Last updated on: January 27, 2026

There are several different payment adjustment options available (Finance > Payments > Find payments):

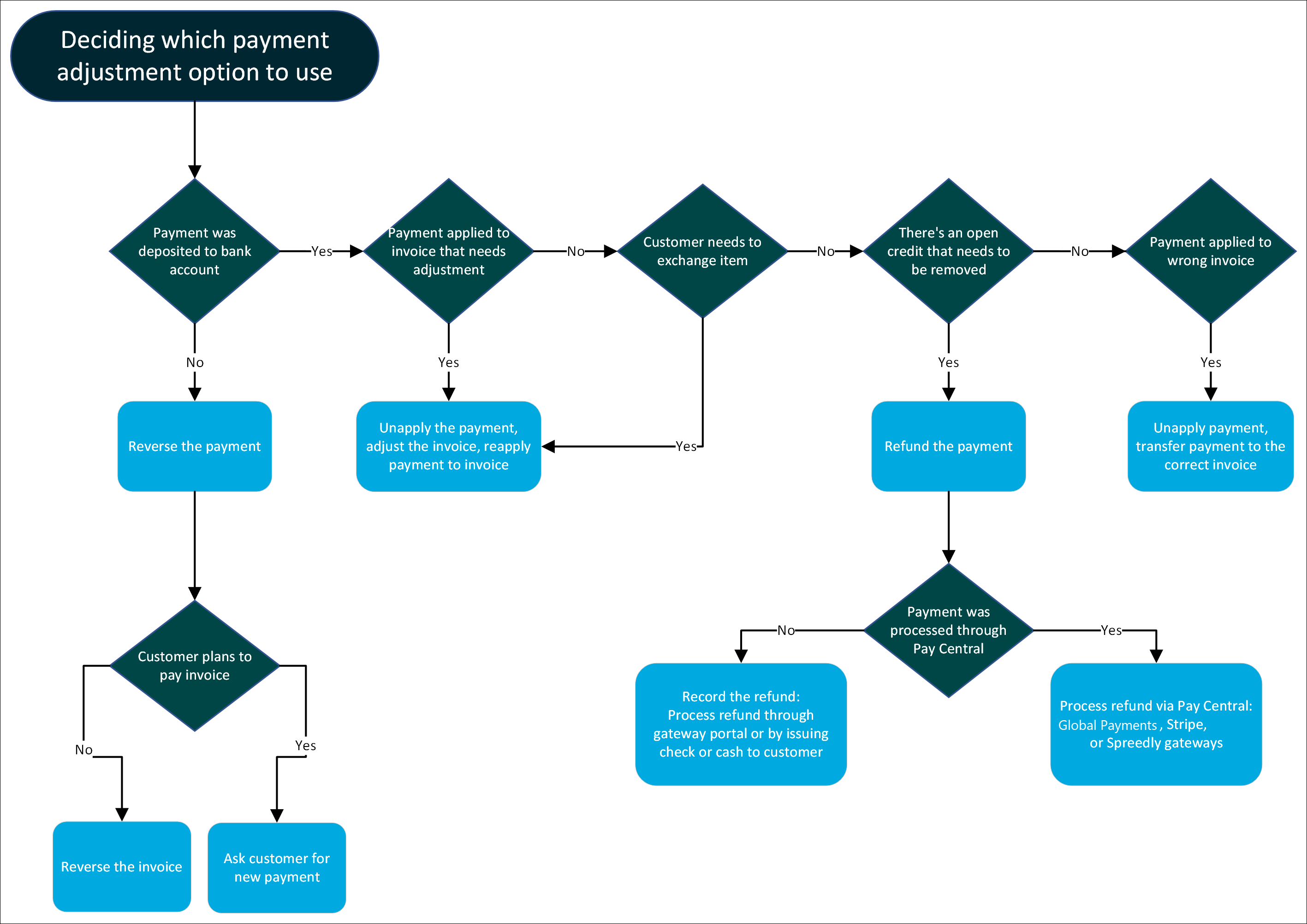

Figure 1: Deciding which payment adjustment option to use

Refund

Use the refund option when any of the following scenarios occur:

- Customer's payment was deposited to association's bank account, and the customer no longer wants/needs the purchased goods/services.

- Customer's payment was deposited to association's bank account, and the customer is not exchanging a product.

- There is an open credit on the customer's account because of a pre-payment or overpayment, and the customer would like the credit returned to them.

Refunding a payment consists of processing or recording the refund:

- Processing a refund - Credit card and ACH payments processed through Global Payments, as well as credit card and direct debit payments processed through Stripe, can now be refunded directly within iMIS. For all other gateways, processing a refund payment must be manually performed through the gateway.

- Recording a refund - If you are processing a refund for a cash or check payment that was not processed through the gateway, it is still important that the payment is recorded as refunded, so that general ledger accounts are kept balanced and correct.

See Refunding payments.

Unapply

Use the unapply option when any of the following scenarios occur:

- The payment was deposited to the association's bank account, and now the customer wants to adjust the order invoice (add/remove products):

- Unapply the payment.

- Adjust the related invoice (membership, orders, fundraising).

- Reapply the payment to the invoice.

- Unapply an individual line item.

- The payment was deposited to the association's bank account, but now the customer wants to exchange the order for something else:

- Unapply the payment.

- Adjust the related invoice (membership, orders, fundraising).

- Reapply the payment to the invoice.

- Unapply an individual line item.

- The payment was deposited to the association's bank account, but the payment was applied to the wrong invoice:

Reverse

Use the reverse option when any of the following scenarios occur:

- Payment was never actually deposited to bank account (e.g., bounced check because of insufficient funds or credit card chargebacks).

- Payment was temporarily deposited but was later removed.

- There is an open credit on the customer's account because of a pre-payment, but no payment was actually ever received.

To reverse a payment, see Recording a payment reversal.