Last updated on: January 27, 2026

Processing deferred income transactions consists of the following steps:

- Run the Deferred Income Detail report - Run this report to verify the deferred income transactions are correct. If the data is incorrect, it must be corrected before the export is generated.

- Generate the export file - Generate the export file to process individual deferred income transactions.

- Run the Deferred Income Matrix Summary report - Run this report to review the processed transactions.

Step 1: Running the Deferred Income Detail report

A critical step in processing deferred income transactions is verifying the deferral term before running the general ledger export. The Begin Date on which the deferred income transaction goes into effect and the Paid Thru ending date (when the term expires) determine the deferral term for any single line item.

To view each transaction, you must run the Deferred Income Detail report. To run the report, do the following:

- Go to Reports > Accounting reports.

- Select the Deferred Income Detail report, then click Run.

- Enter the Begin Date and End Date range for the deferred income transactions you wish to review.

- From the Exported drop-down, select one of the following:

- Exported only - Includes transactions that have been exported to the GL.

- Non-exported only - Includes transactions that have not yet been exported to the GL.

- All - Includes all transactions.

- Click Refresh.

- Verify the accuracy of the data and make modifications as needed before running the general ledger export.

Step 2: Generating the export file

iMIS processes individual deferred income transactions through the general ledger export. To generate a general ledger export file, see Exporting general ledger transactions.

Note: Cancellations, reversals, or adjustments of previously deferred billing product income should be processed with the appropriate beginning period and term. The general ledger export procedure will automatically adjust the deferred income matrix for these transactions in iMIS and create the necessary entries to adjust the deferred income and earned income amounts in the General Ledger.

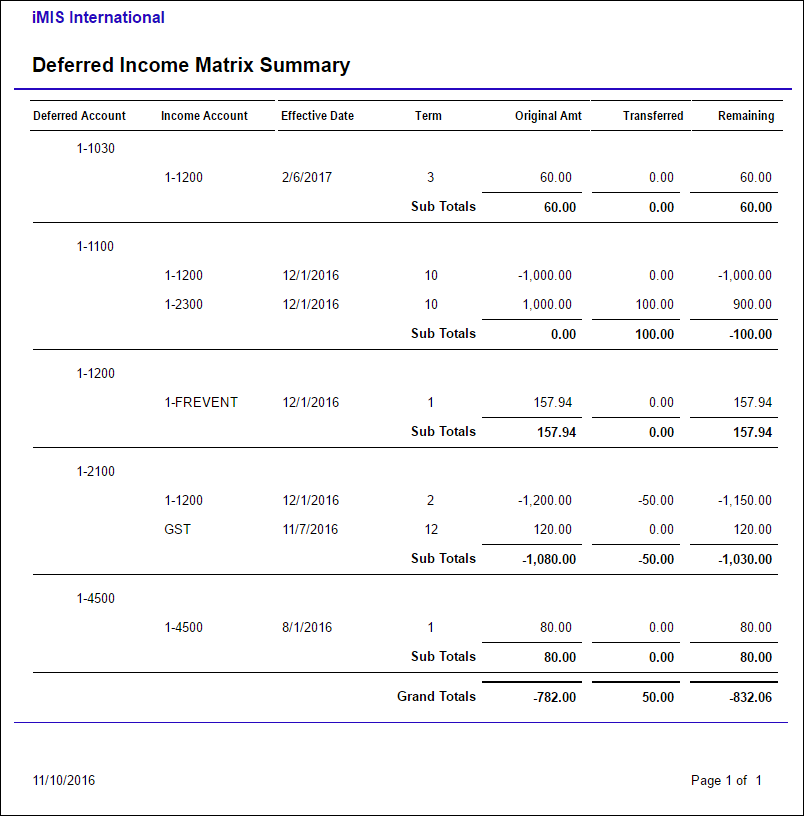

Step 3: Running the Deferred Income Matrix Summary report

As iMIS processes individual deferred income transactions through the general ledger export, the deferred income amounts are posted to a summarized Deferred Income Matrix Summary report (Reports > Accounting reports). This report keeps track of the total balance in the deferred income accounts, which are divided into the following summary columns:

- Deferred Account - Deferred income account number

- Income Account - Income Account number

- Effective Date - (for example, month-year) Date to begin income recognition

- Term - (for example, number of months) Time frame over which to spread income

- Original Amount - The original amount of currency in the deferred account

- Transferred - Amount transferred from the deferred account to the income account

- Remaining - The amount remaining in the deferred account

A row is created for each combination of the provided columns. From this structure, iMIS determines and generates the necessary entries to transfer amounts from deferred income to regular income.

Understanding The GL Export & Deferred Income Matrix

The general ledger export procedure performs the work related to deferred income processing as follows:

- Creates a deferred income entry to credit the deferred income account instead of the regular income account for the full amount for all deferred income transactions

- Updates the deferred income matrix table for the combined dollar amount of the transactions involved

- Analyzes the deferred income matrix and creates the appropriate transfer entries to recognize income

Note: In some cases, transfer entries work in a catch-up mode. For example, if late cash-basis subscription payments are received and processed after the subscription term has begun, iMIS immediately recognizes the full amount due to be recognized as the accounting period being processed (that is, if a payment entry is recorded six months after a subscription started, iMIS generates an entry to recognize or transfer one-half (6 , 12) of the subscription income amount).

The following is an example of a general ledger export file. Lines 3 and 4 create a deferred income entry to credit the deferred income accounts, and lines 5 and 6 analyze the deferred income matrix and create the transfer entries to recognize income:

01/01/2023 1-1100 PAY,DEMO-DUES-PAY 1200.00

01/01/2023 1-1200 AR,DEMO-MEETING-AR 500.00

01/01/2023 1-2100 DIST,DEMO-DUES-BASIC -1200.00

01/01/2023 1-2200 DIST,DEMO-MEETING-TECX/MAIN -500.00

01/01/2023 1-4200 Deferred Income Transfer -100.00

01/01/2023 6 1-2100 Deferred Income Transfer 100.00