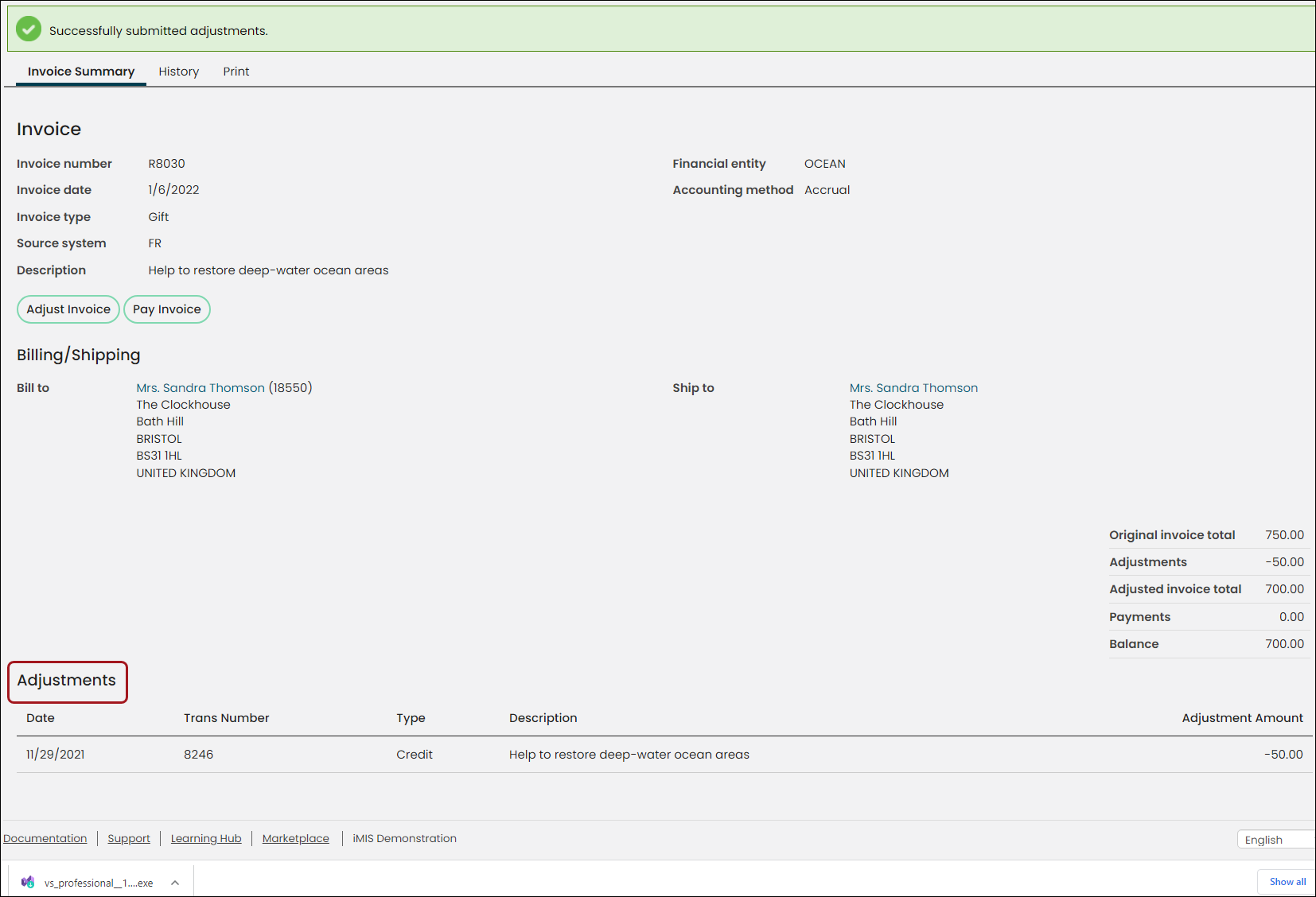

- Click Submit. The adjustments appear in the Adjustments section of the invoice.

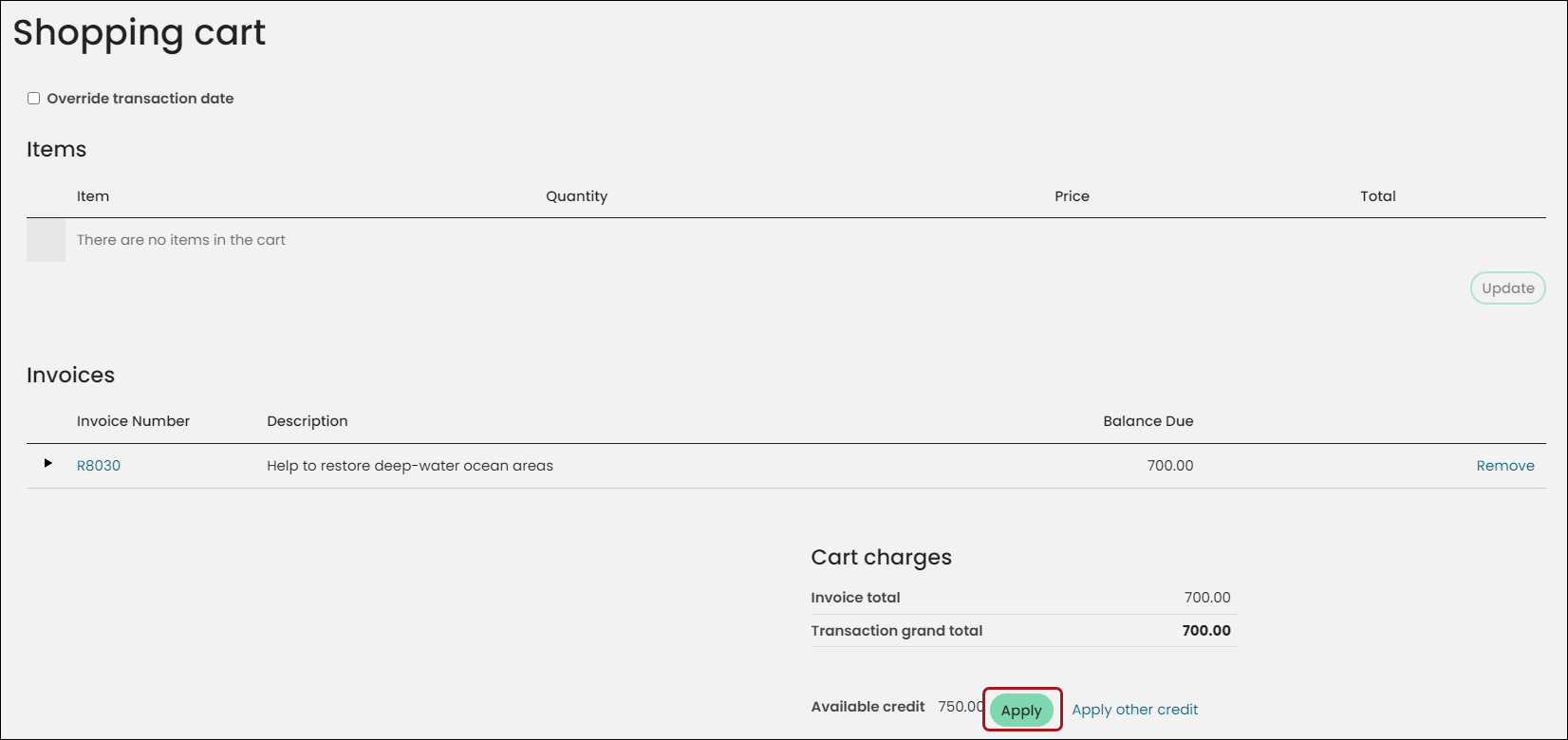

- From the same window, click Pay Invoice. You are automatically taken on behalf of the Bill To contact.

- From the Cart, click Apply to reapply the payment..

- Click Submit Order.

- If the adjustment results in an overpayment, you can refund the remaining balance, or leave it as an open credit.

Note: If the payment methodType is Other, the only option is to reverse the payment. This applies to In Kind payments. After the payment is reversed, adjust and correct the invoice, then apply a new payment.

Note: Click Set to end of month to advance all remaining installment pledge due dates to the last day of the month.

Reversing a gift, pledge, or installment pledge invoice

Reversing an invoice is not available if there have been any previous adjustments to the invoice (quantity, price, shipping, and/or handling). If the invoice was already paid, the related payment must be reversed before the invoice can be reversed. To reverse a gift, pledge, or installment pledge invoice, you must be a system administrator or a staff user with Fundraising: 1 or Finance: 4module authorization level permissions.

Note: Once and invoice is reversed, it cannot be un-reversed. The invoice must be regenerated as a new invoice.

Do the following to reverse a gift, pledge, or installment pledge invoice:

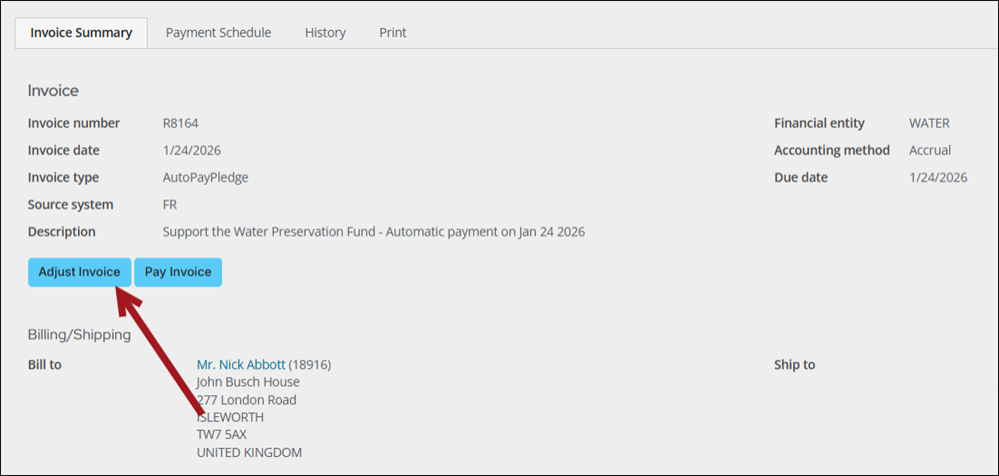

- Go to Finance > Invoices.

- Select an invoice, or search for an invoice.

- Click Adjust Invoice. The Adjust Invoice button will not appear if the invoice is paid and has a balance of zero. If the invoice has already been paid, you must first reverse the payment.

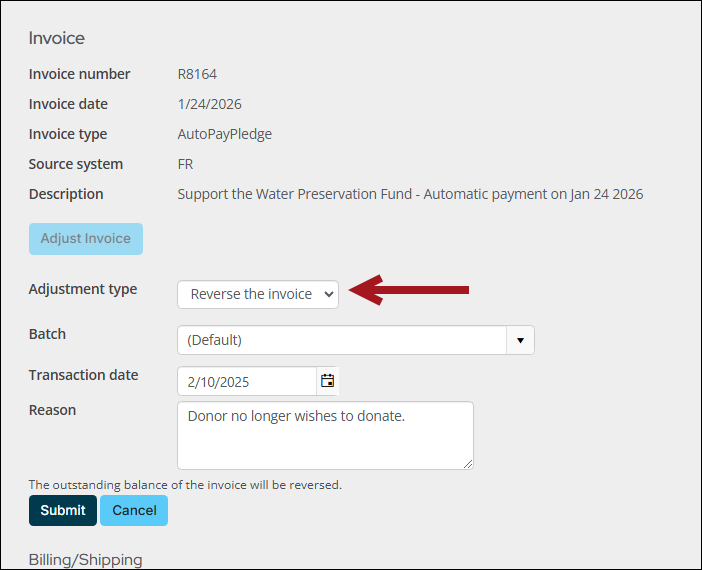

- From the Adjustment type drop-down, select Reverse the invoice. This option will not appear if the invoice was previously adjusted or already reversed.

- Click the Payment Schedule tab. The entire remaining payment schedule is displayed.

- Click Reverse for the scheduled payment you want to reverse.

- You can modify the Reversal date. The new date must be between the invoice date and today's date.

- Click Submit. The Payment Schedule tab is updated to show an adjustment for the specific scheduled payment you reversed, as well as the remaining payments on the Payment Schedule.

- The Transaction date field will automatically populate to the current date. This date can be changed to any date between or equal to the original invoice date and the current date.

- Enter a Reason for reversal.

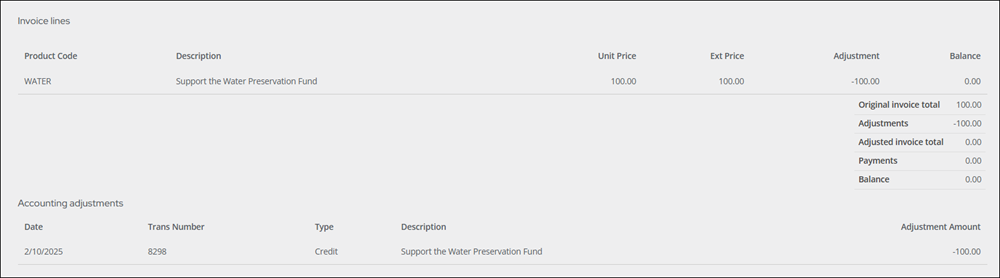

- Click Submit. The adjustments are displayed at the bottom of the invoice Adjustments panel, along with the Adjusted Amount. For an installment pledge, the Adjustments panel displays each scheduled payment, along with the Adjusted Amount.

Note: The Adjust Invoice button does not appear for invoices containing line items that are not eligible for adjustment.

For a pledge, the reversal amount is equal to the invoice balance on the pledge. For an installment pledge, the balance on each remaining installment is reversed.

Reversing individual installment pledge scheduled payments

At this point, you can reverse individual scheduled payments for an installment pledge:

Reversing multiple open pledge or installment pledge invoices

Do the following to reverse multiple open pledge or installment pledge invoices:

- Go to Fundraising > Reverse open pledges.

- Search for the desired open invoices using the available search options.

- Select the open pledge or installment pledge you want to reverse.

- (optional) Click the Invoice number to open the Invoice Summary window and review invoice details.

- Click Reverse Invoices. A message is displayed, indicating the invoice reversal has been submitted.

- (optional) Select the Log tab to check the status of the submission. The Log lists the reversals that have been submitted. The Log describes the Type of reversal initiated, as well as the Status of the reversal.

- Click the Start Time link to open the Reversal log detail. You can see the Status of the reversal.

- You can click the Invoice number on the Reversal log detail to open the Invoice Summary window.

Note: You can add or edit queries if you want to use different criteria to search for invoices. By default, the OpenPledgeInvoices query is at $/Accounting/DefaultSystem/Queries/OpenPledgeInvoices.

You can configure the following log retention options:

- Number of days to retain successful task logs - Enter any numeric integer value to represent the number of days the database will retain the successful task logs until they are removed.

- Number of days to retain failed task logs - Enter any numeric integer value to represent the number of days the database will retain the failed task logs until they are removed.

- Number of days to retain completed task logs - Enter any numeric integer value to represent the number of days the database will retain the completed task logs until they are removed.

- Go to Settings > RiSE > Process automation to configure your log retention options.

Note: Reversing multiple open pledge or installment pledge invoices is only available to system administrators and staff users with appropriate module-level permissions (Fundraising: 3).