Last updated on: January 27, 2026

Deferred income provides delayed recognition of income to coincide with when the income is earned to match when the related expenses are incurred, rather than when the invoice is generated or the funds are received. Deferred income credits a user-specified deferred income liability account (rather than the regular income account) when the transaction is initially entered.

iMIS processes deferred income for billing products and event registrations. Billing products are processed incrementally over the subscription term, while event registration orders are processed in a lump sum during the month the event occurs.

In This Article

- Understanding deferred income processing

Handling existing deferred income items

Enabling deferred income processing

Understanding deferred income processing

When the deferred income account is referenced for a billing product or event registration, the full amount charged or received will be booked as deferred income. Each time the general ledger export runs, iMIS analyzes which deferred balances can be completely or partially identified as earned income. When iMIS finds deferred income amounts, it automatically generates journal entries to transfer earned income amounts out of deferred income.

Required configurations

Although the entries to record deferred income and subsequently recognize income are generated during the general ledger export procedure, the determination of when the income will be recognized occurs as you process each transaction. Deferred income processing requires the following information:

- Deferred income account codes - The deferred income account must be selected for each billing product, and for each event program item and registration option recognizing deferred income. You must specify these accounts to enable deferred income processing.

- Verification of Begin Date and Term - For event registration transactions, verify that the event's Begin Date is correct. For billing products, verify that the billing term on each customer/subscriber's deferred line item is correct.

billing products

Deferring income for billing products is incremental. The income is recognized in equal monthly increments over the number of months in the billing product term, starting with the begin date. iMIS calculates the term from the beginning and ending dates of the billing product term.

Example: For a 12-month subscription, iMIS recognizes 1/12 of the income during each month of the subscription term.

Successful processing of billing product deferred income transactions depends on products with a defined deferred income account number.

Cash and accrual dues use deferred income, but the time frame for the deferral varies based on the accounting method used:

- Cash - Cash dues defer income when payments are recorded or reversals are processed.

- Accrual - Accrual dues defer income at billing time or when recording credit memos and debit adjustments.

The beginning and term periods over which the income is recognized coincides with the beginning and ending date of the dues or subscription term.

event Registrations

Deferred income for event registration orders is recognized in a lump sum during the month that the event occurs.

As event registrations are processed and functions are selected which have a defined deferred income account, the income for these functions is automatically triggered for deferral until the month of the event, at which time 100% of the income is recognized.

Example: The Annual Conference event is on September 20. Members register for the event from March – August. The income for the event registrations is recorded on September 1.

Handling existing deferred income items

When you begin using iMIS to manage your deferred income, you will need to continue dealing with any pre-existing balances in the deferred income accounts by creating manual deferred income-to-regular income transfer entries only for the amounts that existed before using iMIS for deferred income until all of those amounts are recognized.

Enabling deferred income processing

Review the following to enable deferred income for billing products and event registrations.

Billing products

Do the following to define a deferred income account for a billing product:

- Go to Membership > Billing products.

- Select the billing product Name.

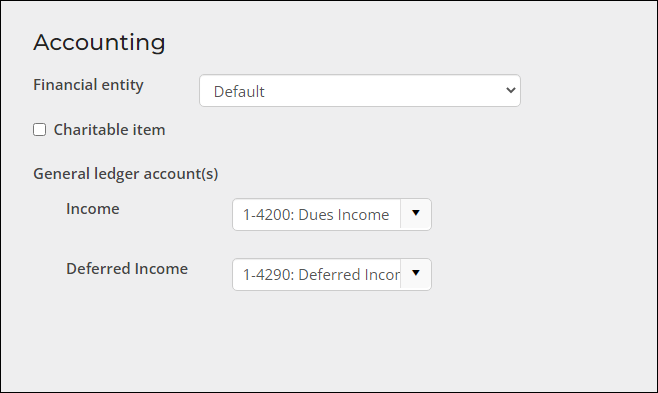

- (required for deferred income processing) From the Accounting section, define the Income and Deferred Income accounts:

- Income - The account the deferred income will be transferred to.

- Deferred Income - The liability account that income resides until it is recognized and transferred to the regular Income account.

- Click Save & Exit.

Event registrations

Do the following to define a deferred income account for event registration options and program items:

- Go to Events > Find events.

- Locate and open the event.

- Define deferred income accounts for the event's program items:

- Select a program item for which you wish to define a deferred income account.

- Select Edit.

- Click the Accounting tab.

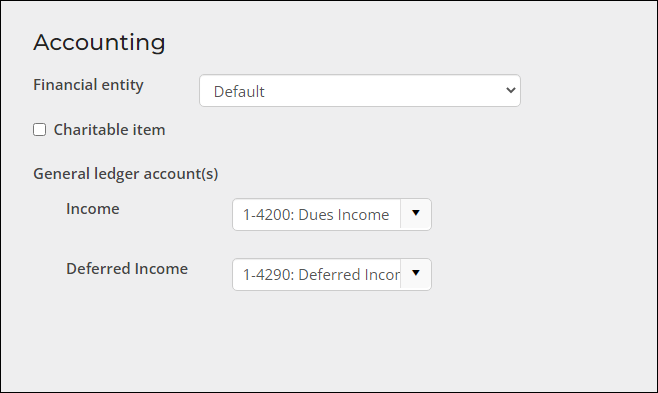

- (required for deferred income processing) Select the Income and Deferred income accounts.

- Click Save & Close.

- Continue the same process for each program item.

- Define deferred income accounts for the event's registration options:

- Open an event for edit.

- Click the Pricing tab.

- Select the Registration option for which you wish to define a deferred income account.

- Click the Accounting tab.

- (required for deferred income processing) Select the Income and Deferred income accounts.

- Click Save & Close.

- Continue the same process for each registration option.