Last updated on: January 27, 2026

Quick Tutorial Training course

Note: Deferred income is a licensed feature. For more information, contact your AiSP or ASI Technical Support.

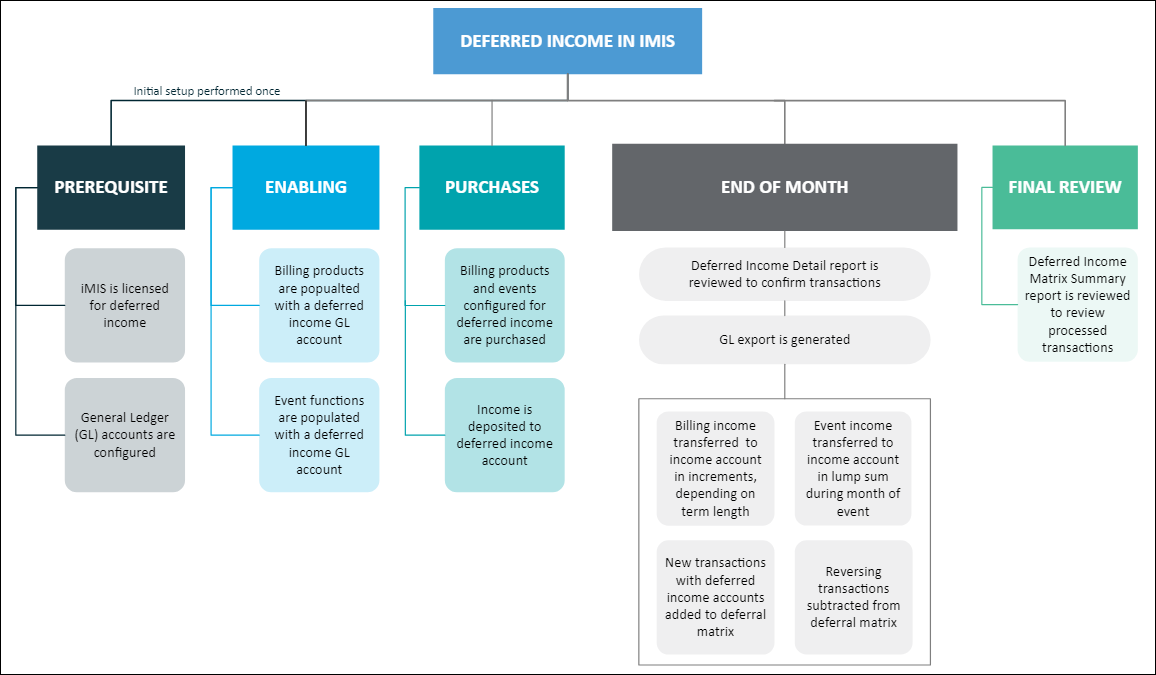

iMIS manages the recognition of the appropriate income amounts as the income is earned, and generates the corresponding entries to transfer those amounts from the deferred income account to the regular income account in the general ledger.

Figure 1: Using Deferred Income in iMIS

The deferred income feature is transparent to the user. Tracking and processing can be automatically triggered for billing products and event registrations. The following terms are unique to the deferred income process:

- Deferred income - Money that is credited to a liability account until it is recognized and transferred to the regular income account.

- Earned income - Income that is recognized during a specific accounting period.