Last updated on: January 27, 2026

iMIS comes with several out-of-the-box countries that your organization can begin using. You can edit a country or add a new one that iMIS does not have:

- Go to Settings > Addresses > Countries.

- Select Add new country.

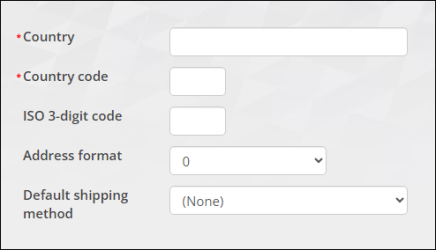

- Enter in the full Country name.

- Enter the two-letter Country code.

- Enter the ISO 3-digit code for the country.

- Select the Address format you want associated with this country.

- Select the Default shipping method when shipping orders. The values in this drop-down are populated using the SHIP_METHOD general lookup table.

- (optional) Enable Use GST/HST/GSTINC style taxation if this country uses GST/HST/GSTINC style taxation.

- The following options appear if the default organization is configured for VAT:

- (required for EU member countries) The EU country code is a two-character code assigned to each European member country. Enter a code in this field if the country is an EU country.

- (required for EU member countries) Intrastate code - The intrastate code is a country code that is used on intrastate reports. These reports list the transactions between an organization and customers from EU member countries.

- Since code lengths vary by country, you can automatically validate the number of characters entered by specifying code length parameters in the Minimum size of VAT number and Maximum size of VAT number fields.

- To automatically validate VAT codes, you can write a VAT validation procedure and attach it. In the Validation procedure field, enter the name of the stored procedure to run against any VAT codes entered into the system.

- Click Save.

Note: This option only appears if the default organization is configured for GST style taxation.