Last updated on: January 27, 2026

Several summary and detail level reports let you review the status of deferred income.

Go to Reports > Accounting.

In This Article

- Deferred Income Detail Report

Deferred Income Matrix Summary

Deferred Income Analysis Spread

Deferred Income Audit Trail

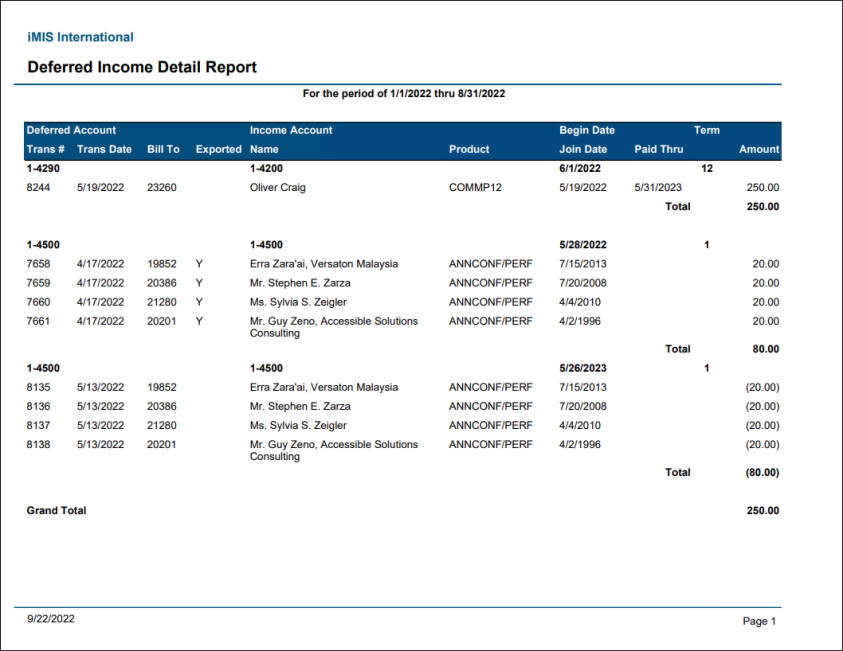

Deferred Income Detail

Provides a report of transactions to be posted to deferred income. This report should be printed prior to running the GL export. Verify the accuracy of the data and make modifications as needed before running the GL export. Any transactions that have already been exported to the Gl display a "Y" in the Exported column.

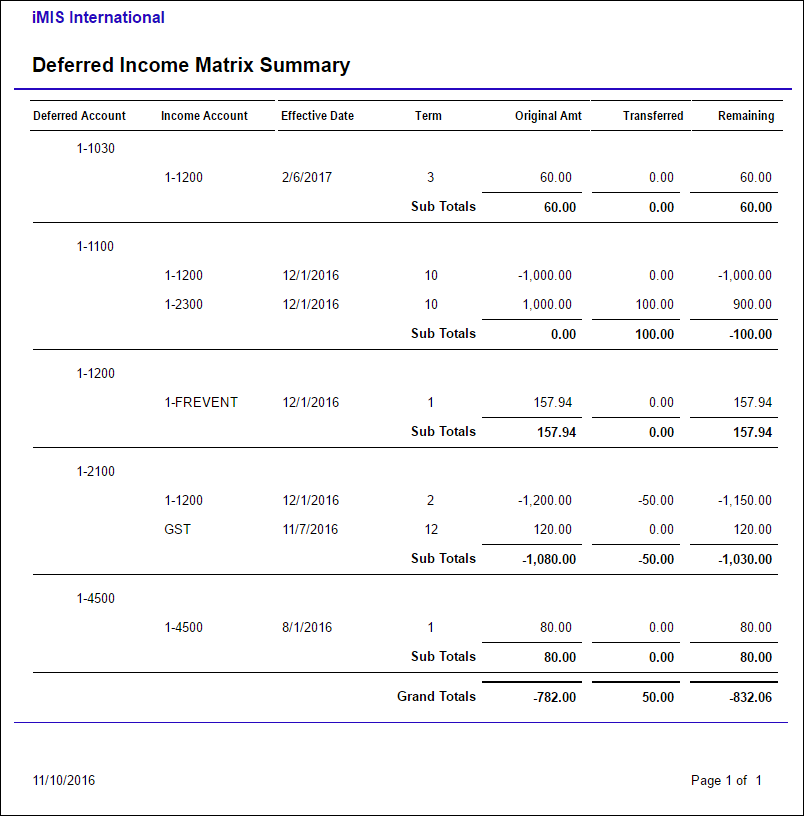

Deferred Income Matrix Summary

Provides the current status of deferred income grouped by account. Includes the totals that were originally posted to deferred income, how much has been recognized to date, and the amount that remains to be recognized in future months.

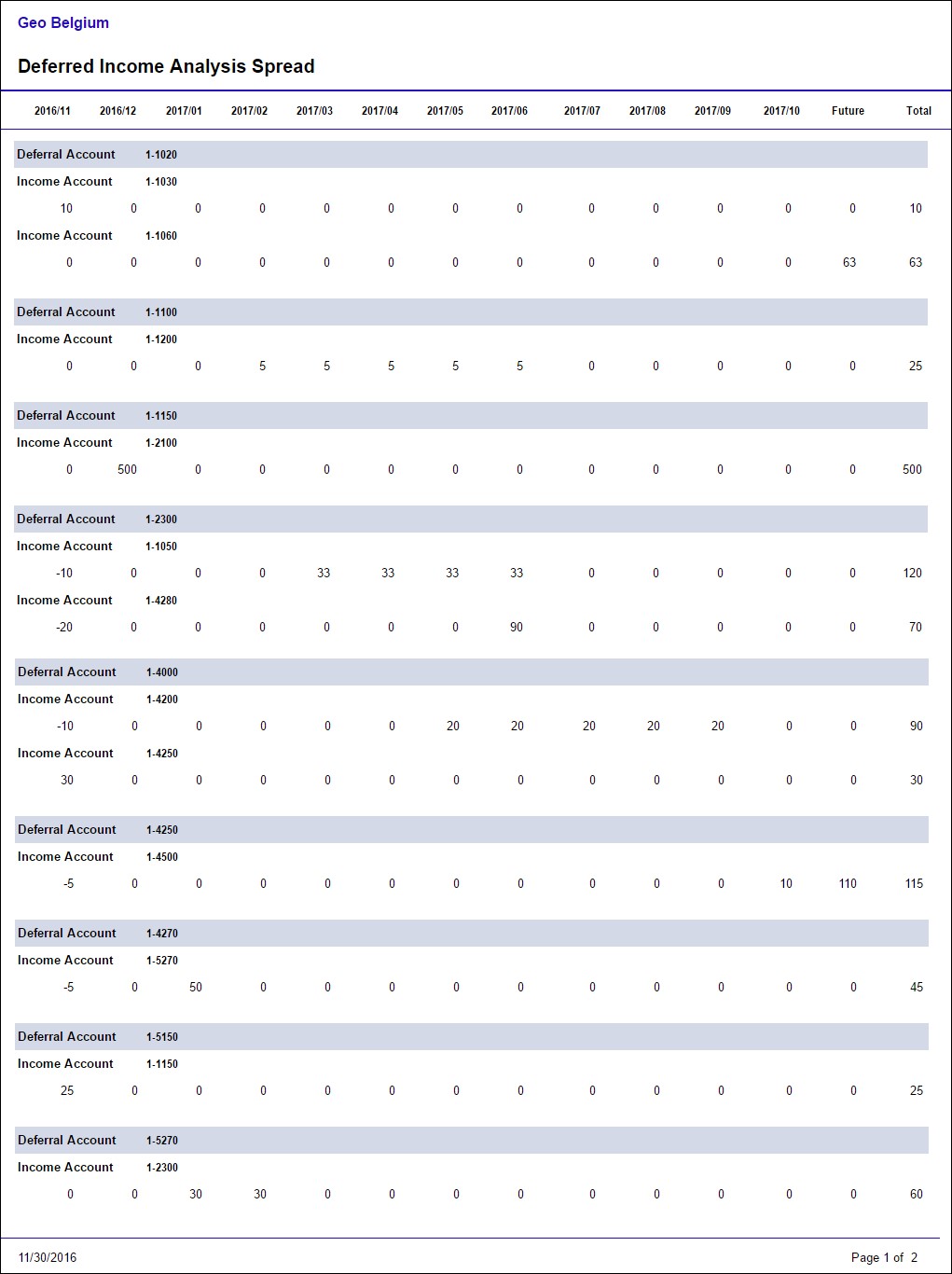

Deferred Income Analysis Spread

Provides a projection of how the current balances in deferred income will be recognized in each future period. Includes 12 months of projections as well as a summary of projections beyond that.

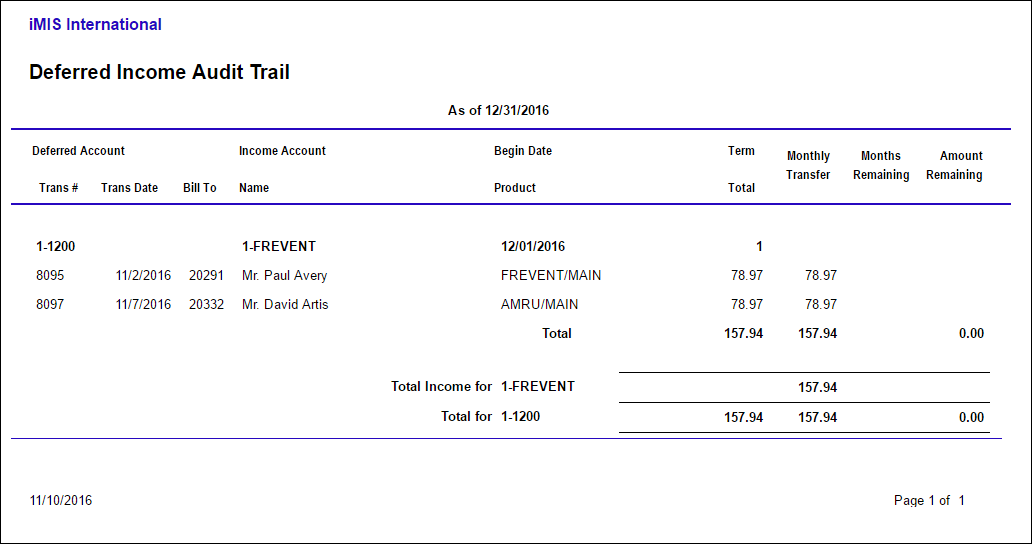

Deferred Income Audit Trail

Provides an audit trail to simulate the income that was recognized and the deferred income balances that remained for a specific monthly period (any month for which the GL Export has already been run). The report is designed as an audit trail report to simulate the income that was recognized, as well as the deferred income balances that remain at the end of the reporting period.

Note: This report is generated using the specified Effective Date. Only transactions equal to or less than the report's Effective Date are included. It is important to always enter the last day of the month.

This report is based on deferred income transactions for which the deferral/recognition timeframe is still in effect as of the beginning of the month being reported on (residual income is yet to be recognized either during the report month and/or in a future month).

This report simulates the process that iMIS uses to generate the deferral to income transfer entries with one exception. It depicts the income recognition at the individual detail transaction level, as opposed to the matrix summary level that iMIS uses to generate the actual entries. As a result, the reported income amounts will most likely be different from the actual amounts by small rounding differences. Nonetheless, the report should give a close approximation of the actual transfer amounts per month as well as the residual balance at the end.

This report is structured as follows:

- The report is based on all transactions dated on or before the reporting effective date that have been posted to the deferred income matrix.

- The transactions are grouped, sorted, and subtotaled by the four key deferral matrix elements (Deferred Account, Income Account, Begin Date, and Term).

- For identification and cross reference, the Trans #, Trans Date, Bill To ID, Bill To Name, and Product code are listed.

- The transaction amount is listed and subtotaled at the matrix summary level. This subtotal should agree with the original amount on the Deferred Income Matrix Summary report as of the end date of the report (the sign is shown as positive instead of the normal credit balance for easier use of the report).

- For each detail line, the monthly transfer column will show the portion of the income that should have been transferred during the reporting month. In most cases, if the begin date is equal to or less than the reporting period, this will be the transaction amount divided by the term, with appropriate rounding. In some cases, the amount might be more if the transaction date falls within the reporting date and the deferral begin date was within an earlier period. In this case, iMIS works in a catch-up mode on income that needs to be recognized by the reporting date. If the reporting period is the last period within the deferral term, the amount might be smaller or larger to account for any cumulative rounding differential. The transfer amount is summarized at the matrix level and is also subtotaled for each income account. The actual transfer amount can be compared to the total income from transfer for the reporting period.

- The Months Remaining in the deferral term beyond the reporting month is shown for each transaction.

- The deferred income Amount Remaining is shown at the individual transaction level, matrix summary level, and the Total amount by the deferred GL account. It can be compared to the GL balance and/or the Deferred Income Matrix Summary report as of the end of the reporting month. Again, due to the detail basis of the report, this balance will only be an approximation, which can be off by a rounding difference.

Note: If the actual transfer amount differs substantially from the report amount, this can be due to timing issues where the income for certain transactions was not recognized because a future month's general ledger export was processed before the affected transactions were processed through an GL cycle.