Last updated on: January 27, 2026

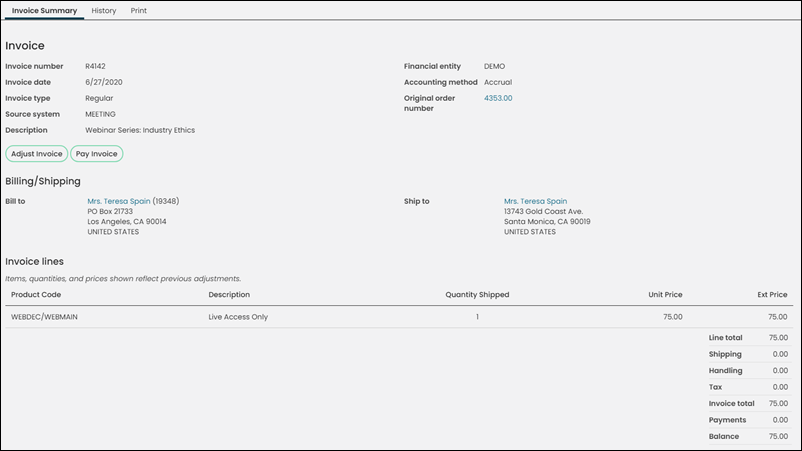

This article explains the various fields that appear on an invoice. This article also demonstrates how to print, export, and email an invoice.

Staff users with a Finance: 2 module authorization level or higher are able to search for and review specific invoice details.

Reviewing invoices

To review invoice details, do the following:

- Go to Finance > Invoices.

- Search for the invoice using the Select a query drop-down (All invoices or All open invoices) and enter invoice-specific information in the search fields.

- Click Find.

- Click the Invoice Number to review more detailed information related to the invoice.

- Invoice

- Invoice number - The number associated with the invoice.

- Invoice date - The date the invoice was initially created.

- Invoice type - There are many different invoice types. See Understanding the invoice types for specific details.

- Source system - The system or module that generates the invoice:

- AR – Accounts Receivable

- DUES – Membership fees

- EXPO – Exposition

- FR – Fundraising

- MEETING – Events

- ORDER – Commerce products

- SC – Service central

- Description - Description of the invoice. Accrual dues invoices display the term dates of the invoice in the Description field. To change the date formatting, go to Settings > Organization, locate the Display dates and numbers using field, and choose Organization default. Choose the Default culture that matches the desired date format.

- Financial entity - The financial entity for any transactions related to the invoice.

- Accounting method - Accrual or Cash.

- Due date - Date the invoice is due.

- Term dates - Visible only on invoices for membership joins, membership renewals, and non-dues subscription items for accrual or persisted membership dues.

- Original order number - If applicable, the associated order number is displayed. The order number appears as a link, enabling you to navigate to the order details and review the original order.

- Billing/Shipping

- Bill to - The contact responsible for paying the invoice.

- Ship to - If applicable, the name and address of the customer to whom an invoiced order is shipped. If the invoice was processed as a part of a list billing, then there is no Ship to contact. Instead, there is a Recipient column in the Invoice lines section.

- Invoice lines:

- Product Code - The product code for the item on that line.

- Description - The title of the product line item.

- Recipient - This column is displayed only if the invoice was processed as apart of a list billing (the Bill to recipient will be the company or person that processed their list bill). The Recipient column details the name of the person whom the invoice line items apply to. See List billing for more information.

- Quantity Shipped - The quantity of the product purchased.

- Unit Price - The price for one quantity of the specified line item.

- Ext Price - The extended price (Unit Price multiplied by the Quantity = Ext Price).

- Adjustment - This column is displayed only when the invoice line has an adjustment. This is the total of all adjustments applied to the invoice line.

- Payment - This column is displayed only when the invoice line has a payment. This is the total of all payments applied to the invoice line.

- Balance - This column is displayed only when the invoice line has an adjustment or payment. This is the amount of the invoice line that has not yet been paid and is still owing.

- Invoice Tax Details and Amount - These items are displayed only when tax is applied to the invoice. The tax authority is displayed with its dollar amount.

- Line total - The subtotal, or the sum of the extended amounts.

This line is not displayed for fundraising, membership or subscription renewal invoices. - Shipping - Amount of the invoice total dedicated to shipping charges.

This line is not displayed for fundraising, membership or subscription renewal invoices. - Handling - Amount of the Invoice total dedicated to handling charges.

This line is not displayed for fundraising, membership or subscription renewal invoices - Tax - Amount of the Invoice total dedicated to taxes.

This line is not displayed for fundraising, membership or subscription renewal invoices - Invoice total/Original invoice total - The invoice total before any adjustments are applied.

- Adjustments - Total of all adjustments applied to the invoice.

- Adjusted invoice total - The adjusted invoice total after any adjustments are applied.

- Payments - Total of payments applied against the invoice balance.

- Balance - The amount of the invoice that has not been paid and that is still owed.

- If there are adjustments associated with the invoice, there will be an Adjustments panel at the bottom on the invoice.

- (History tab) The History tab details the transaction history for the invoice. This tab does not appear for cash dues invoices.

- Select Back to return to the list of invoices.

Note: Additional queries added to the $/Accounting/DefaultSystem/Queries/Invoices folder will be displayed in the Select a query drop-down. Always use the InvoiceLineData business object (rather than the InvoiceLines business object) when creating invoice data queries.

You are taken to the Invoice Summary tab, where the following fields are displayed:

Note: To add additional queries to this tab, add the query to the $/Accounting/DefaultSystem/Queries/Invoice Transactions folder.