Last updated on: January 27, 2026

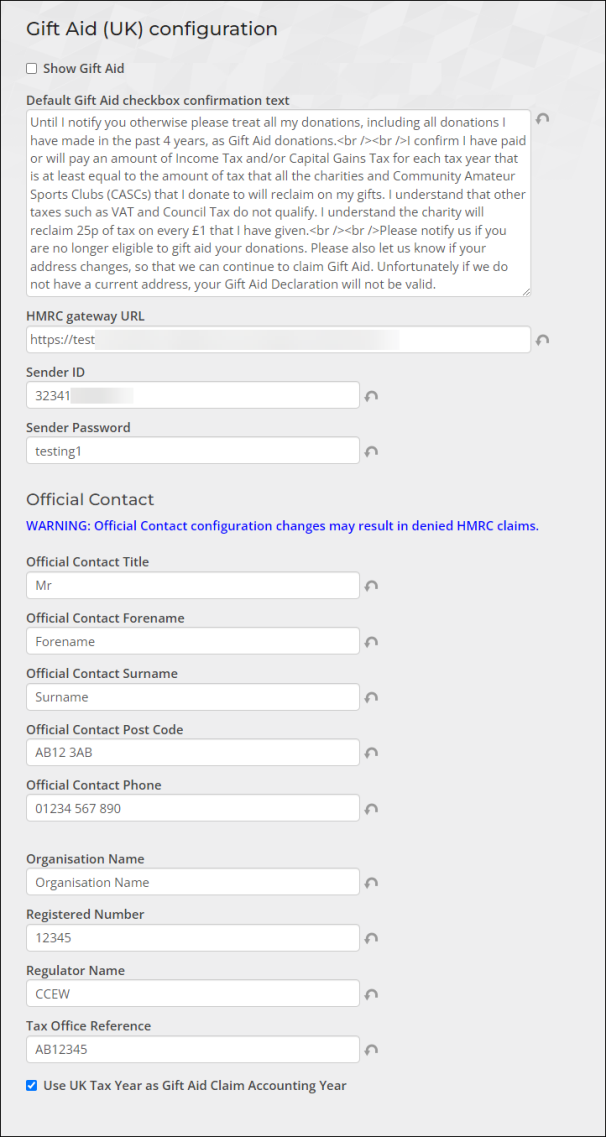

To take advantage of HMRC's Gift Aid, the default settings related to Gift Aid must be configured. The default settings include surfacing the out-of-the-box Gift Aid content and creating default confirmation text.

- Enable Show Gift Aid to surface the following:

- A Gift Aid panel located on the Giving tab of donor profile pages. The panel can only be seen by staff users.

- A Yes, add Gift Aid checkbox located on the staff Enter gifts (Fundraising > Enter gifts) window.

- The Gift Aid Declaration content item on the Give Now with Gift Aid content record. See Creating the Gift Aid donation page for more information.

- Enter the preferred confirmation text in the Default Gift Aid checkbox confirmation text field. This text can be written using standard HTML for line breaks and minor styling.

- Complete your organisation's HMRC tax information:

- HMRC gateway URL

- Sender ID

- Sender Password

- Official Contact Title - This field is optional, and allows only 4 characters. Punctuation is not needed.

- Official Contact Forename - Your official contact's first name as registered with HMRC.

- Official Contact Surname - Your official contact's last name, as registered with HMRC.

- Official Contact Post Code - Your official contact's post code, as registered with HMRC.

- Official Contact Phone - Your official contact's phone number, as registered with HMRC. Use only numbers and spaces.

- Organisation Name

- Registered Number - You must register your organisation as a charity. For more information, see Get recognition from HMRC for your charity.

- Regulator Name - The governing body with which a charity must be registered in order to be recognised as a charity for tax purposes.

- Tax Office Reference - The reference number a charity receives when registering for Gift Aid.

-

Use UK Tax Year as Gift Aid Claim Accounting Year - The UK tax year is April 6 through April 5 of the following year. If this setting is not selected, the accounting year is assumed to start on the first day of the month defined in iMIS as the First Month of Fiscal Year (go to Settings > Finance > Financial entity). The value of this setting is used to determine how far back an enduring Gift Aid declaration can be used. HMRC states that Gift Aid declarations with Past=true can be used for gifts that are up to four “tax years” old. The start of that date depends on the organisation’s definition of a tax year. Most organisations will use the UK tax year, but some will use their own. This depends on the type of organisation it is.

Note: When defining a Gift Aid donation page, there is a configuration option located on the Gift Aid content item that allows for the default confirmation text to be replaced. If the option in the content item is enabled, the default text defined here will be replaced by the text defined in the individual donation page. For more information, see Gift Aid text on a donation page.

Warning!

Once you set your Official Contact information, any changes you make might affect your HMRC claims. This could result in denied claims.