Last updated on: February 13, 2026

Example: A company administrator paid a dues invoices on behalf of a member and accidentally applied the credit card payment to the wrong member’s invoice. They now need the payment to be transferred to the correct invoice.

You may need to correct a payment if the payment was applied to the wrong invoice. Do the following to transfer a payment:

- Go to Finance > Pay Central > Find payments.

- Locate the original payment and click the Payment ID.

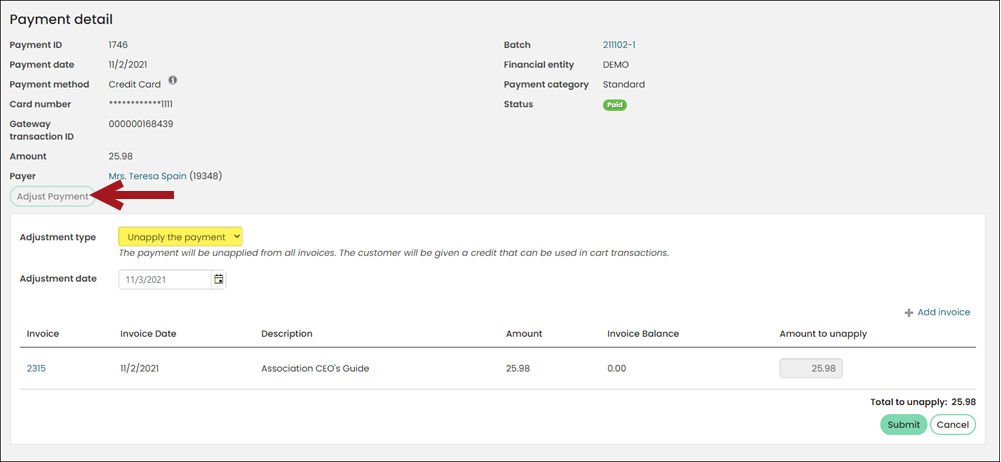

- Click Adjust payment.

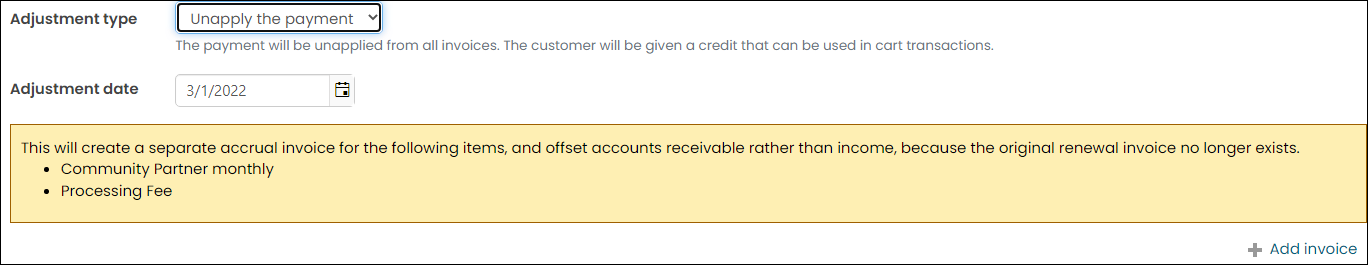

- From the Adjustment type drop-down, choose Unapply the payment.

- (Cash membership dues or subscriptions only) If you are unapplying a cash membership dues or subscriptions payment, a warning message may appear, informing you a separate accrual invoice will be created and additional action items may be necessary. Be sure to carefully review the warning message before submitting the refund.

- The cash dues or subscription has been rebilled since the time of the original payment

- The subscription item has been:

- Inactivated

- Deleted

- Refunded or partially refunded

- Click Submit. There is now an open credit on this contact’s account.

- Go to Finance > Invoices.

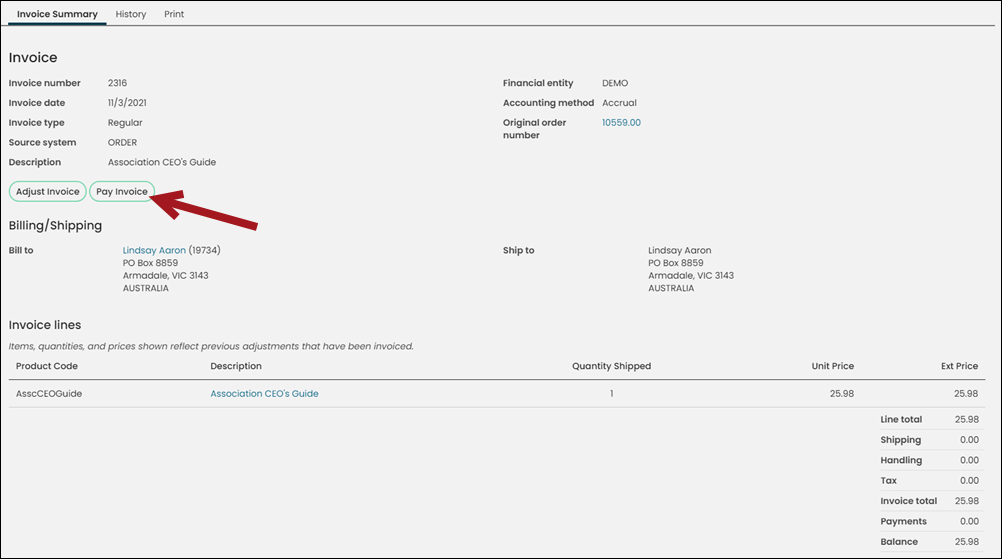

- Locate and open the invoice that you need the payment to be applied to.

- Click Pay Invoice.

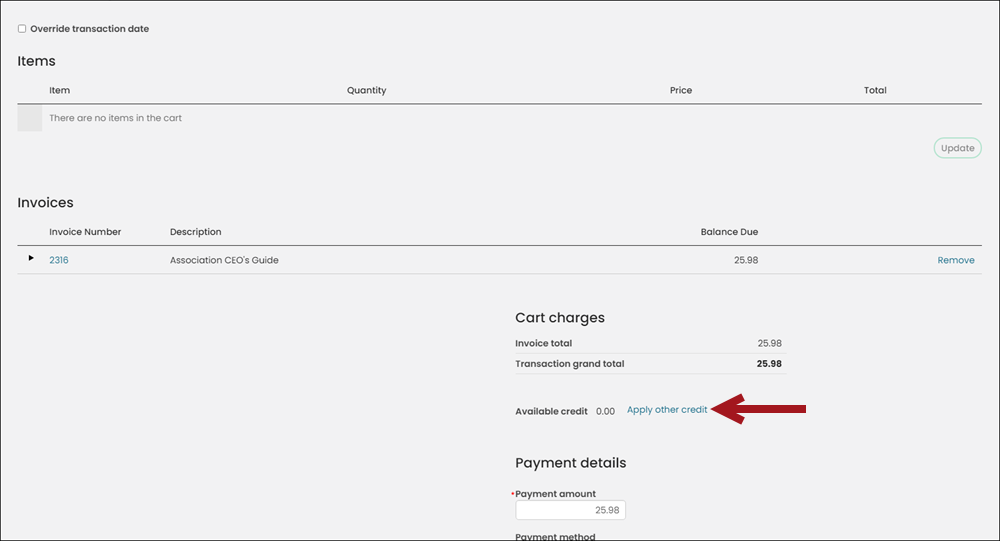

- From the Cart charges area, choose Apply other credit.

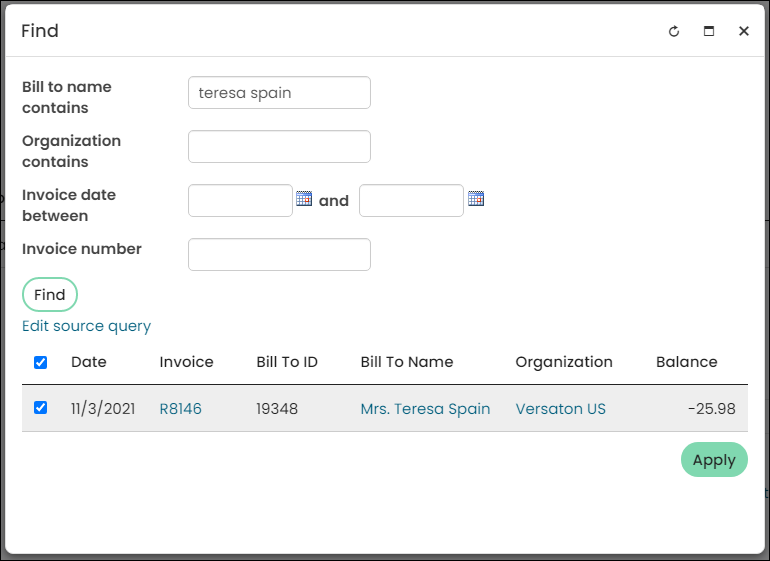

- Search for the member that currently has the payment on their account.

- Enable the row, then click Apply.

- If there is a remaining balance, enter the payment details.

- Click Submit Order.

The following warning message may appear if you are unapplying a cash membership dues or subscriptions payment:

“The following items have been billed or purchased again since this payment was submitted. The payment can still be adjusted but these items will not be available for repayment after the adjustment.”

The warning message may appear if any of the following are true: