Last updated on: January 27, 2026

In-kind gifts are a type of payment method in which goods or services are given instead of money. These in-kind gifts are distinguished from gifts of cash. Each charity can determine what types of in-kind contributions they accept (for example, clothing, food, vehicles, real estate, or securities) and configure iMIS to support their needs.

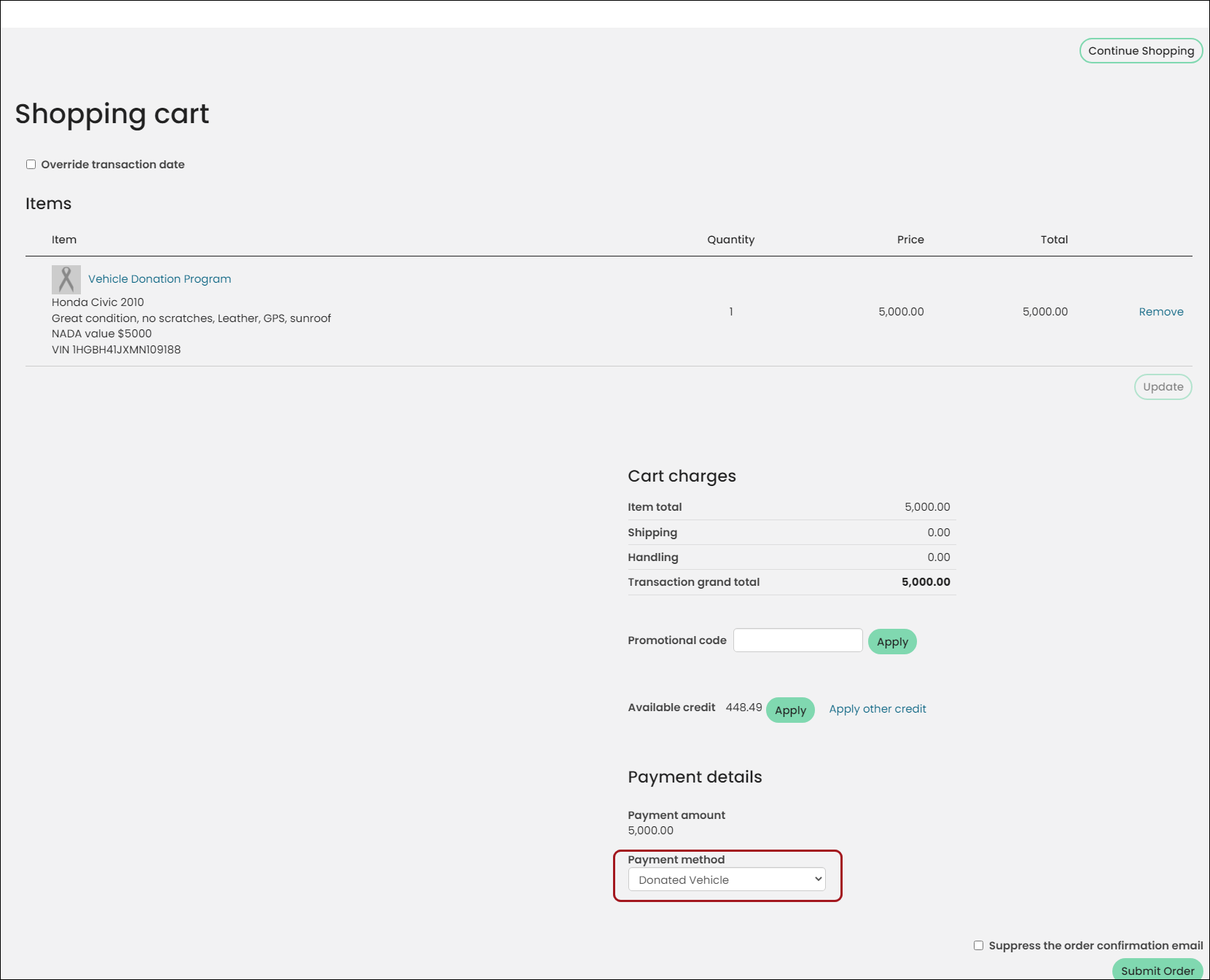

For example, a charity has a vehicle donation program where donors can donate their unwanted vehicles to support the charity's work. The charity works through a third-party to later resell the donated vehicles and uses the proceeds from those sales to fund its programs. iMIS is used in this situation to simply record the donation portion of the transaction.

In This Article

- Summary of an in-kind set up

Creating the payment method

Updating the payment method set

Creating the in-kind gift item

Entering an in-kind donation

Reporting and campaigns for in-kind donations

Summary of an in-kind set up

The following is a summary of what the charity would need to do in order to begin accepting vehicles as donations:

- The charity creates a payment method named Donated Vehicles, then adds the payment method to the Staff payment method set.

- The charity creates a Gift item named Vehicle Donation Program.

- A donor makes a donation of their 2010 Honda Civic to the charity, so the charity enters the vehicle donation on behalf of the donor using the Vehicle Donation Program gift item:

- The gift Amount should be the value that the charity assigns to the donation.

- The Description should contain any details about the donor's vehicle:

- Vehicle Identification Number (VIN)

- Description of the car's condition

- How the value was assigned to the vehicle (for example, the current NADA Blue Book value on the day that the transfer of title occurs)

- The charity chooses the Donated Vehicles payment method and completes the transaction.

Creating the payment method

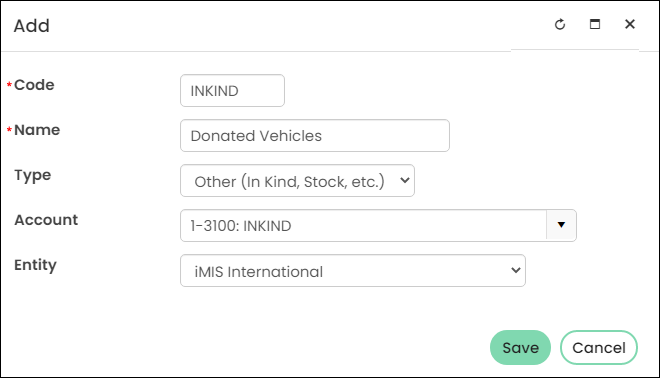

Do the following to create a payment method of in-kind:

- Go to Settings > Finance > Pay central.

- Select Add new payment method.

- Code – Enter a code for the in-kind payment method. For example, INKIND or DonVeh.

- Name – Give the payment method a name that convey its purpose. For example, Donated Vehicles.

- Type – Select Other.

- Account – Assign the appropriate general ledger account. This is the asset account to be debited when receiving this type of donation.

- Entity – Select the appropriate financial entity that the in-kind donation is associated with.

- Click Save.

Updating the payment method set

Do the following to update the payment method set to include in-kind payments:

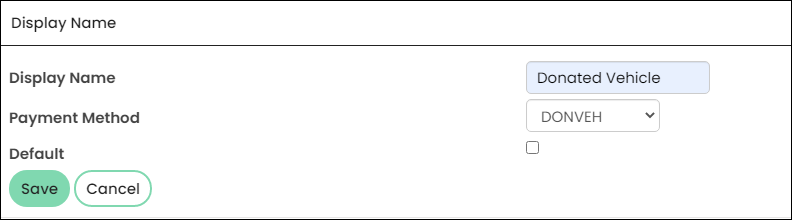

- Go to Settings > Finance > Pay Central > Payment method set tab.

- Select the Staff payment method set.

- Click Add new.

- Enter the Display Name. For example, Donated Vehicle. This is the name that will appear in the cart when you are selecting a payment method.

- Select the in-kind Payment Method you just created. The payment method Code appears in this drop-down.

- Click Save.

Creating the in-kind gift item

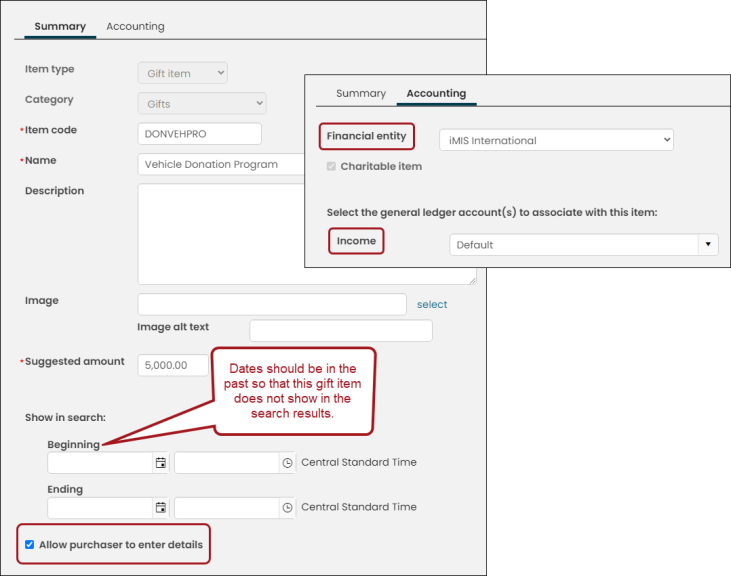

Do the following to create an in-kind gift item:

- Go to Fundraising > Add gift item.

- Enter the Item code, then Name the gift item after the type of donation you are expecting. For example, Vehicle Donation Program.

- Enter a Suggested amount. This is the amount that will automatically display when someone is giving to the donation item. Donors can always overwrite the suggested amount.

- In the Show in search fields, enter a Beginning and Ending date that occurs in the past. This is because you will probably only want staff entering these types of gifts, so the gift item needs to be hidden from search results. Staff users can locate this gift item by searching with Include inactive results enabled, or a navigation item can be created that points directly to this gift item that only staff have access to.

- Enable Allow purchaser to enter details.

- Click the Accounting tab.

- Select the appropriate Financial entity.

- Select the general ledger Income account. This is the contributions account to be credited when receiving this type of in-kind donation.

- Click Save.

Note: You can create more than one gift item to use for each of the types of in-kind gifts (for example, vehicles, real estate, securities, clothing, and so forth) you receive from donors if you need to credit different general ledger accounts for each type. If you only use one contributions account, then only one gift item is needed.

Entering an in-kind donation

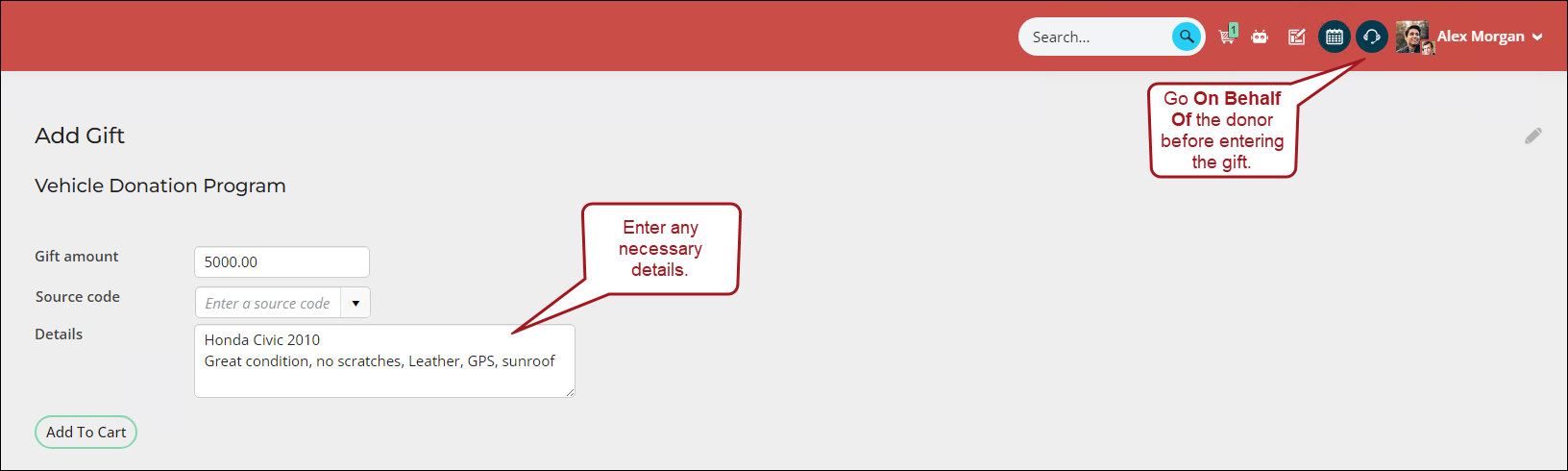

Do the following to enter an in-kind donation:

- Go to Fundraising > Find gift items.

- Enable Include inactive results, then search for the gift item.

- Begin working on behalf of the desired contact:

- Select the On behalf of icon.

- Search for and select the desired contact.

- In the Gift amount field, enter a value for the gift (for example, the value the charity assigns to the vehicle) for the gift.

- In the Details field, enter a description about the in-kind donation. The description should be in reference to what the donation is. For example, if someone is donating their car, you would enter Honda Civic 2010, and any other required information (VIN, car's condition, Blue Book value, and so forth).

- Click Add to Cart, then navigate to the Cart.

- From the Payment method drop-down, select the In-Kind method you created (Donated Vehicle).

- Click Submit Order.

Navigate to the donor's profile page, then click the Giving tab. The In-Kind donation can be seen in the Giving history panel. To issue the invoice, the associated batch must first be posted. To issue the donation receipts, see Issuing and viewing charitable receipts.

Reporting and campaigns for in-kind donations

To report on specific gift items, you can use the following reports:

You are able to connect gift items to campaigns by using source codes in the URL. See Assigning a source code to a hyperlink for more information.